If you’re looking to enter the finance industry, then an online associates degree in finance can help equip you with relevant skills, from basic accounting to data analysis.

Finance is one of the most long-standing sectors, with new jobs emerging every year. It’s also a core function in practically every company, so there are many finance-related roles across various industries.

Editorial Listing ShortCode:

Since finance jobs often involve technical knowledge, an associate degree program in finance can help you become better prepared while giving you fundamental business training.

Universities Offering Online Associates in Finance Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Columbus State Community College

The Associate in Finance program at Columbus State Community College consists of 60 credits taken over four semesters, covering a variety of topics from personal finance to marketing.

By providing online and traditional classroom formats, the program offers the flexibility many students need. No matter the format taken, the classes are designed to give students the essential knowledge needed to launch successful careers in the financial sector.

Columbus State Community College is accredited by the Higher Learning Commission.

Davenport University

The 2 year associate degree in finance program at Davenport University covers fundamental financial concepts and concrete technical skills through a curriculum designed by industry leaders. To graduate, students are required to complete 65 credits.

The program’s goal is for students to leave with the foundational knowledge necessary for careers in finance.

Davenport University is accredited by the Higher Learning Commission.

Franklin University

Franklin University’s Associate in Finance consists of 64 credits, and all classes are held online over the course of either 6 or 12 weeks. Courses such as the Principles of Finance, Microeconomics, and Managerial Accounting comprise the program’s curriculum.

The classes are designed to improve each student’s professional expertise.

Franklin University is accredited by the Higher Learning Commission.

Madison Area Technical College

Classes for the Associate in Finance at Madison Area Technical College are held either fully online or at one of the Madison College campuses. Most students can earn their Financial Assistant Technical Diploma after a year in the program and their full finance associate degree upon completion of the 2 year curriculum.

Madison Area Technical College is accredited by the Higher Learning Commission.

Northeast Iowa Community College

Northeast Iowa Community College offers an Associate in Finance that requires the completion of 63 credits. The courses are designed to provide a foundation for a fulfilling career in finance or continued studies in a bachelor’s program.

This online program is open for admission three times a year, allowing students to get started at their earliest convenience.

Northeast Iowa Community College is accredited by the Higher Learning Commission.

Seminole State College of Florida

For students interested in the high-demand field of finance, Seminole State College of Florida offers an online Associate in Finance program. It is designed to prepare graduates for a variety of positions in banking, management, or sales.

Students attending classes full-time can potentially complete their associate degree in as little as 2 years.

Seminole State College is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Stark State College

The Associate in Finance program at Stark State College aims to give graduates a competitive edge in their career aspirations, whether in the corporate, government, or private sectors.

Students have the option to work toward their degrees full-time or part-time, and all classes have flexible scheduling and online options to fit the needs of individual students.

Stark State College is accredited by the Higher Learning Commission.

University of Cincinnati

The University of Cincinnati’s Associate in Financial Management program is designed to prepare students for entry-level jobs in a variety of financial fields, from banking to loans and collections.

The program consists of 60 credits spread over two years, with coursework in key aspects of finance, such as accounting, personal finance, and investment banking.

The University of Cincinnati is accredited by the Higher Learning Commission.

Wake Technical Community College

Wake Technical Community College offers an Associate in Finance and Accounting program that is designed to help students put theories into practice. It includes studies in business law, finance, and economics. The program consists of 68 credits and can typically be completed in 2 years.

Wake Technical Community College is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

Wilmington University

At Wilmington University, the Associate of Science in Finance program contains 20 courses that cover topics from the principles of management to corporate finance. Full-time students can typically complete these classes in 2 years, either fully online or in a traditional classroom setting.

The program aims to be an excellent first step toward a dynamic, in-demand career in finance.

Wilmington University is accredited by the Middle States Commission on Higher Education.

Online Associates Degrees in Finance

Online finance associate degrees can help you develop a solid grounding in the essentials of finance. You’ll likely study investing, accounting, corporate finance, the banking system, and more.

