Is finance a good career path? Finance is a popular industry with a number of growing job opportunities—from accounting to investment banking—but it’s also known for being highly competitive.

Working in finance requires strong analytical skills, a passion for numbers and details, and a willingness to learn about other fields, including management and economics.

Editorial Listing ShortCode:

Finance is one of the main driving forces of society today, and there are diverse opportunities that specializing in finance can offer.

Is Finance a Good Career Path?

Yes, finance is a good career field for many students. One reason why finance attracts millions of professionals is because it’s associated with careers that are stable and even lucrative.

For example, the Bureau of Labor Statistics states that business and finance jobs have a median salary of $76,570, which is higher than the national median wage for all jobs. Financial analysts, financial advisors, accountants, and auditors all have median salaries that are more than $70,000.

Individual salaries still vary based on factors such as location and industry, but finance roles typically offer a clear career progression, where you can earn higher as you gain experience. Some finance jobs, such as hedge fund management, even offer commissions on top of a base salary.

On top of this, finance tends to be a more stable field because financial functions like accounting, banking, and insurance are needed by both organizations and individuals. Some professionals choose to work at a financial institution or take on a finance-related role in practically any industry, meaning finance is a good major for many students.

As financial technology catches on, there are many innovative developments, with emerging roles in areas like quantitative trading and blockchain research.

5 Things You Can Do with a Finance Degree

Whether you’re interested in analyzing financial data or working closely with people, a finance degree can equip you to work in diverse fields. Here are five career paths that fit well with a finance degree.

1. Financial Advisor

A financial advisor helps clients achieve their financial goals by assessing the current state of their finances and then coming up with a detailed plan.

Financial advisors can give recommendations on a wide range of areas, from building an investment portfolio to adopting good saving habits and growing income. To enhance their credentials, they may study to become certified financial planners (CFPs).

2. Budget Analyst

Budget analysts ensure that an organization’s finances stay on track, with resources allocated properly and objectives followed.

A key part of a budget analyst’s job involves collecting data about their organization’s spending and writing reports for managers, who make the final decisions about the company’s budget. Budget analysts may review budget-related proposals, come up with strategies for cutting down costs, and forecast future expenses.

3. Investment Banker

Unlike personal financial advisors, investment bankers give financial guidance for organizations, usually with the aim of increasing capital.

Investment bankers may help with proprietary trading, which involves stocks and bonds. They also study how to deal with more complicated situations, like mergers, sales, and changes in regulations. They may also contribute to an organization’s overall business strategy by evaluating the possible risks and returns of projects.

4. Accountant

Accountants record official financial transactions for companies, and they’re in charge of creating and maintaining financial documents, such as balance sheets and cash-flow statements.

Some accounting professionals are responsible for filing tax returns and auditing the company’s existing financial data to make sure it’s accurate and in line with regulations. To advance their qualifications, accountants can pursue certification to become a certified public accountant (CPA).

5. Financial Analyst

Financial analysts assess complex data about company finances, investment opportunities, and market trends so their company or client will be well-informed, especially when making major decisions.

Their tasks include coming up with predictive models through quantitative analysis, compiling their findings into a report, and presenting them to leaders and stakeholders. They may also assess the performance of current investments and conduct their own surveys.

Finance Careers

A bachelor’s degree in finance, regardless of whether it’s a BS vs BA in Finance, can be highly practical because it teaches you skills that are relevant to many careers, such as data analysis and financial reporting.

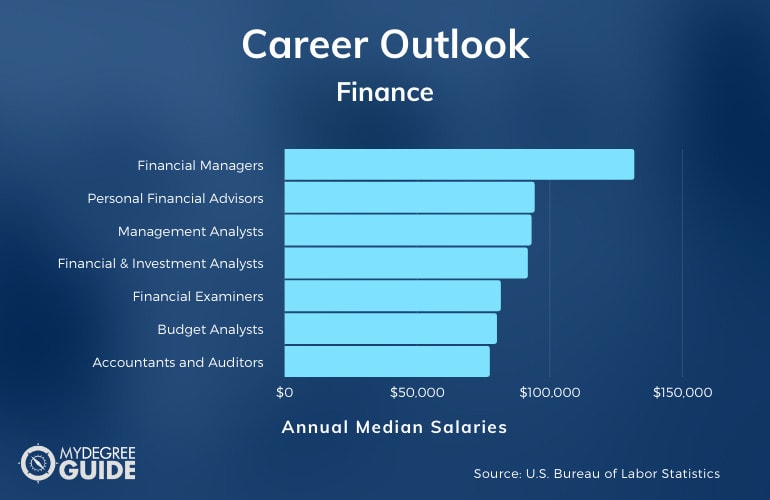

According to the Bureau of Labor Statistics, here are the median yearly salaries for a range of finance careers.

| Careers | Annual Median Salaries |

| Financial Managers | $131,710 |

| Personal Financial Advisors | $94,170 |

| Management Analysts | $93,000 |

| Financial and Investment Analysts | $91,580 |

| Financial Examiners | $81,410 |

| Budget Analysts | $79,940 |

| Accountants and Auditors | $77,250 |

| Compensation, Benefits, and Job Analysis Specialists | $64,120 |

| Loan Officers | $63,380 |

| Property Appraisers and Assessors | $61,340 |

Many of these finance careers—such as accountants, personal finance advisors, and property appraisers—benefit from additional certifications.

