Explore Online Finance Degrees for 2024. Compare schools offering a bachelors in finance online (8 week classes available).

Earning an online finance degree can prepare you for a career in the exciting world of business and finance.

Editorial Listing ShortCode:

This job sector is experiencing a 7% growth rate, and the U.S. Bureau of Labor Statistics predicts that the number of positions will grow by 591,800 in the next ten years.

List of Schools Offering Online Finance Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

1. Baker College

Baker College is Michigan’s largest university, and it is a private, not-for-profit institution with campuses across the state of Michigan and online. As a career college, it features more than 150 career programs within its system. Also, it maintains a right-to-try policy and couples this policy with an extensive financial aid office.

Baker College is accredited by The Higher Learning Commission.

2. Colorado Technical University

Established in 1965, Colorado Technical College is a private university that offers undergraduate, graduate, and doctoral degrees primarily in business, management, and technology. Although the school has no public or official affiliation with the State of Colorado, it remains to have over 23,000 students and 2,500 postgraduates.

- Bachelor of Science in Business Administration – Finance

- Master of Business Administration – Finance

Colorado Technical University is regionally accredited by the Higher Learning Commission.

3. Columbia College

Founded in 1851, Columbia College has a traditional college with over 30 campuses all over the nation. The college has local centers and a residential campus in Columbia, Missouri, and it provides an evening program and online classes. The institution currently offers 10 associate degrees, more than 30 bachelor’s degrees, and eight master’s degrees.

Columbia College has been accredited by the Higher Learning Commission.

4. Davenport University

Established in 1866 by Conrad Swensburg, Davenport University is a private, not-for-profit institution with campuses throughout Michigan as well as online.

The motto of Davenport University is “Get where the World is Going,” and this school offers an athletic program that allows students to participate in the National Collegiate Athletic Association (NCAA) under Division II.

Davenport University is accredited by the Higher Learning Commission.

5. Dickinson State University

Dickinson State University is a small public university in Dickinson, North Dakota. The institution was founded in 1918 as Dickinson State Normal Scholl, and it was only granted full university status in 1987. With only 1,350 students enrolled, Dickinson State University has a 10:1 student to faculty ratio.

Dickinson State University is accredited by the Higher Learning Commission.

6. Florida International University

Florida International University is a public research university in Greater Miami, Florida. It is classified among the “R1: Doctoral Universities – Very High Research Activity” and considered a “research university” by the Florida State University.

Florida International University participates in Division I of the National Collegiate Athletic Association, and its students are nicknamed the “Panthers.”

Florida International University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

7. Florida State College at Jacksonville

Located in Jacksonville, Florida, FSCJ is a public school with four campuses in the area. Though still a college versus a university, it qualifies as a state college rather than a junior college for its number of degree offerings. The school was founded in 1966 and now enrolls between 50,000 and 55,000 students per year.

FSCJ is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

8. Granite State College

Established in 1972, Granite State College is a public college located in Concord, New Hampshire, and it is a member of the University System of New Hampshire.

As of the moment, this institution is headed by Dr. Mark Rubinstein, and it has seven locations across the state.

Granite State College is accredited by the New England Commission of Higher Education.

9. Liberty University

Liberty University is a private evangelical Christian university in Lynchburg, Virginia. It is one of the largest Christian universities in the world and one of the largest private non-profit universities in the United States. It also consists of 17 colleges, which includes a School of Medicine and a School of Law.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

10. Metropolitan State University

Metropolitan State University is a public university in Minneapolis-St. Paul, Minnesota that offers high-quality, flexible, and affordable tuition fees for undergraduate and graduate students. The university was established in 1971, and it is a member of the Minnesota State College and University System.

Metropolitan State University is accredited by the Higher Learning Commission.

11. Missouri State University

Missouri State University is a public university established in 1905. The school features a campus of over 200 acres in Springfield, Missouri. Additionally, it has an academic staff of over 1,100 members. Also, it has sporting affiliations with Division I of the National Collegiate Athletic Association.

Missouri State University’s regional accreditation is through the Higher Learning Commission.

12. National University

Established in 1971, National University is a private non-profit university that has 28 campuses, with its headquarters located in La Jolla, California. The school has over 23,000 students and over 170,000 alumni. The university’s motto is “Discendo Vivimus,” which means “We Live through Learning” in English.

National University has been accredited by the WASC Senior College and University Commission.

13. New England College of Business and Finance

Formerly called the “New England College of Finance,” the New England College of Business and Finance is a private, college located in Boston, Massachusetts.

