We’ve identified 35 accredited Online Masters in Accounting No GMAT Programs. Want to get one of these masters accounting degrees without taking the GMAT? Start here!

Accounting professionals often find work in thrilling fields like show business, law enforcement, fashion, government and professional sports. They can hold positions of great influence in a company, including that of chief financial officer.

It might surprise you to learn that accounting can be fun, exciting and, sometimes, even glamorous.

Editorial Listing ShortCode:

Universities Offering Online Master’s in Accounting Programs without GMAT Requirement

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

The following schools offer online master’s in accounting degrees and have no GMAT required for admission consideration.

1. Albertus Magnus College

Through evening or online courses, you can earn an MS in Accounting from Albertus Magnus College in Connecticut. Courses include Financial Statement Analysis and Fraud Investigation. After this program, you may have enough credits to sit for the CPA examination. You can also choose a track that will prepare you for certification as a Personal Financial Specialist.

- Master’s in Accounting

- MBA – Accounting

Albertus Magnus College is accredited by the New England Commission of Higher Education.

2. American InterContinental University

The MBA in Accounting program from American InterContinental University offers classes like Accounting for Managers to help refine your leadership and critical thinking skills. When you earn this degree online, you can take advantage of the school’s Intellipath program, which may allow you to earn credit for previous schooling or professional experience.

- MBA – Accounting

American InterContinental University is regionally accredited by the Higher Learning Commission.

3. Baker College

The MBA in Accounting program from Baker College in Michigan includes core business classes like Human Resource Management and Strategy in a Global Environment.

There are accounting-specific classes like Taxation, Accounting for the Contemporary Manager and Financial Accounting. This program highlights critical thinking, ethical behavior and clear communication.

- MBA – Accounting

Baker College is accredited by the Higher Learning Commission.

4. Bay Path University

Three concentration options are available for the MS in Accounting at Massachusetts’ Bay Path University: Private Accounting, Public Accounting (Tax and Audit), and Forensic Accounting. Designed for current business professionals, this flexible online program offers start dates throughout the year and doesn’t hold classes during the busiest months for accountants.

- Master’s in Accounting

Bay Path University is accredited by the New England Commission of Higher Education.

5. Bellevue University

The MS in Accounting program at Bellevue University in Nebraska includes classes like Accounting Theory, Taxation of Business Entities and Financial Auditing. If you wish, you can add a Tax or Finance concentration to your coursework. To help you gain hands-on experience, there’s an internship component to this degree program.

- Master’s in Accounting

Bellevue University is accredited by the Higher Learning Commission.

6. Benedictine University

Illinois’ Benedictine University offers a Masters in Accountancy program that covers both foundational and advanced accounting topics.

You’ll study managerial topics to improve your leadership and organizational skills. Finally, the program includes electives through which you can earn a concentration in Forensic Accounting, Auditing or Tax Accounting.

- Master’s in Accountancy

BU is regionally accredited by the Higher Learning Commission (HLC) of the North Central Association of Colleges and Schools (NCA).

7. Brenau University

For a Master of Accounting program, consider taking online classes from Brenau University in Georgia.

Courses include Corporate Taxation, Fraud Prevention and Internal Control, and Nonprofit and Governmental Accounting. After earning this degree, you may be prepared to take the examination to earn your credentials as a Certified Public Accountant or a Certified Management Accountant.

- Master’s in Accounting

- Master’s in Organizational Leadership – Managerial Accounting

- Master’s in Organizational Leadership – Public Accounting

- MBA – Managerial Accounting

- MBA – Public Accounting

Brenau University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

8. California Baptist University

In CBU’s online MS in Accounting program, you’ll take core business classes like Financial Management and Quantitative Business Modeling. You’ll also take accounting-specific courses such as Advanced Business Law for Accountants, Contemporary Issues in Accounting and Assurance, and Ethics and Professional Responsibilities for CPAs.

- Master’s in Accounting

California Baptist University is regionally accredited by the Western Association of Schools and Colleges Senior College and University Commission (WSCUC).

