When you’re looking for an undergraduate finance program, the choice between BA in Finance vs. BS in Finance may come up again and again. To decide which type of traditional or online bachelor’s in finance is right for you, consider the classes you’d like to take and your goals for after graduation.

While closely related, the classes that you take for a BA vs. BS in finance will be different. Jobs opportunities also vary between the two.

Editorial Listing ShortCode:

List of Schools Offering a BA or BS in Finance

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Baker College

Baker College is committed to its mission of helping students succeed in their academic endeavors and future careers. Established in 1911, Baker College has been around for over a century.

Having seen the changing needs of people over the passing of time, they offer programs which are relevant for the modern and global economy. These programs are shaped by industry leaders, ensuring that students are equipped with the skills and knowledge that employers need.

- Bachelor of Business Administration – Finance

Baker College is accredited by the Higher Learning Commission of Chicago, Illinois.

Colorado Technical University

Colorado Technical University was founded in 1965 and offers degrees primarily in management, business, and technology. Most of their students complete their courses fully online.

Repeatedly, Military Times magazine ranked CTU as #1 Best for Vets in the online and non-traditional universities category.

- Bachelor of Science in Business Administration – Finance

Colorado Technical University is regionally accredited by the Higher Learning Commission.

Columbia College

Columbia College, or the Columbia College of Missouri, is a private and independent liberal arts and sciences college located in Columbia, Missouri. It was founded in 1851 and has since been helping students advance their lives through higher education.

Among the advantages of being a part of the Columbia College community are small classes, experienced faculty, and excellent educational programs.

- Bachelor of Arts in Finance

- Bachelor of Science in Finance

Columbia College has been accredited by the Higher Learning Commission since 1918.

Florida State College – Jacksonville

Florida State College at Jacksonville, a part of Florida College System, is a public college in Jacksonville, Florida. It was established in 1965 and it opened to serve the Northeast Florida region. It continually strives to provide high value and relevant lifelong education that enhances students’ intellectual and social development.

They offer traditional college classes, hybrid and online classes, some in accelerated formats to suit students’ individual needs and schedules.

- Bachelor of Science in Financial Services

FSCJ is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

Granite State College

Granite State College is a public college in Concord, New Hampshire. Since 1972, Granite State College embraced a powerful goal of providing access to college education to motivated students, regardless of age, income, and background.

They offer courses online with a range of flexible and convenient options. Student support is available both virtually and in person, every step of the way.

- BS Accounting and Finance

Granite State College is accredited by the New England Commission of Higher Education.

Metropolitan State University

Metropolitan State University is a comprehensive public university in the Minneapolis–St. Paul, Minnesota, and is part of the Minnesota State Colleges and Universities system. Since its founding in 1971, it has been dedicated to meeting the higher education needs of the people of Minneapolis–Saint Paul.

With their aim to provide lifelong learning, the university builds on its reputation for innovative and student-centered programs that enable students of all backgrounds to achieve their educational goals.

- Finance (BS)

Metropolitan State University is accredited by the Higher Learning Commission.

Missouri State University

Missouri State University, a public university in Springfield, Missouri, is the state’s second-largest university in terms of enrollment. It was founded in 1905 as the Fourth District Normal School. They have a close-knit community of passionate and steadfast learners and educators who are committed to ethical leadership, competence, and community involvement.

- Bachelor of Science in Finance

Missouri State University‘s regional accreditation is through the Higher Learning Commission.

New England College of Business and Finance

New England College of Business, founded in 1909, is a private college located in Boston, Massachusetts. The university grants associate, undergraduate, and graduate degrees in Digital Marketing, Business, and International Business. It operates on a mission to provide high-quality, accessible, and affordable degree programs and professional training for its students.

- Bachelor’s Business Degree – Banking & Finance

NECB is accredited by the New England Association of Schools and Colleges.

Pennsylvania State University

Pennsylvania State University is a public land-grant university with campuses throughout Pennsylvania. It was founded in 1855 as the Farmers’ High School of Pennsylvania. With an average annual enrollment of more than 46,800 graduate and undergraduate students, it is considered one of the largest universities in the country.

- Bachelor of Science in Finance

PSU is regionally accredited by Middle States Association of Colleges and Schools.

Purdue University Global

Purdue University Global operates as part of the Purdue University System. With courses delivered mostly online, its programs focus on career-oriented fields of study at the associate, undergraduate, and graduate levels.

Students can earn a degree tailored to the unique needs of busy working adults. The university’s innovative approach to teaching, along with modern curriculum, enables students to acquire skills needed to achieve their career goals.