Founded in 1909, the school offers associate, undergraduate, and graduate degrees in Business, Digital Marketing, and International Business. The school also provides online courses.

NECB is accredited by the New England Association of Schools and Colleges.

14. Northeastern University

Northeastern, located in Boston, Massachusetts, is classified as an R1 – Highest Research – University. It’s a private institution with more than 27,000 students per year and also operates branch campuses in Charlotte, Seattle, San Jose, and Toronto.

The distinguishing feature of this university is its co-op program, in which students gain valuable working experience via 3,100 partner organizations and businesses.

If you’re a sports fan, you can root for the school’s Huskies as they compete in the NCAA – Division I in 18 sports.

- Bachelor of Science in Finance and Accounting Management

- Master of Science in Finance

- MBA in Finance and Business Administration

- MS in Finance and Business Administration

Northeastern University is accredited by the New England Commission of Higher Education.

15. Northwood University

Northwood University offers 21 majors for their BBA degree, and it was ranked as one of the best online bachelor’s in business programs by U.S. News & World Report.

Established in 1959 in Midland, Michigan, Northwood University has over 57,000 graduates since its founding. It currently has 20 locations in eight states and international programs in Malaysia, Sri Lanka, and Switzerland.

NU is regionally accredited by the Higher Learning Commission.

16. Old Dominion University

Established in 1930, Old Dominion University is a public research institution located in Norfolk, Virginia. It is currently one of the largest universities in Virginia, with 24,176 enrolls in 2019. The school offers 168 undergraduate degrees, and it has an online platform that provides long-distance access to over 24,000 students.

Old Dominion University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

17. Pennsylvania State University

Founded in 1855, Pennsylvania State University is a state-related doctoral university with campuses and facilities throughout the state. It offers various services, ranging from teaching, research, and public service.

The school’s annual enrollment exceeds 46,000 students, making it one of the largest universities in the United States. It currently has an online platform called World Campus and 24 campuses that offer over 160 majors.

The Pennsylvania State University has been accredited by the Middle States Commission on Higher Education.

18. Purdue University Global

Purdue University Global operates as a part of the Purdue University System, where content delivery is mostly online, with its focus geared towards career-oriented fields of study.

The university has eight physical locations and an online law school. It approximately has 29,000 students, and although it is mainly an online university, it still has campuses in Indiana, Iowa, Maryland, Nebraska, and Maine.

Purdue Global is accredited by The Higher Learning Commission.

19. Southern New Hampshire University

Located between Hooksett and Manchester, New Hampshire, the Southern New Hampshire University was established in 1932. The online Bachelor in Business Administration Project Management degree program consists of the normal 120 credit hours to achieve the degree.

The flexibility of online and on-campus elective courses helps students to customize their learning experiences.

- BS in Finance

Southern New Hampshire University is accredited by the New England Commission of Higher Education.

20. State University of New York – Canton

Located in the Town of Canton, New York, State University of New York – Canton is the public four-year college of SUNY Canton. It offers 29 bachelor’s degrees, 20 associate degrees, and five one-year certificate programs.

Established in 1906, the State University of New York – Canton was the first post-secondary, two-year college authorized by the New York State Legislature. Currently, it is among the first to launch an esports management degree, and it was awarded $1.3 million New York State Grant for Canton Midtown Plaza Revitalization.

SUNY Canton is accredited by the Middle States Commission on Higher Education.

21. Thomas Edison State University

Located in Trenton, New Jersey, Thomas Edison State University is a majority-online institution that mostly serves the state’s adult population. In fact, it is one of the first schools in the country specifically designed for adults.

Established in 1972, the school offers various programs, which include associate, bachelor’s, and master’s degrees in more than 100 areas of study. It also has a national reputation for academic excellence, and it is one of New Jersey’s 11 senior public institutions of higher education.

Thomas Edison State University is accredited by Middle States Commission on Higher Education.

22. University of Alabama – Birmingham

Located in Birmingham, Alabama, the University of Alabama at Birmingham or UAB was established in 1936. Back then, it was only an academic extension and later became fully autonomous in 1969. It currently offers 140 programs of study in 12 academic divisions. The school has a total enrollment of more than 22,000 students from over 110 countries.

The University of Alabama at Birmingham is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

23. University of Houston – Clear Lake

The University of Houston – Clear Lake (UHCL) is located in Pasadena and Houston, Texas, with branch campuses in Pearland. The university was founded in 1971, and it is part of the University of Houston System.

