An online forensic accounting degree is one of the most straightforward tracks to specializing in detecting and solving financial crimes.

Forensic accountants are often curious and detail-oriented with a passion for working with numbers. With more companies worldwide prioritizing financial protection, forensic accounting is a growing field where you can make a real impact while tackling complex and interesting cases.

Editorial Listing ShortCode:

If you’d love to study business, accounting, and criminal investigation, then you might consider an online forensic accounting degree.

Universities Offering Online Bachelors in Forensic Accounting Degree Program

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Champlain College

Champlain College offers an online Bachelor’s in Accounting program. Champlain offers a number of specialized accounting certificates, including a Forensic Accounting Certificate. Champlain’s graduates who sit for the CPA exam have a near-perfect success rate.

The program can also help prepare students for other financial careers, such as budget analyst or tax accountant.

Champlain College is accredited by the New England Commission of Higher Education.

Davenport University

Davenport University offers a Bachelor’s in Accounting Fraud Investigation. The program can help students develop their accounting, auditing, and investigative skills. Courses include Corporate Finance, Business Law Foundations, Cost Accounting, Federal Taxation I, and more.

Students have the choice to complete an internship, field experience, or a capstone project to graduate.

Davenport University is accredited by the Higher Learning Commission.

DeSales University

DeSales University offers a BS in Accounting and Forensic Accounting. The program features accelerated courses and convenient options both online and on campus. It is designed to provide flexibility for adult learners, and students can transfer up to 75 qualifying credits into the program.

DeSales University is accredited by the Middle States Commission on Higher Education.

Eastern Oregon University

Eastern Oregon University offers both a Bachelor of Science and a Bachelor of Arts in Accounting with a concentration in Forensic Accounting. The program is designed to provide solid accounting knowledge and prepare students for licensure exams.

Students in the program can experience a collaborative learning environment in a cohort model.

Eastern Oregon University is accredited by the Northwest Commission on Colleges and Universities.

Florida Atlantic University

Florida Atlantic University offers a Bachelor of Business Administration with a concentration in Accounting. The program covers auditing, bookkeeping, forensics, taxation, and more. The degree can be earned 100% online. FAU also provides opportunities to participate in internships and study abroad programs.

FAU is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Franklin University

Franklin University offers a BS in Forensic Accounting. Classes are 6 or 12 weeks long and 100% online. Courses include Financial Accounting, Auditing, Business Interviewing Techniques for Fraud Investigation, Legal Elements of Fraud, and more. There is also a capstone experience.

Franklin University is accredited by the Higher Learning Commission.

Indiana State University

Indiana State University offers an online program for a BS in Accounting. A variety of optional minors are also available, including one in Forensic Accounting. Courses include Financial Accounting I and II, Auditing Theory and Practice, Fraud Examination, and more.

This program can help prepare students for a variety of careers in accounting, financial planning, and other related fields.

Indiana State University is accredited by the Higher Learning Commission.

Maryville University

Maryville University offers an online program for a Bachelor of Science in Accounting with a specialization in Forensic Accounting. No campus visits are required. The curriculum is informed by industry leaders and is designed to prepare students for the CPA exam. It covers marketing, business statistics, economics, and more.

Maryville University is accredited by the Higher Learning Commission.

New England College

New England College offers a hybrid online and on-campus BS in Forensic Accounting program. Courses include Fraud Examination, Investigative Techniques for Fraud, Corporate Governance and Internal Control Assessment, Internal Audit and Risk Management, and more.

NEC is accredited by the New England Commission of Higher Education.

Point University

Point University offers an online program for a Bachelor of Science in Accounting. It is completely asynchronous, allowing students to learn at their own pace. Classes have a 13-to-1 student-teacher ratio, and instruction is faith-based.

Courses include Detection and Prevention of Fraudulent Financial Statements, Auditing, Governmental and Nonprofit Accounting, and more.

Point University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Purdue University

Purdue University offers a Bachelor of Science in Accounting with a concentration in Auditing and Forensic Accountancy. The courses are 10 weeks long and start once per month. There is also an accelerated track available to help students earn a Master of Science in Accounting.