A finance program typically covers:

- Interpretation of financial statements

- Core concepts, such as risk and types of capital

- Valuations of businesses and assets

- Knowledge of different markets

- Popular monetary policies

- Tools like spreadsheets and related software programs

All in all, you’ll likely become more comfortable with financial management and data analysis, and you may be able to help businesses make more strategic decisions.

An associate’s degree in finance usually takes only 2 years to finish with full-time study, so the coursework typically consists mostly of specialized finance classes. You’ll likely take courses on economics, accounting, taxation, and personal and institutional finance.

Business classes, such as corporate law and statistics, are usually part of the coursework too.

Most of your classes will likely focus on case studies and hands-on work, and you might have a capstone project at the end of the program.

Graduates can pursue a variety of career opportunities in insurance, banking, retail trade, healthcare, social assistance, and human resources, just to name a few. Many entry-level finance jobs involve working with numbers and handling documents.

It’s also possible you’ll be able to use your associate degree later on as credit toward a bachelor’s degree.

Finance Careers & Salaries

Earning an online finance associate degree can help you qualify for an entry-level career in the finance industry. Typically, after about 2 years of study, you can pursue starting positions in a variety of financial companies, such as insurance companies, banks, tax agencies, and real estate agencies.

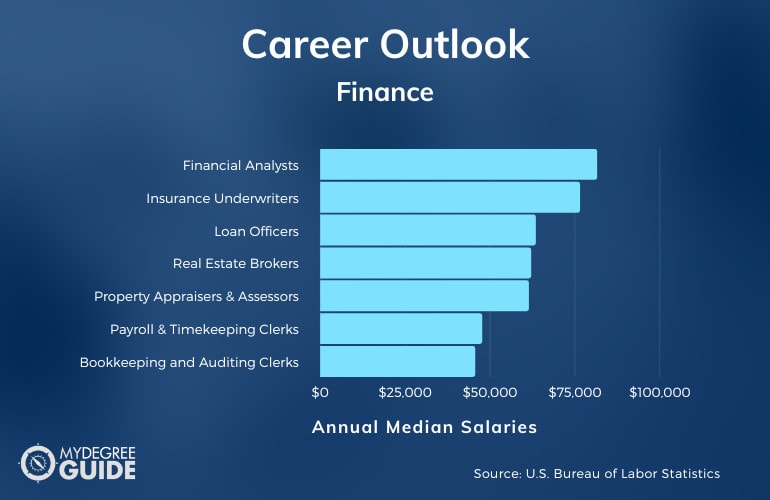

According to the Bureau of Labor Statistics, these are the yearly median salaries of some popular finance jobs for those with an associate degree in finance.

| Careers | Annual Median Salaries |

| Financial Analysts | $81,410 |

| Insurance Underwriters | $76,390 |

| Loan Officers | $63,380 |

| Real Estate Brokers | $62,010 |

| Property Appraisers and Assessors | $61,340 |

| Payroll and Timekeeping Clerks | $47,610 |

| Bookkeeping, Accounting, and Auditing Clerks | $45,560 |

| Financial Clerks | $44,760 |

| Bill and Account Collectors | $37,700 |

| Information Clerks | $37,450 |

Many of these jobs involve working heavily with financial documents. These can serve as an entry point to the industry. Some of the most common roles involve working as an assistant to accountants, investors, and financial advisors.

Graduates may also join the financial departments of companies across different industries. For example, many graduates become payroll clerks, bookkeeping clerks, real estate brokers, and loan officers. As you gain more experience, you may take on more high-level roles, such as financial analysis and even management.

Finance Associate’s Curriculum & Courses

Online associate in finance degree programs will likely cover the following major courses:

- Financial Accounting: This class covers the fundamentals of accounting, including how to read balance sheets and cash flow statements and how to do valuations of potential investments.