UHCL has a total enrollment of over 6,000 students. It also offers 97 degree programs. Lastly, it ranked #18 among public universities in U.S. News & World Report’s university rankings.

UHCL is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

24. University of Houston – Downtown

UHD has a 40-acre campus in downtown Houston, Texas. There’s also a smaller campus in Harris County. It was established in 1974 and is still the second-largest college in the metropolitan Houston area. It is a public school with 52 possible degree programs and an enrollment of approximately 14,000 students per year.

University of Houston – Downtown officially accredited and/or recognized by the Southern Association of Colleges and Schools Commission on Colleges.

25. University of Houston – Victoria

The University of Houston-Victoria is part of the University of Houston System. The establishment of the university in 1971 was brought about by local efforts in Victoria to bring a higher learning institution in the community.

The institution is composed of four academic colleges where each school offers both undergraduate and master programs and degrees. Also, it has an enrollment reaching over 4,300 students.

The University of Houston-Victoria is accredited by the Southern Association of Colleges and Schools Commission on Colleges to award baccalaureate, masters, and specialist degrees.

26. University of Maryland Global Campus

The University of Maryland College is a public university focused primarily on online education. Its headquarters is located in Adelphi, Maryland, and it has satellite campuses across the Baltimore-Washington Metropolitan Area.

With its global range, the school currently serves over 90,000 students, making it one of the largest distance-learning institutions in the world. They also offer 120 academic programs, including bachelor’s, master’s, and doctoral degrees.

- Accounting and Financial Management Master’s Degree

- Management Master’s Degree with Financial Management Specialization

- Online Bachelor’s Degree: Finance

University of Maryland University College is regionally accredited by the Middle States Commission on Higher Education.

27. University of Massachusetts – Amherst

Located in Amherst, Massachusetts, UMass Amherst is a public research and land-grant university, and it is the flagship campus of the University of Massachusetts System.

The school has an annual enrollment of over 30,000 students. It also offers 109 undergraduate programs, 77 master’s degrees, and 48 doctoral degrees. Finally, it is classified among the “R1: Doctoral Universities – Very High Research Activity” by The Carnegie Classification of Institutions of Higher Education for its research expenditures exceeding $200 million (National Science Foundation).

The University of Massachusetts Amherst is accredited by the New England Commission of Higher Education.

28. University of Minnesota – Crookston

Crookston University is a public university located in Crookston, Minnesota, and it is one of the five universities in the University of Minnesota System. As of 2018, the schools had over 1,900 enrolled students coming from 20 different countries and 40 states.

In highlighting its significance, the university uses the slogan “Small Campus, Big Degrees” to show that the physical size of its campus does not affect the value of education it provides to its students.

UMC has secured continued accreditation status from the Higher Learning Commission.

29. University of the Southwest

Located in Hobbs, New Mexico, the University of the Southwest is a private interdenominational four-year university. It was established in 1962 as a two-year Baptist educational institution.

Today, this school grants baccalaureate degrees in different fields. Also, it has three academic schools that offer over 50 undergraduate and 15 graduate programs.

The University of the Southwest is an accredited member of the Higher Learning Commission.

30. Walsh College

Walsh College became Walsh University in 1993. It is a private, non-profit Roman Catholic university located in North Canton, Ohio. Currently, it offers 70 majors, seven graduate programs, and an online learning platform to approximately 2,700 students.

In line with the university’s ideals, they also offer study abroad programs that aim to foster global citizenship in different countries like Rome, Uganda, and Haiti.

Walsh College is accredited by The Higher Learning Commission.

Online Finance Degree Courses

Programs for a bachelor of science in finance are a mix of business classes and finance-specific courses. The curriculums are designed to introduce students to theoretical concepts that influence financial decisions and policies as well as practical skills that can be applied to future employment settings. Here is a sample of common classes for this degree:

- Business Law: Many federal laws regulate the workings of the U.S. business and financial systems, and this class can give you an overview of them. The curriculum may also touch on local and international regulations. You may learn about contracts, employment law, torts, and other legal issues.

- Business Communication: This class can help you become more proficient at communicating with supervisors, coworkers, clients, shareholders, and others through memos, videoconferencing, email, and presentations. Your course may particularly focus on writing business reports. These skills can help you put your best foot forward, command attention, and persuade others with your words.

- Ethics in Finance: Unethical dealings have been the downfall of many business people and companies. To help you avoid that trap, this class covers ethical decision-making in business. You may discuss making above-board choices, cultivating an ethical workplace environment, operating within the boundaries of the law, and protecting the environment through sustainable practices.