9. Concordia University – Wisconsin

You can prepare for a career as an auditor or a budget analyst with an MBA in Accounting from Concordia University Wisconsin. The coursework is available online and at several of the school’s campuses. After finishing this program, you may be ready to take the CPA exam.

- MBA – Accounting

Concordia University Wisconsin is accredited by the Higher Learning Commission.

10. DePaul University

Illinois’ DePaul University can advance your business skills with an online or on-campus MS in Accountancy. The program includes business courses like U.S. Business Culture and Practice, Principles of Financial Management, and Fundamental Operations Management. You’ll also take classes that cover auditing, taxation, business law and accounting theory.

- Master’s in Accountancy

DePaul University is accredited by The Higher Learning Commission.

11. Florida Institute of Technology

You can earn a fully online MBA in Accounting through the Florida Institute of Technology. Managerial accounting, data analysis and cost evaluation are key concepts covered in this program, and you can put your education to practice in business, government, nonprofit or healthcare settings. Classes include Organizational Behavior and Marketing Management.

- MBA – Accounting

- MBA – Accounting & Finance

Florida Tech is accredited by the Southern Association of Colleges and Schools (SACS) Commission on Colleges.

12. Franklin University

When you study online with Franklin University in Ohio, you can choose to pursue a concentration in Taxation or Financial Operations. Alternatively, you will have the option to select a mix of electives from these two concentration tracks. The core courses include Financial Accounting Theory, Management Control Processes and a capstone seminar.

- Master’s in Accounting

Franklin University is accredited by the Higher Learning Commission.

13. Gardner-Webb University

The Master of Accountancy program from Gardner-Webb University in North Carolina gives you the opportunity to select your own accounting and business electives. You can earn a generalist degree by taking a variety of electives or choose to focus your classes around an area of specialization. You’ll finish your studies with a capstone course.

- Master’s in Accountancy

Gardner-Webb University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

14. Indiana Wesleyan University

For an MS in Accounting at IWU, you’ll take classes like Advanced Auditing, Corporate Taxation, Financial Accounting Theory and Issues, and Advanced Managerial Accounting. Classes at IWU are taught from a Christian perspective, so part of this program involves learning to integrate faith and business endeavors.

- Master’s in Accounting

Indiana Wesleyan University is accredited by The Higher Learning Commission and is a member of the North Central Association of Colleges and Schools.

15. Liberty University

The MS in Accounting program at Virginia’s Liberty University offers a generalist track as well as six specializations. Options include Financial Services, Forensic Accounting, Leadership and Business. Your classes may include Fraud Examination or Leadership Theory. Liberty University is a Christian school, so classes may incorporate biblical principles.

- Master’s in Accounting – Audit and Financial Reporting

- Master’s in Accounting -Business

- Master’s in Accounting – Forensic Accounting

- Master’s in Accounting – Financial Services

- Master’s in Accounting – General

- Master’s in Accounting Leadership

- Master of Science in Accounting – Taxation

- MBA – Accounting

Liberty University is accredited by the Southern Association of Colleges and Schools.

16. Maryville University

Even if your bachelor’s degree isn’t in the accounting field, you can earn an MS in Accounting through Maryville University in Missouri. The bridge program is designed to prepare non-accounting students for master’s-level accounting work. To help you get ready for the CPA test, Maryville’s program uses Becker test-preparation techniques.

- Master’s in Accounting

- MBA – Accounting

Maryville University of Saint Louis is accredited by The Higher Learning Commission.

17. Merrimack College

Studying accounting at Merrimack College in Massachusetts can help you improve your business communication skills, your decision-making abilities and your practical knowledge of financial tools and technology.

The online or campus-based MS in Accounting program includes classes like Assurance Services, Marketing Management and Taxation of Business Enterprises.

- Master’s in Accounting

Merrimack College is accredited by the New England Commission of Higher Education (NECHE).

18. National University

National University offers a Master of Accounting that can be earned online or on-campus at sites across California. The program offers two pathways of study, one for those that have experience in accounting and one for those that have little to no experience in the field.

The latter provides instruction in the fundamentals, while the pathway for those with experience allows students to learn advanced topics in accounting without having to repeat courses covering the basic fundamentals of accounting.

