Is a Masters degree in Finance worth it? Is it worth the cost and time? Will it advance you in a business climate that is focused on Finance? What is more important: education or experience?

These are all essential questions that can be answered through a careful exploration of the educational opportunities available.

Editorial Listing ShortCode:

Masters in Finance vs MBA

A Masters degree in Finance is different than an MBA. An MBA is not a concentrated, specialized degree. It is a degree that concentrates on various sciences related to management.

The MBA program may include classes focusing on management, human resource management, and administration. It can include Finance, but it is not limited to one subject.

A Masters degree focuses on one specialized topic. For example, a traditional or online Masters degree in Finance focuses strictly on all things related to Finance.

The pros of a Masters degree in Finance include:

- Focused knowledge

- Career advancement in the specialized field

- Increased potential for income

- Lifelong education

- Better networking skills

The cons of a Masters degree include:

- Financial cost

- Commitment

- Limited time for family and friends

- Making time for classes

On the other hand, the MBA, which has a broader, less specific range of topics usually related to organizational management, includes these positives:

- Credibility in different business areas

- Transitional skills

- More strategic thinking

- Developed communication

- Self-discipline because of the full range of material studied

- Focused time management

The MBA is more commonly sought-after by professionals in their career as a chance to explore other avenues within their scope of employment. Many employers offer an incentive when an employee achieves an MBA. As with any degree, there are negatives to an MBA:

- Non-specialized education. The MBA focuses on a generalized range of topics.

- Cost

- Time

- The possibility of not being considered for employment without a specialized, focused education

As you can see, both the MBA and the Masters degree have various pros and cons, but the question remains: is a Masters degree worth the time, cost, and energy? The answer depends on what you want to do with your career.

Is It Better to Get a Masters or an MBA?

If you’re looking at focusing on Finance, and only Finance, then a Masters degree may be the best choice.

Employers who work with Finance degrees often look for a Masters degree in the field because they know that the prospective employee has taken the time and effort to build upon their knowledge and expertise in the area of Finance.

Why Should I Study Masters in Finance?

As a student interested in Finance, you are most likely wondering why you should even consider a Masters degree in Finance. The Masters degree is a specialized finance degree online or on-campus that focuses on the thing you are most passionate about.

Is it Finance? If that’s a yes, then attaining a Masters degree can show that you’re not only excited about it but willing to take the time and make the sacrifice that is important in achieving such an education.

A potential hire who has the foresight and drive to attain a Masters in a given field can impress employ. Imagine interviewing for a huge financial conglomerate, and you list the attainment of a Masters degree as one of your highest accomplishments.

There should undoubtedly be more consideration to the potential new hire who has given up their lives and spent the time dedicated to learning and mastering the science of Finance.

Is Masters in Finance Hard?

The degree of difficulty in a Masters program in Finance depends on the person and the amount of discipline they have as a student.

The lessons of the Masters degree often involve real-world, career-based courses taught by experienced professors who may have, at one time, served in fiduciary roles within a corporation.

It is not sufficient to say the Bachelor degree was enough; a Masters degree goes above and beyond the lessons of the Bachelor degree because of a significant increase in work, time, and a greater emphasis on career preparation.

A Masters degree in Finance contains highly organized classes focusing on the career field of the specific discipline. In this case, many of the instructors will highlight and draw intense focus on the field of Finance.

They will explore topics relevant to the career choice. The complex nature of the course is because the career field of Finance is not an easy choice; there are many careers that require a higher level of thinking and problem-solving.

The classes you take to obtain your Masters degree will undoubtedly hold you accountable in preparation for these career choices.

What Jobs Can You Get with a Masters in Finance?

What are the career choices you may have with a Masters degree in Finance? There are many to choose from. They include:

- Corporate Finance

- Commercial or Investment Banking

- Private Wealth Management

A corporate financier manages the accounts of a company and manages capital with effectiveness, deciding on crucial investment strategies to generate profit for the company.

They work closely with the executive team of a company, with a specialized structure that most often reports to the Chief Financial Officer, or the CFO. The end goal of a corporate Finance position is to end up serving as the CFO of a company.