- Economic Analysis: Understanding how to evaluate economic data can help you make solid business choices. Courses in economic analysis talk about both microeconomics and macroeconomics. You may get to explore various software applications that can be useful when performing financial analyses.

- Financial Accounting: This foundational class is designed to be an introduction to the basics of accounting. You and your classmates can study why careful accounting is important to the success of an organization. In addition to these theoretical ideas, you can also acquire practical skills for keeping track of financial records.

- Global Finance: Business dealings are often conducted across international markets. This course can help you prepare for working with people from other countries and performing transactions outside of your home country. In addition to learning about worldwide financial regulations, exchange rates, and international trade, you may also practice demonstrating cultural sensitivity when working in diverse settings.

- Introduction to Real Estate: Your online degree in finance may lead you to a career in real estate, so this course is designed to introduce you to some of the real estate concepts you may need to know. Topics covered may include appraisals, contracts, loans, and market analysis.

- Management of Investment Portfolios: Earning a financial advisor degree may lead to a job in managing financial assets and investments for others. This course addresses important topics that you’ll need to understand before taking on that responsibility, such as risk management, stocks, diversification, and asset selection.

Keep in mind that course selections can vary among finance schools. If your finance degree has a particular concentration or area of focus, you will take additional classes that are specific to that field of study.

Some online finance bachelor’s degree programs also require students to complete internships or other hands-on experiences in addition to the regular coursework.

What Can You Do with a Finance Degree?

Many career paths are available to people who have a bachelor’s degree in finance. With your bachelor’s degree, you may be able to get a finance job in a variety of areas including banking, insurance, taxation, accounting, and risk management.

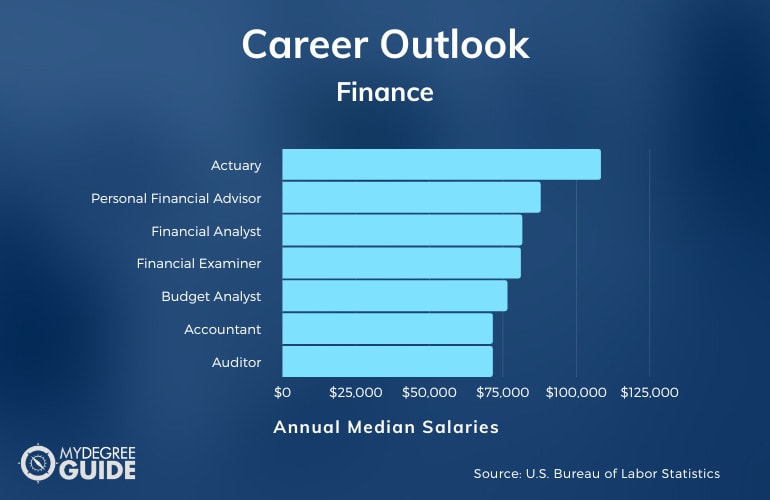

Finance is a diverse field, so starting a finance program won’t lock you into any one job. You can explore several options and pursue the type of career that most appeals to you. According to the Bureau of Labor Statistics, some possible financial career paths and their correlating salaries include:

| Careers | Descriptions | Annual Median Salaries |

| Actuary | Use statistical data to evaluate risk and make recommendations for insurance companies or other businesses | $108,350 |

| Personal Financial Advisor | Work one-on-one with clients to help them plan for their futures and make sound investments | $87,850 |

| Financial Analyst | Study financial data and economic trends to determine the best course of action for investments or business decisions | $81,590 |

| Financial Examiner | Monitor the practices of financial institutions to ensure legal compliance and consumer protections | $81,090 |

| Budget Analyst | Help set an organization’s budget and see that the plans are followed | $76,540 |

| Accountant | Maintain financial records, prepare tax forms, and take care of other responsibilities to keep track of income and expenses for organizations or individual clients | $71,550 |

| Auditor | Evaluate financial statements to look for errors and to ensure that an organization’s practices are legal and ethical | $71,550 |

| Insurance Underwriter | Determine whether an insurance company should offer policies to applicants | $70,020 |

| Loan Officer | Work with commercial or individual clients who are applying for loans to evaluate whether they are good candidates for borrowing money | $63,270 |

| Real Estate Appraiser | Evaluate and compare the value of commercial or residential real properties | $57,010 |

| Real Estate Agent | Negotiate the buying and selling of houses and other properties | $50,730 |

The above salaries are median figures for the entire country. Salaries can vary significantly based on geographic location, experience, and education. Having an online MBA in finance or even an online PhD in finance can likely cause a boost to the average annual salary.