Finance graduates often work in insurance companies, banks, investment consultancies, accounting firms, real estate agencies, legal companies, and even government organizations. Most companies have a finance team, so you can apply your finance skills to virtually any industry.

Finance Major Curriculum

Each school will have its own curriculum, but as a finance major, you will likely study these core subjects:

- Accounting: Finance programs require several accounting classes, so you can learn how to prepare financial statements and may also learn how to tackle complex cases like partnerships and liquidations.

- Banking and Financial Institutions: This course introduces you to major financial institutions, like central banks and insurance companies, and how they’re affected by policies and regulations.

- Investment Management: You’ll learn about how to build and manage investment portfolios that consist of various financial assets, including stocks, bonds, and commodities.

- Corporate Finance: This course focuses on the major financial decisions and processes that companies have to deal with, such as doing business valuations, raising capital, and handling mergers.

- Principles of Economics: In a finance program, you’ll study both microeconomics and macro-economics, from how supply and demand play out in the market to the impact of inflation on businesses.

- Principles of Management: This course examines how to be an effective leader in an organization, with lessons on conducting strategic analysis and creating a strong work culture.

- Business Statistics: You’ll learn how to apply statistics to business decision-making through practical techniques such as linear regression, time-series analysis, and sampling.

- Business Law: This course explores laws and regulations that are very influential throughout the life cycles of businesses, with emphasis on contracts, tax laws, and consumer protection.

- Operations Management: You’ll examine how to improve an organization’s processes and how to use resources efficiently, with a focus on continuous improvement.

- International Business: This course studies the cultural, economic, and political factors that affect managing a global business and prepares students to create their own strategies based on these.

Finance programs consist of a mix of general business classes and more technical, specialized classes.

How to Know If a Degree in Finance Is Right for Me

A finance career path might be a good fit for you if you think most of these statements describe you:

- You like math. Finance involves plenty of math—from basic calculations to calculus and statistics—which finance professionals apply to real-world problems. You might even use specialized software for complicated calculations.

- You’re interested in problem-solving based on data. Finance professionals often need to be comfortable with a data-oriented approach, collecting and studying data to make informed decisions.

- You’re curious about how businesses work. Finance is tied up closely to business processes and economics. Aside from crunching numbers, it’s helpful to have an understanding of business fundamentals.

- You’re willing to learn about other fields. Whether you’re interested in risk analysis or doing accounting for a healthcare company, finance is often intertwined with other industries.

- You’re detail-oriented and organized with documents. In a finance career, you’ll likely handle documents, record information, and prepare reports, so there’s a high emphasis on accuracy.

- You communicate well, both in writing and speaking. From explaining your findings to staying on the same page with managers and clients, you could be interacting a lot with other people.

It can be helpful to look at the day-to-day activities of specific finance jobs to see if a role appeals to you.

Finance Licensure and Certifications

Since finance can be a highly technical field, many people choose to earn industry certifications to demonstrate their skill sets and advance their professional qualifications. Here are some top finance certifications:

- Certified Public Accountant (CPA): This prestigious credential demonstrates a professional’s advanced education and knowledge in accounting.

- Certified Financial Analyst (CFA): The CFA is among the most respected credentials in the finance industry.

- Certified Financial Planner (CFP): To earn this credential, it’s necessary to have knowledge in different areas of finance, such as real estate and investing.

Getting one of these certifications typically requires many hours of studying. Some employers may prefer certified candidates for more advanced roles.

Is Finance a Good Major

Yes, finance is a good major for many undergraduate students. Finance is a popular business degree because it can lead to many stable and potentially lucrative careers, such as management consulting and financial planning.

Since finance is such a vital part of daily life, there’s also a steady demand for finance professionals, regardless of the industry. In addition, a finance degree program can teach you about the fundamentals of managing a business while training you in data analysis. These versatile skill sets are also an asset for other career paths beyond finance.

Is Finance Hard?

Whether or not you’ll find the field of finance difficult will likely depend on your interests and natural proficiencies.

This sector of business involves plenty of math and logical problem-solving, with classes like calculus and business statistics. Beyond this, it requires interdisciplinary knowledge of fields like business management, economic trends, and even diplomatic relations.