Purdue University is accredited by The Higher Learning Commission of the North Central Association of Colleges and Schools.

Southern New Hampshire University

Southern New Hampshire University offers a BS in Accounting with a concentration in Forensic Accounting. The program is intended to help students become certified fraud examiners. Graduates often work in accounting firms, insurance agencies, law firms, and other similar settings.

There are six terms that are 8 weeks long each year, with applications accepted on a rolling basis.

Southern New Hampshire University is accredited by the New England Commission of Higher Education.

University of Alabama – Birmingham

The University of Alabama at Birmingham offers a Bachelor of Science in Accounting. The program is 100% online with no residency requirements. Students in the program can receive networking opportunities and preparation for the CPA exam and learn from experienced accounting experts.

There are three start dates each year.

The University of Alabama at Birmingham is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

University of Northwestern Ohio

The University of Northwestern Ohio’s College of Business offers a 4 year Bachelor’s in Forensic Accounting degree program. It is designed to help prepare students for the Certified Fraud Examiner’s Exam. There is also a 5 year accounting degree program that can help prepare students for the CPA exam.

Classes at UNOH are taught by experienced business professionals.

UNOH is accredited by the Higher Learning Commission.

Utica University

Utica University offers a BS in Fraud and Financial Crime Investigation with a concentration in Financial Investigation. Courses include Financial Accounting, Managerial Accounting, Corporate Finance, and more.

Through Utica’s partnership with a leading cryptocurrency intelligence company, students are also given the opportunity to gain specialized knowledge in cryptocurrency fraud and theft.

Utica University is accredited by the Middle States Commission on Higher Education.

Online Forensic Accounting Degrees

An online forensic accounting degree program can help you develop the specialized accounting and auditing skills needed to conduct finance-related investigations.

Studies in this field involve learning how to identify, document, and help prevent cases like the following:

- Insurance fraud

- Money laundering

- Cybercrime

- Fake financial statements

- Embezzlement

- Defaulting on debts

- Identity theft

Fraud is becoming more common as companies expand their financial services and technology leaves more room for vulnerabilities.

There are forensic accountants who work for government and law enforcement agencies, such as the Federal Bureau of Investigation (FBI). Many forensic accountants also work in risk security departments, insurance companies, and accounting and auditing firms. Because you’ll be exposed to general accounting as well, you may choose to become a regular accountant or auditor as an alternative path.

Most forensic accounting programs include plenty of core courses in accounting as well as management fundamentals, like marketing and operations. As a forensic accounting major, you’ll likely learn how to analyze a company’s cash flow, create financial statements, prepare tax returns, and conduct audits.

These degree programs include specialized classes on fraud and criminal justice as well. Aside from being able to identify inconsistencies in financial records, forensic accountants also gather evidence that can be presented in court. They may even testify in court themselves, so it’s essential to know about the legal aspects of accounting.

Some forensic accounts also interview suspects and assist in search warrants. Given their expertise in handling fraud, forensic accountants can help companies troubleshoot and strengthen their internal systems to reduce the risk of fraud.

Most accredited forensic accounting programs can help you qualify for industry certifications, such as the Certified Public Accountant (CPA) and Certified Fraud Examiner (CFE). Neither certification is required for becoming a forensic accountant, but having them can typically enhance your career opportunities. The CFE in particular is seen as industry proof that you have specialized knowledge in fraud.

Both certifications require at least 2 years of work experience, so finishing your bachelor’s degree in forensic accounting is the first step.