Professional Organizations for Those with a Business Finance Degree

For those who love numbers and money matters, finance can be an exciting field. Connecting with others who have similar passions can help drive your professional growth. To learn from other financial experts through journals, conferences, classes and online forums, join an industry organization.

- American Finance Association: AFA is dedicated to conducting research on financial matters and disseminating information among finance professionals and the general public. The organization publishes a journal and holds an annual meeting.

- Association for Financial Professionals: AFP represents professionals who work in finance and treasury positions. In addition to putting out publications and holding events, the organization offers certification programs for treasury professionals, financial planners, and financial analysts.

- Institute of Management Accountants: Finance professionals who work in the business world can benefit from membership in IMA. This group runs certification programs, offers career tools, provides ethical guidance, publishes books and journals, and distributes information through classes and webinars.

- The National Association of Personal Financial Advisors: NAPFA brings together personal financial advisors who are committed to providing the best possible counsel to their clients. To join, you must use a fee-only payment structure for charging your clients — no commissions allowed.

- National Society of Accountants: NSA membership is intended for financial professionals who work in small accounting firms. The group advocates for accountants and tax professionals, provides educational support for members, holds annual meetings, and conducts surveys to gather industry information.

Membership in a financial professional organization usually offers multiple perks. In addition to the benefits listed above, your membership fees may also grant you access to discounts, journal subscriptions, continuing education classes, job listings, advocacy, discussion boards, and local or national gatherings.

Certification and Licensure Following a Finance Degree Online

Clients and employers want to know that the people they hire are competent financial professionals. Industry certifications and licenses can help you demonstrate that you are an expert who understands financial matters and can be trusted to handle their money. See the listed financial certifications as you may want to pursue one or more of the following.

- Chartered Financial Analyst (CFA): CFA charterholders earn this highly regarded distinction through study, four or more years of professional experience and a satisfactory score on the CFA Program exam. This certification for financial analysts is offered by the CFA Institute.

- Certified Financial Planner (CFP): With enough education and experience as a financial planner, you can take the exam to receive this certification from the CFP Board. To qualify, you must also subscribe to a code of ethics.

- Certified Internal Auditor (CIA): Internal auditors can take an exam to receive CIA credentials from The Institute of Internal Auditors. Applicants must also present character references who can testify to their ethical professional conduct.

- Certified Public Accountant (CPA): The Association of International Certified Professional Accountants grants CPA status to applicants who earn around 150 credit hours of education in accounting, gain professional experience under the supervision of a licensed CPA, and pass a rigorous exam. Exact licensure requirements vary between states. The Uniform CPA Exam consists of four parts that you can take over 1.5 years.

- Financial Risk Manager (FRM): To advance your risk management career and earn the respect of banks and corporations, you can take a two-part exam in pursuit of FRM certification from the Global Association of Risk Professionals. Professional experience is required.

Studying for these financial certifications takes work and determination, but the potential career advancement makes the effort worthwhile.

Accreditation for Online Finance Degrees

All schools that you consider for your online finance degree should be regionally accredited. This is a distinction that can be granted only by one of the country’s official regional accrediting bodies. These organizations evaluate schools on their overall academic quality as well as additional criteria, such as their organizational structure and their leadership.

If you attend a regionally accredited school, whether brick-and-mortar or online, you can have confidence that you are going to receive a reputable education. You’ll find it easier to transfer your credits elsewhere, get into grad school, or find a good job. Overall, regionally accredited schools ensure your education investments and bachelor’s degree get recognized.

AACSB Online Finance Degrees

If you want to enroll in one of the best finance programs, look for a school that is approved by AACSB International. This industry-specific organization grants programmatic accreditation to business and accounting degree programs.

AACSB accreditation signifies that a program meets the highest standards of business or accounting excellence.

Financial Aid for a Bachelor’s Degree in Finance

No matter which finance program you are planning on studying, you may be able to get tuition assistance from the government, your school or private sources. Filling out the Free Application for Federal Student Aid (FAFSA) should be your starting point for the financial assistance process.

The federal government or your state government may give you grants or low-interest loans. You may also be eligible for the Federal Work-Study Program.

Schools sometimes grant scholarships to their most-qualified applicants. Other scholarship sources may include industry organizations, special-interest groups, local clubs, corporations, and community businesses.