With some of the highest starting salaries in Finance, commercial or investment banking is a field that is both demanding and rewarding at the same time.

Commercial banking is the management of day-to-day operations within a bank that serves most of the population. The positions in this choice would be in the range of loan officers, mortgage bankers, and credit analysts.

Investment banking concerns large financial transactions, such as the sale of stocks and bonds, and corporate mergers. With a Masters in Finance, you could seek a career in risk analysis, financial analysis, compliance officer, or a merger and acquisitions adviser.

Investment banking involves a broad spectrum of careers, such as a portfolio manager, which involves working directly with companies seeking to move their investments, or individuals who have a high net worth.

Private wealth management concerns helping individuals with a high net worth plan for the future, effectively managing their finances. This is often a personalized service covering everything from tax advice to the selling of stocks and bonds.

Masters in Finance Salary

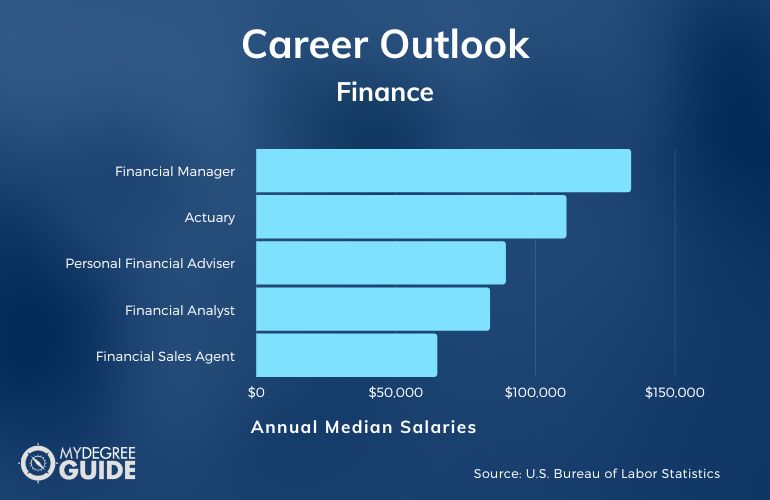

Here is a list of potential careers and their salaries, according to the Bureau of Labor Statistics:

- Financial Manager $134,180

- Actuary $111,030

- Personal Financial Adviser $89,330

- Financial Analyst $83,660

- Financial Sales Agent $64,770

One can see that finance is a good career path in different areas. The payoff for a Masters degree in Finance is evident, as is the return on time invested. But keep in mind, Finance is an ever-changing field that will require you to be a lifelong learner.

This is especially true if you want to climb the corporate ladder into a CFO or Chief Executive Officer position of a company.

The field of Finance has many opportunities that begin with entry-level positions, increasing in importance as you display stronger competence and accountability.

The financial branch is the lifeblood of any company. It is the division that makes sure the company is performing at its most effective, and the employees are taken care of from a financial perspective.

Further Education – How to Move Up in the World of Finance

If you are willing to spend the money and time, you may pursue a Doctoral degree in Finance. The careers that follow a Doctoral degree often include:

- Financial Consulting

- Policymaking

- Investment Research

- Teaching

Those with a PhD in Finance often go on to teaching at the university level. They contribute to textbooks used in Finance classes.

Those with a PhD in Finance may have already served in positions as high as the chief financial officer of a company. A doctorate degree in an advanced field such as Finance can be used to demonstrate a higher knowledge and level of experience in the range of financial matters.

When it comes to careers outside the classroom, a doctoral or PhD most often involves concentrated investment research, consulting, and financial policy creation.

If you have a doctorate, you may work for or in conjunction with government bodies, constructing financial obligations and business decisions that affect the public.

These are important decisions that involve a certain level of experience and education because of the widespread impact made by such decisions.

Finance Certification Options

Within the field of Finance, there are several financial certification options. These areas include:

- Certified Financial Planner

- Chartered Alternate Investment Analyst

- Chartered Financial Analyst

- Chartered Financial Consultant

- Chartered Life Underwriter

- Chartered Mutual Fund Counselor

- Financial Risk Manager

A certified financial planner is formally recognized in the field of financial planning, taxes, and insurance, as well as estate planning and retirement. They often deal with 401k’s and financial decisions made for the future. The financial planner is focused on customer service as well and asks for strong interpersonal skills. A person with a background in customer service is sure to do well when dealing with people and their particular needs.