- Bachelor of Science in Finance

Purdue Global is accredited by The Higher Learning Commission.

Bachelor of Arts in Finance Courses

In a Bachelor of Arts program, you can expect to take a broad mix of courses. Some of these will deal directly with business, finance, or accounting.

Other portions of the curriculum will aim to give you a well-rounded education; these may include classes in language, history, psychology, science, communications, and mathematics.

- American History and Government: This course will give you a better understanding of the beginnings of the nation and how the governmental structure was established. You’ll survey historical events that have taken place since the country’s foundation and learn how government, leadership, and the Constitution have changed over time.

- College Algebra: This mathematics class will review the concepts you learned in your high school program and help you further develop your math skills. You may learn about expressions, equations, and The things you learn in this class may be foundational for the science or statistics classes that you take later in college.

- Economics: In one or more classes, you’ll explore both microeconomics and macroeconomics. You’ll learn about the economies of the U.S. and other countries, find out how to perform economic analysis, study supply and demand, and discuss the implications of inflation and recessions.

- English Composition: Being able to clearly communicate through the written word is a critical skill for professionals. In one or more composition classes, you’ll refine your writing abilities, gain a better understanding of English grammar, and practice using the written word to persuade others.

- Financial Management: This finance course will help you learn how to be a business leader who makes decisions based on financial data and analysis. The topics may include reading financial statements, balancing risk and growth, managing debt, evaluating market conditions, and handling capital.

- Global Finance: In today’s business world, international markets are quite connected. Working in an American business may require regular contact with foreign companies. This overview of international markets will prepare you to navigate global transactions successfully. Overseas banking and the processes of importing and exporting goods may be covered.

- Introduction to Accounting: There are many overlaps between the disciplines of accounting and finance, so it’s a good idea for finance students to take an introductory accounting class. You’ll study cost accounting, budgeting, taxation, auditing, and cash flow statements.

Because a BA in Finance online equips you with much more than just financial skills, this degree may be preferable for those looking for grad school admission. The bachelor’s program may give you a solid academic foundation, and the master’s program may afford you more in-depth studies.

If you know you’re going to want to earn a higher degree after your bachelor’s program, then a BA in Finance may be the way to go.

Bachelor of Science in Finance Courses

If you opt to pursue a Bachelor of Science in Finance, you’ll still take a mix of general education courses, but there may not be as many of them. Instead, a higher percentage of your courses will be dedicated to the study of finance.

This focus means that your degree should do a thorough job of preparing you for the workforce.

- Academic Writing: Because there is a strong math and science emphasis in a BS program, the writing class you take may focus on scholarly communications rather than general composition. You’ll study grammar, documentation, and making a case through your writing. You will also practice your research skills so you can cite scholarly sources when you write.

- College Calculus: Advanced math is a necessary requirement of some bachelor’s degree in finance programs. This may come in the form of one or more calculus courses. You may need to take a general calculus class or one that’s specifically geared toward business studies. In a business-focused class, you may study derivatives, logarithms, and

- Corporate Finance: This class will prepare you to provide financial leadership in a business setting. You’ll study how to work with assets, capital, and The financial structure used in corporate settings may be another emphasis of this curriculum. At some schools, this course gives an overview of both domestic and international corporate finance.

- Communication: As a business leader, you’ll need to speak and send information in ways that get your team’s attention and impart understanding. This course may focus on giving presentations, leading meetings, and communicating with shareholders or the general public.

- Financial Statements: Learning to understand and analyze financial statements will equip you to determine the value of an organization and evaluate its performance. Although this class may address the preparation of financial statements, your finance curriculum is more likely to focus on interpreting statements that others have already compiled.

- Investments and Risk Management: This course will provide an overview of the practices used for growing financial assets. You may learn about securities, derivatives, and The course will equip you with tools for evaluating the risks and rewards associated with various decisions so that you can competently manage investments for individuals or organizations.

- Statistics for Business: This business math class will give you a framework for many of the challenges that you’ll encounter during your finance studies and your career. You’ll learn about probability, linear regression, and sampling, and you’ll study how to use these skills as a basis for business decisions.

If you’re looking for a four-year degree that will help equip you for a job in finance, then you may want to pursue a BS in Finance online. With a strong emphasis on the science and practices of finance, this degree program can help you find a reliable finance job right out of college.

BA in Finance Salary

While there are some jobs you can do with a finance BA right after graduation, there will often be even more options available to you if you go on to earn a master’s degree in the field.

