If you’re interested in the worlds of banking, business, and problem solving, you might consider pursuing a masters in risk management.

This degree combines knowledge of math, statistics, finance, and law to help businesses mitigate the sometimes wild world of running a corporation. You can study the different types of risks involved in various types of businesses and learn how to strategize and prepare.

Editorial Listing ShortCode:

Let’s take a look at what’s involved in earning your master in risk management degree online.

Universities Offering Online Masters in Risk Management Degree Program

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Boston University

Boston University offers a Master of Science in Enterprise Risk Management. The program is designed to teach students the essential skills needed to identify, assess, and respond to risk across a variety of professional fields. The program consists of 40 credits that can be completed on campus or fully online, and most students finish their courses in only 18 to 24 months.

Boston University is accredited by the New England Commission of Higher Education.

Butler University

Butler University’s Master of Science in Risk and Insurance aims to help students succeed in the rapidly expanding sectors of risk management and insurance. The curriculum is designed to help students master skills in accounting, finance, and leadership in addition to the fundamentals of risk and insurance. The program can typically be completed in 2 years and is housed fully online.

Butler University is accredited by the Higher Learning Commission.

Cambridge College Global

Cambridge College Global offers a fully online program for a Master of Science in Risk Management and Insurance. It is designed for those interested in supporting individuals or organizations through a risk management and insurance industry profession. The curriculum aims to provide students with a comprehensive education in topics pertaining to property, liability, and health and life insurance.

Cambridge College is accredited by the New England Commission of Higher Education.

Columbia University

Columbia University offers an online program for a Master of Science in Enterprise Risk Management. It focuses on enterprise risk management framework and risk identification, quantification, governance, and decision-making. Students who move through the program at a full-time pace can typically finish in 3 terms, while part-time students can usually complete their courses in 6 terms.

Columbia is accredited by the Middle States Commission on Higher Education.

Florida State University

Florida State University offers a Master of Science in Risk Management and Insurance. Its goal is to prepare students for risk management work through critical thinking and diverse perspectives. This 33 credit program can be attended fully online and includes courses in business law and ethics, liability insurance, data analytics, and risk financing.

The Florida State University is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

New York Institute of Technology

New York Institute of Technology offers an online program for a Master’s in Risk Management. Its goal is to help student learn the skills necessary to excel in the competitive and dynamic world of risk management. The curriculum is composed of 30 to 42 credits and can usually be completed in 2 years.

New York Institute of Technology is accredited by the Middle States Commission on Higher Education.

North Carolina State University

North Carolina State University’s Poole College of Management offers an online program for a Master of Management in Risk and Analytics. It is designed to provide students with the fundamental knowledge needed for strategic, data-driven leadership roles. The 30 credit curriculum boasts a flexible, online format to help students fit their education around their schedules.

North Carolina State University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Notre Dame of Maryland University

At Notre Dame of Maryland University, the Master of Science in Risk Management aims to educate leaders in the fundamentals of risk assessment, management, and communication. This online program is designed for students from a variety of backgrounds and with different experience levels. It may be beneficial for those in corporate, government, nonprofit, or education sectors.

Notre Dame of Maryland University is accredited by the Middle States Commission on Higher Education.

St. John’s University

The Risk Management and Risk Analytics Master of Science program at St. Johns University can be attended either online or in person. This is a 30 credit program that can typically be completed in 2 years. The curriculum covers how to identify and mitigate risk, insurance and corporate risk management strategies, and decisive and dynamic decision-making skills.

St. John’s University is accredited by the Middle States Commission on Higher Education.

University of Colorado – Denver

The University of Colorado—Denver offers a Master of Science in Finance and Risk Management. The program boasts industry-insider faculty, cutting edge computer programming, and a curriculum focused on hands-on learning. Students have many options in completing the program, including online or in person courses, full-time or part-time class schedules, and rolling admissions in fall, spring, and summer terms.

CU Denver is accredited by the Higher Learning Commission of the North Central Association of Colleges and Schools.

Online Masters in Risk Management Programs

In a perfect world, running a business would be straightforward and simple. We live in a world, though, where changes in staffing, technology, and even the environment can impact how a business can get things done.

Business risk management is the art of being able to continue business in the face of adverse situations, along with developing careful plans for risk control. Those who pursue a risk management graduate program will learn about financial, operational, human capital, and legal risk. You can also learn how to apply knowledge of topics such as ethics, statistics, and financial theory when developing operational risk control plans.