A chartered alternate investment analyst looks at the assessment of hedge funds, venture capital, real estate investments, derivatives, and private equity. These analysts often help corporations make decisions such as those in mergers and acquisitions as well as other corporate ventures.

A chartered financial analyst is recognized on a global scale with the designation given by the CFA Institution, which measures the competence of a financial analyst. After attaining a bachelor’s degree from an accredited institute of higher learning, the potential candidate needs to pass the CFA Level 1 exam and have relevant work experience of 48 weeks in the investment decision-making process.

A charted financial consultant is a globally recognized designation that works with organizations on major financial decisions, such as mergers and acquisitions. To achieve the certification, one must pass a rigorous test and take coursework in a CFP Board-approved program. The topics covered by the consultancy is retirement, estate planning, and insurance.

The chartered investment counselor, otherwise known as the CIC, is a certification awarded to individuals with qualifications and expertise in securities investment, retirement design, 401k management, and corporate financial decision making. They often serve as the fiduciary of a company, helping the CFO plan the financial future of the company.

A chartered life underwriter is the certification for individuals seeking a career choice in life insurance and estate planning. To obtain the certification, one must apply and demonstrate competency through the Life Underwriting program. You must also have 4 years experience in underwriting.

A charted mutual fund counselor is the certification designating an individual as having the recognized competency in the required field. They often help individuals or companies decide on which mutual fund is the most profitable.

A financial risk manager is a professional designation by the Global Association of Risk Professionals. The financial risk manager identifies threats to the assets of a company, as well as the earning capacity, or success of a business. They work in sales, trading, marketing, financial services, and private banking.

Accreditation for a Finance Master’s Degree

When one chooses to follow the Finance career path, there are regionally accredited institutes of higher learning and certification programs designed for individual programs.

Every college should be accredited by a regional board. This covers every program the school offers.

Business schools or programs may also be accredited by one or more of these boards:

- The Association to Advance Collegiate Schools of Business

- The Accreditation Council for Business Schools and Programs

- The International Assembly for Collegiate Business Education

The Association to Advance Collegiate Schools of Business, or the AACSB International, is a professional organization. The AACSB is a voluntary accrediting agency that oversees the standardization of collegiate schools of business and accounting.

The Accreditation Council for Business Schools and Programs concentrates on accrediting schools with an emphasis on teaching and learning. The association looks at business programs, serving specialized accreditation in various fields of business.

The International Assembly for Collegiate Business Education focuses on preparing students for careers in business.

The group is a member of the International Network for Quality Assurance Agencies in Higher Education. Its focus is on the evaluation of business colleges and their respective degree programs.

Admission Requirements for a Masters in Finance Program

To be accepted into a Masters program in Finance, it is best to have an undergraduate degree from an accredited university or college in math, accounting, or a related field.

There may be the need to score in the acceptable range on the GMAT or GRE. A good grade point average during your undergraduate program will be a positive on your application as well.

A trend among schools is the offering of online programs in the Masters degree. These are classes that are designed for the working individual who does not have the time or capacity to attend a brick and mortar institution.

The online degree does not differ from a degree one would obtain by attending classes. This type of degree offers a chance for all students to be able to expand their educational horizons.

Financial Aid for a Finance Master’s Degree Online

Financial aid is different for a Masters program than a Bachelor’s degree. Financial assistance is available, but the funding comes from sources such as a PLUS loan or a direct unsubsidized loan.

The process begins with the Free Application for Federal Student Aid (FASFA), similar to the undergraduate process.

Masters degree students are typically considered independent students. You will receive less financial aid for graduate school. The interest rate on loans for the Masters program is usually higher. The borrowing limits for the Masters program are higher.

Is a Masters Degree in Finance Worth It?

Yes, a Masters degree in Finance is worth it for many students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years. Common careers in this field include financial sales agent, financial analyst, personal financial adviser, actuary, and financial manager.

You could also be ready to enter a doctoral program.

Explore your opportunities for taking an online course of study.