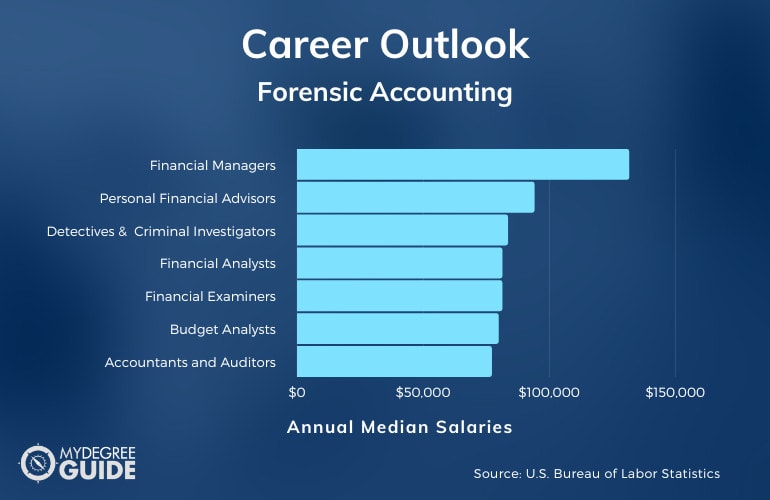

Forensic Accounting Careers & Salaries

Forensic accountants are trained to look out for financial crimes and to analyze financial statements for accuracy and compliance.

These skills are highly sought after in various industries, including risk management, government investigation, insurance and lending, banking, and law enforcement. According to the Bureau of Labor Statistics, here are some of the median yearly salaries of careers related to forensic accounting.

| Careers | Annual Median Salaries |

| Financial Managers | $131,710 |

| Personal Financial Advisors | $94,170 |

| Detectives and Criminal Investigators |

$83,640 |

| Financial Analysts | $81,410 |

| Financial Examiners | $81,410 |

| Budget Analysts | $79,940 |

| Accountants and Auditors | $77,250 |

| Claims Adjusters, Appraisers, Examiners, and Investigators | $64,710 |

| Loan Officers | $63,380 |

| Tax Examiners and Collectors, and Revenue Agents | $56,780 |

Many forensic accountants work in government agencies. These professionals might track and profile criminals, prepare reports for court cases, and help resolve crimes like money laundering and even terrorism.

You can also specialize in risk management and corporate security. Companies want to lower their risks and protect their resources. Forensic accountants in this area may perform regular audits, keep updated with financial policies, and ensure that companies remain compliant.

Some forensic accountants take on behind-the-scenes roles in accounting and legal teams, and they may be called on if suspicious financial activities are found.

Some of the most lucrative forensic accounting jobs are in criminal investigation and financial management. Still, even within the same careers, salaries can vary widely based on your location, specialization, and other factors.

Bachelor of Forensic Accounting Curriculum & Courses

Forensic accounting online degrees usually include these core courses:

- Microeconomics: This course explains how individuals and firms behave in economic systems and how resources are allocated based on public policies, supply and demand, and competition.

- Financial Accounting: This course involves studies of the accounting cycle and the major components of financial statements so you can learn how to prepare them on your own.

- Intermediate Accounting: This course covers how to create financial statements for more complex accounting situations and analyze financial reports to inform executive-level decisions.

- Federal Taxation: Forensic accountants need to have a good grasp of how federal income tax works for both individuals and businesses, and this class includes topics such as gross income determination and property tax.

- Business Law: This course gives an overview of the US legal system for businesses with a focus on relevant areas, such as contracts, bankruptcy, and marketing laws.

- Auditing and Risk Management: In this class, you’ll get to practice examining financial statements for compliance while applying professional ethics and standards in accounting.

- Principles of Forensic Accounting: This course gives an overview of forensic accounting through case studies that demonstrate criminal psychology and real-life investigation procedures.

- Computer Investigation: Forensic accountants often take advantage of technology when investigating fraud. This class includes studies on the sophisticated tools used for crunching data and finding digital evidence.

- Fraud Detection and Prevention: This course delves into how to identify different types of fraud through financial statements and how to prevent these with strong internal systems.

- Interview Techniques for Fraud: This hands-on course focuses on how to effectively interview fraud suspects and other involved parties, including reading body language.

All in all, a forensic accounting degree typically consists of general business courses, such as marketing and management, along with more specialized accounting classes.