- Master of Accounting

National University is accredited by the Western Association of Schools and Colleges (WASC).

19. Ohio University

You can choose online courses, on-campus courses or a hybrid program to complete your Master of Accountancy from Ohio University. If you don’t have an accounting background, bridge courses can help you make the transition to this field. Core classes for all accounting students include Predictive Analytics and Data Analysis for Decision Making.

- Master’s in Accountancy

Ohio University is accredited by the Higher Learning Commission.

20. Plymouth State University

After completing the MS in Accounting program from New Hampshire’s Plymouth State University, you may be ready to take the CPA or CMA examinations.

To prepare, you’ll take core classes like Business Law for Accountants and Economic Analysis, and you can also select electives. Options may include Accounting Information Systems and Professional Ethics for Accountants.

- Master’s in Accounting

Plymouth State University is accredited by the New England Commission of Higher Education (NECHE).

21. Rutgers University

New Jersey’s Rutgers University offers two options for obtaining a master’s-level accounting degree. You can enroll part-time in the Master of Accountancy in Professional Accounting program. Alternatively, you can pursue a full-time degree through the MBA in Professional Accounting program. Previous experience in the field is not required for either program.

- Master’s in Accountancy – Governmental Accounting

Rutgers is accredited by the Commission on Higher Education of the Middle States Association of Colleges and Schools.

22. Saint Joseph’s College of Maine

Dialogue with faculty and fellow students is an important component of the online Master of Accountancy program from SJC. Courses include Leadership and Relationship Management, International Accounting, and Corporate Financial Management. If you already have a bachelor’s in this field, you may be able to enroll for the school’s Fast Track program.

- Master’s in Accountancy

Saint Joseph’s College is accredited by the New England Commission of Higher Education (NECHE).

23. Saint Mary’s University of Minnesota

Earning an MS in Accountancy from Saint Mary’s can prepare you to become certified as a CPA or a CMA. This program is available on campus, online or through a blended format. Financial Communication, Accounting Information Systems and Strategic Management Accounting are a few of the courses that you will take.

- Master’s in Accounting

Saint Mary’s University of Minnesota is accredited by the Higher Learning Commission (HLC).

24. South University

Forensic and Fraud Auditing, Intermediate Financial Accounting and Federal Taxation are some of the courses required for earning an MS in Accounting from South University in Georgia. Your studies will wrap up with a capstone course. This fully online program may help you meet your state’s requirements for taking the CPA examination.

- Master’s in Accounting

South University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

25. Southern New Hampshire University

The MS in Accounting curriculum at SNHU covers topics like auditing, cost analysis, taxation, business law and accounting technology. When you enroll in this online program, you can select one of four concentrations: Taxation, Auditing, Management Accounting or Forensic Accounting. You’ll complete your studies with a capstone course.

- Master’s in Accounting – Auditing

- Master’s in Accounting – Forensic Accounting

- Master’s in Accounting – Management Accounting

- Master’s in Accounting – Taxation

- Master’s in Accounting Finance

Southern New Hampshire University is accredited by the New England Commission of Higher Education (NECHE).

26. Touro University

TUW offers an MBA in Accounting that you can complete fully online. For your degree, you’ll take a mix of core business courses and specialized accounting courses. The accounting classes are Cash Management, Introduction to Financial Accounting, Intermediate Financial Accounting and Accounting Information Systems.

- MBA – Accounting

Touro University Worldwide is accredited by the WASC Senior College and University Commission (WSCUC).

27. University of Dallas

Through online or campus-based classes, you can earn an MS in Accounting from the University of Dallas in Texas. Your coursework will include Accounting Research Methods, Entity Taxation and Business Communications. The school also offers the option to earn an online or on-campus MBA in Accounting.

- Master’s in Accounting

The University of Dallas is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

28. University of Maryland University College

You’ll evaluate case-studies and consider real-life examples as you earn your MS in Accounting and Financial Management from the University of Maryland University College, also known as the University of Maryland Global Campus.