While each program develops its own curriculum and focus, you’ll likely study subjects such as:

- Identification of possible risks

- Crisis management

- Business continuity management

- Implications of various risks

- Reputational risks

Those who earn their online masters in risk management may go on to work in the public or private sectors to help businesses and organizations mitigate risk. Students in risk management programs are often tasked with being able to compute and model operational risk as well as to understand and apply various risk theories to different business situations.

Depending on the focus of their studies, industry professionals who have earned a masters degree in risk management often pursue a career in human resources, finance, operations, or underwriting.

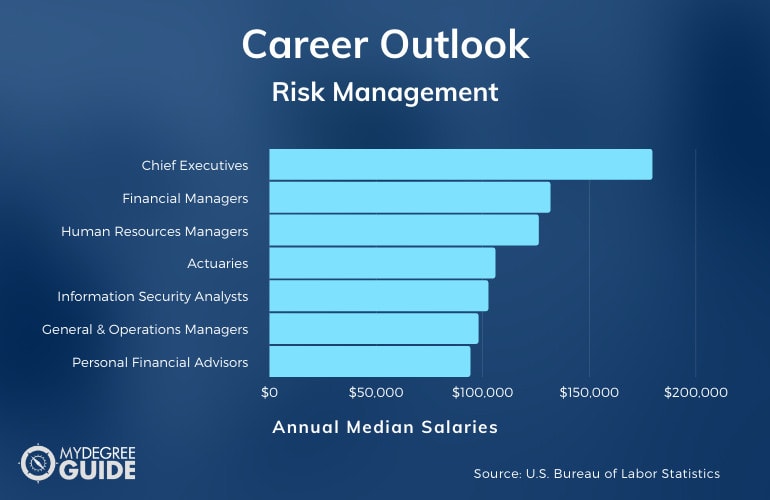

Risk Management Careers & Salaries

Risk management and operational risk control are important for every type of business, from agricultural to zoological. You may have the opportunity to fine-tune your risk management program to focus on an industry that is of interest to you.

According to the Bureau of Labor Statistics, here are some career paths related to risk management, along with their median salaries.

| Careers | Annual Median Salaries |

| Chief Executives | $179,520 |

| Financial Managers | $131,710 |

| Human Resources Managers | $126,230 |

| Actuaries | $105,900 |

| Information Security Analysts | $102,600 |

| General and Operations Managers | $97,970 |

| Personal Financial Advisors | $94,170 |

| Financial and Investment Analysts | $91,580 |

| Operations Research Analysts | $82,360 |

| Insurance Underwriters | $76,390 |

Some risk managers who receive their Master of Financial Risk Management degree continue into fields that explore the risk associated with fund management and budgets. Industry professionals who are more interested in the impact and opportunities among human capital and business continuity may focus on fields applicable to human resources.

As you complete your MS in Risk Management program, you may get a feel for which areas are particularly interesting for you and your future career.

Risk Management Master’s Curriculum & Courses

Risk management graduate programs aim to prepare their students for a future career in risk management with core classes. While each school and program varies in the courses they offer and the focus of their curriculum, course examples include:

- Introduction to Corporate Risk Management: This course examines risk factors and the importance of risk planning in a corporate environment.

- Bankruptcy Risk, Financial Regulation, and Regulatory Risk: Courses such as this can help you explore the financial side of risk.

- Data Privacy, Ethics, and Regulatory Requirements: This type of course explores legal risks and how to ethically operate when disruption occurs.

- International Corporate Social Responsibility and Ethics: In our global market, risk often extends beyond the local business setting.

- Economic Regulation, Conduct, and Risk Governance: Knowing how to understand the market and overall global economy can help you process and survey risk.

- Leadership and Risk Planning: This course explores the responsibilities of leadership in risk management.

- Project Risk and Supply Chain Risk: Risk can lie internally or externally, as is examined in this course.

- Information Systems Risk and Cyber Risk: Technology can be a source of risk for many businesses.

- Decision Analytics: This course helps apply various analytical tools and theories to develop risk analysis skills when making decisions.

- Managing Uncertainty: This course examines methods of designing and implementing plans when a crisis strikes.