How to Choose an Online Degree in Forensic Accounting Program

When you’re looking for an online forensic accounting program, you may want to keep these factors in mind:

- Curriculum. Some forensic accounting programs will help you prepare for the Certified Fraud Examiner (CFE) and Certified Public Accountant (CPA) exams. Ideally, a program will also meet federal government requirements, so you can have the option to pursue government work.

- School Credentials. It’s beneficial to choose an online program from an accredited school so you can get your classes credited for certification in the future. You can also look into faculty members’ achievements in the field along with the school’s overall reputation.

- Student Resources. Forensic accounting requires several hands-on skills, so you may benefit from a program with resources such as networking opportunities, specialized labs, and internship connections. For online programs, you may also want to verify whether your school provides technological support.

- Program Format. Online programs tend to have more flexible scheduling. Some programs have self-paced classes or classes that happen over trimesters or shorter. Some programs require you to be on-campus occasionally, especially for lab activities and practicums. It’s helpful to verify if your program has any on-campus requirements.

- Cost. While online programs tend to cost less on average, they can still vary widely in terms of cost. You may want to take note of how much the tuition costs per credit. You can also consider whether there are additional costs that you might have to pay aside from the tuition.

Enrolling in online accounting degree programs can be a big decision, so it’s strategic to take the time to research and compare each of your choices.

How to Become a Forensic Accountant

A bachelor’s degree is the minimum requirement for forensic accountants, but professionals often pursue additional training and certifications to advance their careers.

Here are the general steps to becoming a forensic accountant:

- Get a bachelors in forensic accounting or a related finance program. Forensic accountants need a bachelor’s degree at minimum for entry-level positions. Earning a forensic accounting degree is the most straightforward track. For other accounting or finance degrees, you’d likely have to take forensic accounting electives.

- Gain professional experience. To widen their professional horizons, most forensic accountants pursue professional certifications. Relevant accounting certifications often require at least 2 years of work experience in a relevant field. Pursuing work related to auditing, risk security, tax, and accounting can be helpful.

- Take the CPA or CFE exam. Once you’ve built up work experience and meet the educational requirements, you can pursue licensure as a certified public accountant (CPA) or a certified fraud examiner (CFE). The CFE exam is specifically focused on forensic accounting and tests your knowledge on fraud, investigation, and law.

- Earn a masters in forensic accounting. While you can be a full-fledged forensic accountant with a bachelors, you could try to grow your career even more by earning a graduate degree in forensic accounting. A masters typically takes 1 to 2 years to finish, and you could choose to specialize in an area such as cybercrime or data analytics. A number of universities offer online master’s in forensic accounting programs.

The type of career and industry you can qualify for will likely depend on your level of training and your areas of specialization.

Forensic Accounting Programs Admissions Requirements

As a forensic accounting degree applicant, you’ll likely need to prepare these admissions requirements:

- Official transcripts. Programs will ask for your high school transcripts to see your GPA and the classes you’ve taken.

- Test scores. Many schools will take into account your scores on standardized tests like the SAT or ACT. A growing number of schools no longer require these, though.

- Letters of recommendation. You’ll usually need to submit two to three letters from teachers and counselors.

- Personal statement. Most schools will give you essay questions to answer in three pages or less.

On top of these, you’ll typically need to submit an online application with your personal information as well.

Online Forensic Accounting Programs Accreditation

If you’re looking at forensic accounting colleges, then accreditation is a top consideration. Regional accrediting organizations assess schools and only give them accreditation if their programs, facilities, and faculties meet set educational standards. The Council for Higher Education Accreditation (CHEA) has a list of these recognized accrediting organizations.

Accreditation is especially important for online programs. This is the case whether it’s for a bachelor’s degree in forensic accounting or a graduate certificate in accounting online. Your degree will likely carry more weight among employers if your school is accredited. Only accredited programs are eligible for government financial aid, and you’ll likely find it easier to get your accredited credits approved for both future studies and official certifications.

Forensic Accounting Programs Financial Aid and Scholarships

Students often pursue financial aid opportunities to reduce college costs. There are generally two types of financial aid: need-based and merit-based. Need-based financial aid is awarded based on your level of financial need, while merit-based financial aid looks at your achievements.