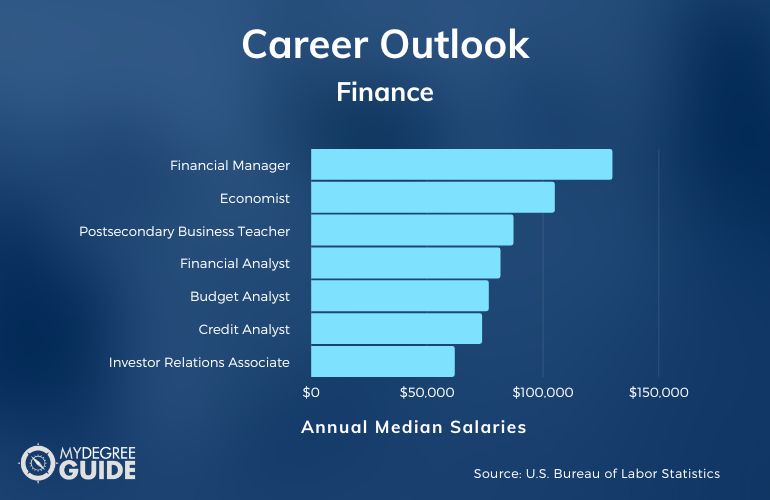

The following chart outlines some of the jobs you can pursue with your BA, according to the Bureau of Labor Statistics, and others that you may qualify for after getting a master’s degree.

| Career | Overview | Median Annual Salary | Educational Path to Consider |

| Financial Manager | Coordinate an organization’s financial activities, including reports, investments and legal compliance, and supervise the finance team | $129,890 | Master’s degree in finance or bachelor’s degree in finance and several years of work experience |

| Economist | Conduct research, make predictions and provide advice on economic matters | $105,020 | Master’s degree in economics |

| Postsecondary Business Teacher | Lead classes in finance or another business discipline at a community college, a university or a graduate school | $87,200 | Master’s or doctoral degree in finance |

| Financial Analyst | Guide organizations in investing their assets, or provide investment recommendations to financial professionals | $81,590 | Bachelor’s degree in finance |

| Budget Analyst | Oversee departmental budgets, and provide guidance to help employees work within the allocated budget | $76,540 | Bachelor’s degree in finance |

| Credit Analyst | Evaluate whether to approve customers for a line of credit and determine how much credit to issue | $73,650 | Bachelor’s degree in finance |

| Investor Relations Associate | Serve as a spokesperson between a corporation and its investors, and work to keep relationships with shareholders on good terms | $61,850 | Bachelor’s degree in finance and work experience |

| Real Estate Agent | Help buyers or renters find new properties and assist owners with the process of selling their properties | $50,730 | Bachelor’s degree in finance and state licensure |

Salary information is based on averages from employers throughout the country. Geographic location, experience, and education can affect your personal pay.

The averages, however, should be enough to answer the question: “Is Finance a good degree?” no matter whether you choose a BA or BS.

BS in Finance Salary

A BS is sometimes recommended as the financial degree to get if you aren’t interested in pursuing graduate studies before landing a steady finance job.

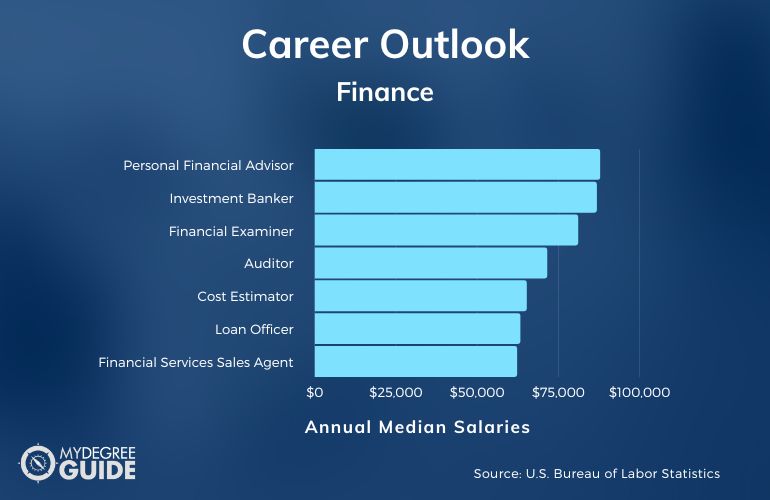

After graduating with your degree in finance, consider one of the job paths in the table below, according to the Bureau of Labor Statistics. Each represents a growing field that you might break into with a finance bachelor’s degree.