Since this field can be highly technical, you could also be dealing with plenty of complex concepts, such as the mechanisms of the banking system.

What Do Finance Majors Do?

Finance majors study how money is managed across all levels, from individuals to organizations and even governments.

Topics covered in a finance program include risk and reward, fund management, and investment analysis. Finance students learn about the workings of financial institutions and how regular companies run their finances, from tax returns to international expansion. Upon graduating, finance majors can focus on personal finance or corporate finance.

Although finance roles can be varied, common job duties include preparing reports, researching market trends, giving advice on business decisions, and ensuring financial practices comply with regulations.

What Can You Do with a Finance Degree?

A finance program can train you in mathematical thinking and help you understand how cash flow works in organizations and markets.

Studying finance can pave the way for many job opportunities. Since the field of finance is so widespread, there are finance positions in most organizations. Finance majors often work in companies as financial analysts, budget analysts, or financial examiners. Others become accountants or go into personal financial advising, where they focus on individuals’ finance.

Many finance professionals work in banks and investment firms, where they manage portfolios. They may also specialize in risk management as actuaries.

Are Finance Jobs in Demand?

According to the Bureau of Labor Statistics, business and finance jobs are expected to have more than 750,000 job openings over the next several years, with an industry growth rate of 8%.

A major growth factor is the increase in financial products and services being used by both companies and individuals. Companies have to follow stricter regulations, and financial technology (FinTech) is becoming more widely adopted.

Management analysts are especially in demand because companies are looking to cut costs and be more efficient. There’s also faster than average job growth projected for financial examiners, who help companies maintain compliance.

What Jobs Can You Get with a Finance Degree?

Finance jobs are available in banks, investment firms, financial technology companies, and accounting consultancies, just to name a few. Common finance roles include:

- Accountants and auditors: Accountants prepare and manage financial records, while auditors check these records for accuracy and compliance.

- Personal financial advisors: Personal financial advisors educate and advise clients about investments, savings, debt, and other financial topics.

- Financial analysts: Financial analysts gather and study financial data to create proposals and forecasts for better decision-making.

Other career opportunities in finance include credit analyst, portfolio manager, loan officer, tax associate, and many more. There are a number of factors that can affect your personal career trajectory, such as your work experience, degree specialization, and geographic location.

How Much Do Finance Majors Make?

Finance can be a highly profitable field, especially for professionals who have gained several years of experience. According to the Bureau of Labor Statistics, the median yearly salary for finance and business professionals is $76,570, which is well above the national average.

Some finance careers with higher median salaries include financial analysts ($81,410), accountants and auditors ($77,250), and personal financial advisors ($94,170). Financial managers tend to earn between $77,040 and $208,000 each year (Bureau of Labor Statistics).

There are also finance major jobs, such as in fund management, that offer commissions based on how much you earn for clients.

What Are Some of the Highest Paying Finance Jobs?

Here are some of the highest paying careers in finance, along with median salary data from the Bureau of Labor Statistics.

| Careers | Annual Median Salaries |

| Financial Managers | $131,710 |

| Personal Financial Advisors | $94,170 |

| Management Analysts | $93,000 |

| Financial and Investment Analysts | $91,580 |

| Financial Examiners | $81,410 |

The entry-level wages of these roles can differ greatly. When it comes to finance jobs that make a lot of money, more experience often leads to higher earning potential.

Advanced finance professionals can also pursue more lucrative leadership roles, such as financial manager and chief financial officer.

What’s the Difference Between Finance vs. Accounting?

Finance and accounting both specialize in money management, but there are some key differences.

| Finance | Accounting |

|

|

Accounting is one part of finance, which is an umbrella term that also covers risk management, commercial bank policies, and many other topics.

Is a Finance Degree Worth It?

Yes, a finance degree is worth it for many students. Finance is still one of the most sought-after undergraduate degrees. This is mainly because it teaches skills—such as communication, analytics, and basic accounting—that are useful in real-life situations.

Studying finance can lead to a wide range of career paths, from traditional careers such as accounting and banking to newer roles in financial technology companies. According to the Bureau of Labor Statistics, business and finance occupations are expected to see 8% job growth over the next ten years.

Finance is known, too, for having some of the most lucrative careers outside of technology, with many common finance roles having higher median salaries than average.

Getting Your Bachelors in Finance Online

If you’re fascinated by how money is managed and invested, then a bachelors in finance might match up well with your interests.

Finance is so influential that it powers nearly everything in society. Professionals in this field hold roles in banking, accounting, insurance, fund management, and many other industries. An online degree in finance can help you gain marketable knowledge and skills for your chosen career path.

There are many accredited schools that offer reputable finance programs both in-person and online. The sooner you start exploring available finance degrees, the sooner you may discover the program that’s best for you.