As a start, you can see if you qualify for government financial aid by filling out the Free Application for Federal Student Aid (FAFSA). Your FAFSA form can determine your eligibility for loans, grants, and work-study programs. Loans are the most common because they’re often available to everyone.

Aside from government aid, you can also explore scholarship opportunities. Some accounting-specific scholarships include the Ritchie-Jennings Memorial Scholarship Program and the AICPA Accountemps Student Scholarship. For a thorough list of financial aid options, you can reach out to your school counselor or look at the financial aid section of your prospective school’s website.

What Is Forensic Accounting?

Forensic accounting is focused on preventing, identifying, and handling financial crimes. Forensic accountants are adept at analyzing financial data and auditing documents to pinpoint suspicious activity, such as tax evasion and fraud.

Forensic accountants are also well-versed in legal procedures. Their responsibilities can include gathering solid evidence and digging deep into financial documents for court cases. Many medium-sized and large organizations have forensic accounting teams. Government agencies, financial companies, and law firms may offer forensic accounting roles too.

Is Forensic Accounting a Good Career?

Yes, forensic accounting is a good career for many professionals. There is a growing need for protection as financial services become more complex and organizations become more prone to technology fraud.

Based on data from the Bureau of Labor Statistics, financial and business careers have a median yearly salary of $76,570, which is higher than average. The median salary for accountants and auditors is $77,250, and detectives and criminal investigators earn a median of $83,640 (Bureau of Labor Statistics).

With a forensics accounting degree, you could potentially pursue an engaging career in various sectors, including government, finance, banking, and accounting.

What Can You Do with a Forensic Accounting Degree?

A forensic accounting degree program can teach you how to investigate fraud and other financial crimes, mainly through studying financial documents. Fraud is present in practically every industry, so a forensic accounting degree can lead to several career options.

Some forensic accountants work for the government on solving criminal cases. They may also join the security department of finance companies, developing systems for reducing risks and preventing fraud. Others might work with law firms and help gather evidence for court cases that range from divorce to business bankruptcy.

How Long Does It Take to Get an Online Forensic Accounting Degree?

If you’re studying full-time, you’ll likely finish an online forensic accounting bachelor’s degree in 4 years. A bachelor’s in forensic accounting generally consists of 120 credits, so a full-time course load involves taking around 12 to 15 credits per semester.

Online programs tend to have more scheduling options. Many offer shorter, 8 week classes, allowing you to complete your degree in less time if you enroll year-round. Studying part-time is common with online programs, but this may take you longer to earn your degree. On the other hand, an accelerated online program could enable you to finish your degree more quickly.

What’s the Difference between an Auditor vs. Forensic Accountants?

Auditors and forensic accountants have different responsibilities.

| Auditor | Forensic Accountant |

|

|

Forensic accountants can generally do auditing, but not all auditors can do forensic accounting.

Is a Forensic Accounting Bachelor’s Degree Worth It?

Yes, a forensic accounting bachelor’s degree is worth it for many students. The Bureau of Labor Statistics projects 7% job growth for accountants and auditors over the next ten years with around 135,000 job openings every year.

The demand for forensic accountants is also growing as financial laws get stricter and there is more need to guard against cybercrime. Aside from forensic accounting, this degree is often flexible enough that you can branch out to other finance-related jobs. For instance, some graduates go on to become general accountants or personal financial advisors.

Getting Your Bachelors in Forensic Accounting Degree Online

Are you fascinated by financial crimes to the point that you’d love to investigate them? If so, you might consider pursuing a forensic accounting bachelor’s degree.

Forensic accountants tackle diverse cases, from embezzlement to corporate disputes and defaulting on debt. An online degree in forensic accounting can help you develop the hands-on skills and legal know-how needed to get started in this intriguing field.

To get started, you can browse through forensic accounting programs from accredited schools to find the one that suits you the best. This could be your first step to a rewarding new career!