| Career | Overview | Median Annual Salary | Expected Job Growth Over the Next 10 Years |

| Personal Financial Advisor | Help individuals and families plan for their financial futures, invest their money and save for college or retirement | $87,850 | 4% |

| Investment Banker | Help businesses raise capital by making deals between investors and organizations or provide financial guidance during mergers and acquisitions | $86,840 | 4% |

| Financial Examiner | Help ensure economic stability and fair transactions by ensuring that financial institutions are following government regulations and maintaining healthy lending practices | $81,090 | 7% |

| Auditor | Check financial records for mistakes, discrepancies or dishonest practices | $71,550 | 4% |

| Cost Estimator | Provide insight for organizations on the investment of time, money and labor that will be required for carrying out projects | $65,250 | -1% |

| Loan Officer | Review loan applications from individuals or organizations, and determine whether to recommend approval for loans | $63,270 | 3% |

| Financial Services Sales Agent | Offer financial services, including loans, bank accounts, credit cards, and financial planning, to individuals or businesses | $62,270 | 4% |

| Brokerage Clerk | Conduct clerical work related to the buying and selling of stocks, bonds, and other securities | $52,750 | 4% |

Although you may be able to establish yourself in one of these lines of work right after graduating with your BS in Finance, you may still want to go back to school someday. A master’s program in finance or a related discipline can help you continue to climb the ladder in your field.

Accreditation for Online Finance Degrees

The business school you choose for a financial degree may be accredited by AACSB International.

This means that the school has gone through the voluntary process of having its business programs reviewed by this independent organization, and AACSB has determined that the programs meet their academic standards.

There are plenty of good programs that don’t have AACSB accreditation, but if you want to make sure you’re getting the best finance education, looking for a school with this accreditation is a good way to go about it.

Regional accreditation, on the other hand, is a must. It’s very important to select a school that has met the standards of one of the country’s regional accrediting organizations, such as the Higher Learning Commission (HLC).Colleges with regional accreditation are reputable; you may trust that you’ll receive an all-around good education from their programs.

Financial Aid for a Bachelor’s Degree in Finance

Earning a finance degree starts with getting your own finances in order. Tuition and other college costs can be expensive. Fortunately, financial aid can make earning a degree more feasible. This assistance may come in a variety of different forms.

- Employer tuition reimbursement

- Payment plans set up by your college

- Private loans

- State or federal grants

- State or federal loans

- Scholarships and fellowships from private organizations or your school

- Work-study programs

Many assistance-granting organizations will base their offers on the results of your Free Application for Federal Student Aid (FAFSA).

Questions Related to Earning a Finance Degree

Here are our answers to a few more questions you might have.

Is Finance a Bachelor of Arts or Science?

Finance is not limited to one particular type of degree. Most often, a college will offer either a Bachelor of Arts in Finance program or a Bachelor of Science in Finance program.

There are also colleges that offer both types of finance degrees, so you may have your pick of the one that’s best for your academic goals.

Yet another degree option is the Bachelor of Business Administration in Finance. If you know you specifically want to use your finance degree in the business world, then you may appreciate the solid business foundation provided by a BBA in Finance program.

What Is a Finance Degree Called?

A finance degree can go by names like Bachelor of Arts in Finance, Bachelor of Science in Finance and Bachelor of Business Administration in Finance. These programs may have slightly different emphases from one another, but all three can help prepare you for generally similar career tracks.

At some schools, you may have the option for a combined degree, such as a BA in Accounting and Finance. In general, though, finance and accounting are two similar but separate disciplines, so getting a BS in Accounting may not prepare you for all of the same careers as a BS in Finance.

Can You Get an MBA in Finance?

After earning your bachelor of finance, you may want to continue your education by going back to school for a master’s program.

An online MBA in Finance is a popular choice for finance students. A Master of Science (MS) in Finance is another good option for professionals in this field.

BA in Finance vs. BS in Finance — What’s Best for You?

Do you have your sights set on a finance master’s degree? Start your educational path with a Bachelor of Arts in Finance. If you’d prefer a bachelor’s education designed especially for workforce preparation, then a Bachelor of Science in Finance may be better for you.

These two types of bachelors in finance programs share many characteristics, though, so you may get a good education either way. The best way to choose is by exploring what various schools have to offer. Apply to the programs that stand out to you, and you may be on your way to a fulfilling career in finance.