- Managerial Accounting: This course is all about using accounting to help managers make decisions, covering methods such as cost-volume-profit analysis and job order costing.

- Principles of Economics: This class teaches both macroeconomics and microeconomics, with topics such as supply and demand, market structures, and globalization.

- Corporate Finance: This course gives an overview of how financial management works in companies, from capital budgeting and sources of funding to daily cash flow.

- Business Law: Finance students need to have a good understanding of basic business laws. This class helps provide that with an emphasis on contracts, bankruptcy, sales, crimes and torts, and court procedures.

- Financial Institutions: This class examines the main components of the financial system, including financial institutions and intermediaries, central banks, and regulations that affect businesses.

- Federal Taxation: This course teaches how to apply federal and state tax laws to individuals and corporations in order to file tax returns and maintain tax records.

- Investment Planning: This class delves into managing investment portfolios with instruments such as stocks, bonds, mutual funds, real estate, and derivatives, all while considering changing market conditions.

- Spreadsheet Applications: This course provides hands-on training in the standard spreadsheet applications used to record and track financial information and how to do advanced calculations.

- Business Statistics: This class teaches how to gather and analyze financial data, apply probability concepts, and summarize the information for managers and stakeholders.

Along with these courses, a program for an associate degree in finance will generally include business classes on topics like management and marketing.

How to Choose an Online Finance Associate’s Degree Program

Here are some considerations for choosing an online finance associate program:

- Program type. Is the program completely online, or does it follow a hybrid format where you have to go on campus sometimes? Most programs also have classes per semester, while others have quarterly or trimester schedules.

- Coursework. Since an associate program generally takes 2 years to complete, you’ll likely take more specialized classes and fewer general education classes. Are these classes in line with what you want to do for work eventually?

- Accreditation. Whichever program you commit to, it’s strategic for it to be at an accredited school. This ensures the credibility of your degree and can impact your ability to transfer credits and receive financial aid.

- Graduate outcomes. It’s often a positive sign if a program has many graduates who are in the line of work you’re interested in. You can look at a program’s retention and graduation rate to see whether people found the program worth staying in.

- Student services. It can be beneficial to choose an associate degree program that offers plenty of student services, such as assistance for internships, academic advising and tutoring, and career consultations.

- Tuition. The cost of the entire program is another key consideration. Some online programs may charge more tuition if you live out of state.

Determining your program preferences can help you narrow down your list of prospective schools.

Admissions Requirements

The admission requirements for online associate programs vary but there are common requirements that are often asked for:

- High school diploma. This proves that you’ve graduated from high school and are eligible to move on to college.

- High school transcripts. A number of online finance programs will look for a minimum GPA.

- Recommendation letters. You’ll likely have to turn in 2 to 3 reference letters that speak about your character and performance.

- Personal essay. You might be asked to describe yourself more and explain why you’re interested in the program using a personal essay.

Some programs will ask for SAT or ACT scores as well, but a growing number of schools no longer require test scores.

Associate in Finance Programs Accreditation

Earning your finance associate degree at an accredited school can be very beneficial. Accredited schools have been reviewed by official agencies and have been found to meet high-quality educational standards by those agencies.

If you go to a regionally accredited school, you may be eligible for government financial aid, and your degree will likely be seen as more valid by hiring managers. You may also be able to transfer credits from an accredited school more easily.

For a list of accredited schools, you can look at the US Department of Education’s directory. Some programs receive special accreditation from business-focused accrediting agencies, such as the ACBSP and IACBE.

Financial Aid and Scholarships

To lighten the cost of earning a finance associate degree, many students apply for financial aid. One option is to fill out the Free Application for Federal Student Aid (FAFSA). This form determines your eligibility for government financial aid and other need-based aid.

Federal aid includes loans, grants, and work-study programs. Loans allow you to borrow money for tuition. Government grants don’t have to be repaid, and they’re usually awarded based on financial need.

Aside from these, there are private scholarships and other forms of financial aid that might be found on your school’s website.