Each course encourages students to look at situations from a financial, economical, environmental, and human impact perspective. This enables you to analyze the overall causes and impacts of risk in order to plan for recovery.

Admissions Requirements

Each MS in Risk Management program will likely have its own admission requirements, so it’s beneficial to check the specific application requirements of your prospective schools. Common admissions criteria include:

- GMAT or GRE scores (only some schools require them)

- Completed application

- Undergraduate transcripts with qualifying GPA

- Professional statement

- Letters of recommendation

Some schools require applicants to have completed a bachelor’s program in economics, finance, mathematics, business, or another related field. This will be noted in the admissions requirements of each school.

Risk Management Graduate Programs Accreditation

When it comes to choosing an MS in Risk Management program, you may wish to select one that has received regional accreditation.

A school receives accreditation when it is able to prove that it has the resources and curriculum available to offer students an exceptional education. These programs are known for educational excellence. Some employers and national professional associations look for candidates who have completed a risk management graduate program from an accredited school as well.

Financial Aid and Scholarships

Many students seek assistance in paying for their master in risk management degree online, and financial aid is available for those who qualify.

You can complete the online Free Application for Federal Student Aid (FAFSA) to see if you’re eligible for needs-based federal financial assistance. In addition, scholarships based on previous academic performance and future goals may be available through the school you choose. Some employers also provide tuition reimbursement or other forms of assistance to help their workers pay for further education.

Many communities also offer grants, scholarship programs, and tuition assistance. You may be asked to complete an application or written statement when applying, depending on the source.

What Is a Risk Management Masters Degree?

A risk management masters degree is designed to help students apply critical thinking, risk analysis skills, and existing theories to establish strategic actions in business operations. A risk management masters degree prepares graduates for a career in understanding, preparing for, and mitigating risk in all areas of a business. Graduates may work for the public or private sector at a corporation or a nonprofit.

Different types of organizations, such as banking and financial institutions, have different risk opportunities. For this reason, you have the opportunity to pursue a variety of concentrations, such as global supply chain management, cybersecurity, or accounting.

Is Risk Management a Good Career?

Yes, risk management is a good career for many professionals. The Bureau of Labor Statistics indicates that the business and financial fields are expected to grow 8% over the next ten years. This will create additional demand for those who are able to develop and implement risk management plans at a corporate or global level.

There are many possible careers for those who can prepare for risk. The skills you hone in a masters of risk management program may prepare you for a career in government, marketing, education, or the insurance industry, depending on your areas of concentration.

What Can You Do with a Masters Degree in Risk Management?

Those who receive a masters degree in risk management may go on to explore careers in information security, financial analytics, or even underwriting and actuarial roles. Others may continue on their education journeys and enter doctoral programs in risk management.

A risk management graduate program can help you develop your ability to understand where risk comes from and how a business can implement risk control practices. Professionals in this field minimize risk by keeping a business safe from cyberattacks, financial crises, and even environmental or social risks, which is important in all areas of business and in all industries.

How Long Does It Take to Get a Risk Management Master’s Degree Online?

Most masters degree programs can be completed in 1 to 2 years. The amount of time required to complete your MS in Risk Management program depends on your enrollment status and the number of credit hours required for completion. You can find this information in your school’s curriculum guide.

As with other online business management degrees, if a master in risk management degree online is 36 credit hours, then full-time, year-round enrollment may allow you to complete it in just 1 year. A thesis or final project on top of your coursework may require more time for completion.

Is a Masters in Risk Management Worth It?

Yes, a masters in risk management is worth it for many students. All businesses and entrepreneurs are exposed to risk every day. Those with a background in business risk management can help recognize and analyze situations that may lead to increased risk or crisis.

According to the Bureau of Labor Statistics, business and financial occupations are projected to see 8% job growth over the next ten years. With the market for financial and information security risk managers on the rise, those who are skilled in current risk theory and planning may have more opportunities available to them.

Getting Your Masters in Risk Management Online

If you enjoy helping companies minimize risk by finding and solving problems through risk analysis and careful planning, a masters in risk management degree might be for you.

You can take a look at the various programs available from accredited universities to discover which ones best fit your areas of focus and concentration. Risk management degrees involve analysis, mathematics, and legal skills, and this sector impacts nearly every industry.

If you would like to advance your qualifications for detecting and mitigating risk, you might consider pursuing an online masters in risk management as the next step in your educational journey.