You can also speak to your school’s financial aid department about setting up a payment plan. Receiving any type of financial assistance towards your degree and credits can make a big impact.

Questions Related to Earning a Finance Degree

See are our quick answers to the most frequently asked questions in regards to earning a bachelor’s in finance, the difficulty behind the curriculum, and the transfer of credits.

What’s the Difference Between Finance and Accounting?

There is a good deal of overlap between finance and accounting departments since both deal with money matters. In general, though, accounting has to do with records of financial transactions that have already happened, while finance focuses on analyzing past data to make decisions for the future.

Even still, you may be able to work an accounting job with a financial analyst degree as both programs share similar fundamentals and principles.

What’s the Difference Between a BA in Finance vs BS in Finance?

Whether you pursue a bachelor of arts or a bachelor of science in finance, you can receive a similar foundation for your financial career.

Both finance programs usually require the same number of credits to receive your bachelor’s, however, the curriculum and coursework will be slightly different. With a BA in finance, your bachelor’s program may involve more liberal arts electives. In a BS in finance program, you may focus more on other technical skills, including math and science.

Both programs share the same principles, and depending on the institution, you may even be able to transfer your credits between finance programs.

How Long Does It Take to Get a Bachelor’s in Finance?

It usually takes students four years, or 120 credits, to get a bachelor’s in finance.

However, depending on the school’s policy, you may be able to test out of classes by achieving high scores in order to reduce the number of credits needed. You may also be able to take accelerated courses that will allow you to earn your credits at a faster pace, granted you pass the courses with high enough scores.

Are There Any Online Finance Degree Masters Programs?

Yes, several universities offer online finance degree masters programs.

After earning your undergraduate degree, you now might want to advance to a master’s program in finance. Fortunately, many graduate financial degrees are now being offered through online business degree classes. Just make sure to consider only schools that have regional accreditation. In addition, remember that some of the best finance degrees are from AACSB-accredited schools.

Are There Any Accelerated Finance Degree Online Programs?

Yes, there are accelerated finance degree online programs.

Getting your financial advisor degree doesn’t have to take four full years. Many colleges offer online classes that are worth the same amount of credits, but follow a fast-track schedule. Courses are typically offered year-round, and each one may be less than 10 weeks long. The topics and coursework cover the same material, but tend to be at a much faster pace.

To get the best financial deal for your education investments, you may want to consider taking online accelerated programs. These programs may help you earn the same number of credits for your bachelor’s degree in just a few years, rather than the typical four years.

How Hard is a Finance Degree?

Earning your financial management degree will probably be challenging at times, but your hard work can pay off in the form of increased knowledge in several financial areas including money, business, economics, decision-making, and data analysis. In addition, your coursework and studies can prepare you to conquer a wide variety of jobs or career paths you might choose.

And although college always requires dedication and attention, you may find that the flexibility of online finance degrees can make studies more feasible for your busy schedule.

How Do I Know if a Finance Degree is the Best Degree For Me?

Whether you are planning on obtaining an online bachelor’s degree, or a traditional degree, it can be quite difficult to choose which degree is right for you. If you have any of the following traits or skills, a finance degree may be the best fit for you.

- Are a natural problem solver

- Have high emotional intelligence (EQ)

- Are exceptionally organized and self-manageable

- Are an analytical thinker

These are just a few characteristics of a finance student, and even if you have just one, or several of these traits, then planning to study finance just might be the best fit for you.

What is the Best Minor to Compliment a Bachelor’s Degree in Finance?

While electives can broaden your education, a minor excels at being able to provide a more in-depth study. By accommodating students with a greater financial acumen, a minor can supplement a finance degree and enable students to add significant value to their finance degree and financial career.

Some of the best minors to compliment a bachelor’s in finance may include accounting, economics, math, business, and foreign language.

In addition, adding a minor to your studies may not even affect your tuition costs. Check with your financial advisor to learn more about this potential opportunity.

Is an Online Finance Degree Worth It?

Yes, an online finance degree is worth it for many students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years. Common careers in this field include insurance underwriter, budget analyst, financial examiner, and actuary.

Organizations and individuals need the expertise of financial professionals. An online bachelor of business administration finance degree can help prepare you to meet this demand. After graduation, you can be ready to pursue a job in a variety of financial fields, including real estate, accounting, and financial analysis.

If you’re ready to take an important first step toward an exciting career in the business world, start exploring undergraduate finance programs and submitting application packets. In just a few short years, you may have your financial advisor degree and be ready to launch your career.