Is Finance a Good Career?

Yes, finance is a good career for many professionals. Finance is one of the largest industries around. As a finance professional, you can work in many possible fields, including tax, banking, insurance, investments, and real estate, among others.

Alternatively, you might use your problem-solving skills and technical know-how to work for companies in other sectors.

Based on data from the Bureau of Labor Statistics, business and finance jobs have a median annual salary of $76,570. There are plenty of opportunities to advance, especially as more financial products and services are created.

What Is a Finance Associate Degree?

A finance associate degree is a 2 year degree that can help prepare you for starting a financial career in institutions such as banks, insurance companies, credit unions, and loan associations.

You can learn about the basic rules of accounting, study diverse financial markets and monetary regulations, and get familiar with managing investments. You can also get practice with interpreting financial data for companies while considering the overall business environment and economic trends.

Courses often have a practical orientation, with modules on using spreadsheets, analyzing financial statements, and filing tax returns.

What Can You Do with an Associates Degree in Finance?

An Associate of Arts in Finance, or an AA in Finance, can help equip you for entry-level jobs in the finance industry. For example, graduates may become loan officers, bill and account collectors, or insurance underwriters.

Since all companies have financial operations, it’s possible to work in the finance or payroll department of various types of companies.

With experience, you may move on to more senior positions as you develop your skills, especially since there is a growing number of finance jobs. The Bureau of Labor Statistics estimates an 8% job growth for the business and finance sector over the next ten years.

How Long Does It Take to Get an Online Associates Degree in Finance?

If you study full-time for an associate’s degree in finance, you can possibly finish in 2 years. An online associate degree program typically consists of around 20 classes, with 5 classes per semester.

If your program is in an online format, the schedule may be more flexible. To finish your associate degree faster, you may be able to take extra classes at a time. Some programs at the best colleges for finance even have semesters that last for only 8 weeks, so if you study year-round, you may be able to finish in less time.

What Jobs Can You Get with an Associates in Finance?

Professionals with associate degrees in finance commonly work in insurance, government, healthcare, and lending and financing. Entry-level jobs in finance include:

- Insurance underwriters. They assess insurance applications and determine how much insurance coverage to give based on the risks.

- Loan officers. They interview loan applicants, process documents, and make decisions for loan approval.

- Bookkeeping clerks. They help maintain companies’ financial records under the guidance of accountants.

Jobs for graduates with associate degrees in finance often involve making financial calculations and handling official documents.

What’s the Difference between an Online Associate’s Degree in Finance vs. Accounting?

Here are some differences between finance and accounting degrees.

| Associates Degree in Finance | Associates Degree in Accounting |

|

|

Both of these types of associate degrees can lead to financial careers.

What’s the Difference between a Certificate vs. Associate Degree in Finance?

An associate degree in finance is more extensive than a certificate program.

| Certificate in Finance | Associate Degree in Finance |

|

|

If you don’t yet have a degree, an associate degree will likely qualify you for more opportunities than a certificate.

Is an Associates Degree in Finance Worth It?

Yes, an associates degree in finance is worth it for many students. Getting a 2 year finance degree can help you find an entry-level job in this growing industry. The Bureau of Labor Statistics estimates that there will be over 750,000 new business and finance jobs over the next ten years.

Earning an associate degree can also boost your earning potential, especially in a technical field like finance. Those with associate degrees tend to earn more than those with high school diplomas. Earning an associate degree in finance can help you develop the necessary skills for this growing field.

Getting Your Associates in Finance Online

If you enjoy working with numbers and you naturally pay attention to details, then you might be a good match for an associate degree in finance.

Whether you’re planning to work right away or pursue a bachelor’s degree, earning an associate degree in finance can help you develop in-demand skills. It can also help you hone your critical thinking and teach you how businesses work.

There are many online finance programs available, so it’s beneficial to search for the best online finance degree programs that most align with your aspirations. You can use this guide to explore accredited schools and plan out the next stage of your education!