Core courses in this program include Long-term Financial Management and Investment Valuation. You’ll also take electives and a capstone class.

- Master’s in Accounting and Financial Management

- Master’s in Accounting and Information Systems

University of Maryland University College is regionally accredited by the Middle States Commission on Higher Education.

29. University of North Dakota

The University of North Dakota offers a Master of Accountancy program online. Potential courses include Business Law for Accountants, Advanced Financial Accounting, Taxation of Businesses, and Audit and Assurance Services. A bachelor’s degree in any field is acceptable for admission, and the program may be completed in 20 months of part-time attendance.

- Master of Accountancy

UND is accredited by the Higher Learning Commission.

30. University of Scranton

The Masters in Accountancy program at the University of Scranton in Pennsylvania gives you the opportunity to tailor your studies with multiple elective classes.

Options may include International Accounting, Financial Reporting and Research, and Occupational Fraud and Abuse. You’ll also take core courses like Managerial Economics and Effective Accounting Communication.

- Master of Accountancy – Accounting Analytics

- Master of Accountancy – Forensic Accounting

The University of Scranton is accredited by The Middle States Commission on Higher Education (MSCHE).

31. University of St. Francis

With an MBA in Accounting from the University of St. Francis, you can enhance your professional skills and seek career advancement. The program, offered online or on the Illinois campus, consists of core classes, competency-area electives and concentration courses. Accounting-specific classes include Fraud Examination and Financial Statement Analysis.

- MBA – Accounting

The University of St. Francis is accredited by the Higher Learning Commission.

32. Upper Iowa University

You can earn an MBA in Accounting from Upper Iowa University through online coursework, or you can attend classes on one of the many campuses throughout the country. You’ll take classes like Taxation for Corporations and Advanced Accounting Information Systems, and you’ll be able to choose an elective course.

- MBA – Accounting

Upper Iowa University is accredited by the Higher Learning Commission (HLC).

33. Utica College

New York’s Utica College offers two options for a graduate accounting degree. You can take online classes in pursuit of an MS in Accounting, or you can take campus-based courses for an MBA in Professional Accounting. For the online program, your classes will include Quantitative Analysis for Management and Advanced Corporate Finance.

- Master’s in Accounting

Utica College is accredited by the Commission on Higher Education of the Middle States Association of Colleges and Schools.

34. Walden University

While working toward your online MS in Accounting from Walden University, you’ll also earn a graduate certificate. There are two tracks from which to choose: Accounting for the Professional and Accounting with CPA Emphasis. Another online degree option from Walden University is the MBA in Accounting program.

- Master’s in Accounting

Walden has been accredited by The Higher Learning Commission (HLC) since 1990.

35. Western Governors University

After getting your MS in Accounting degree from Western Governors University, you may be able to register for the Certified Public Accountant, Certified Management Accountant or Certified Internal Auditor examinations.

Throughout your studies, you’ll complete projects, papers and other assessments. Your coursework will end with a capstone project to demonstrate what you’ve learned.

- Master’s in Accounting

Western Governors University is accredited by the Northwest Commission on Colleges and Universities (NWCCU).

Online Master’s Programs without GMAT Requirements

GMAT is NOT required. Accelerated 8-week online classes available.

Find the type of accounting that best matches your interest:

In addition to no GMAT masters degrees, a number of programs also offer GMAT waivers for qualified students.

Master’s in Accounting

Earning your master’s degree in accounting could mean that you get a Master of Science in Accounting or a Master of Accountancy. Either way, common topics covered in a generalized course of study in this field include auditing, taxation and financial analysis.

These are topics that are covered at the bachelor’s level as well, but a master’s program will go into greater depth.

Editorial Listing ShortCode:

In addition, you’ll likely study policies and regulations that affect accounting practice. You may discuss maintaining ethical standards in your work and operating according to widely accepted best practices. Coursework may also cover international business topics so that you’ll be prepared to work in global markets.

Options may include:

- Change Management

- Accounting for Non-profit Organizations

- Spreadsheet Applications

- Business and Employment Law

- Financial Strategy for Corporations

Because this is a generalist approach to getting your master’s degree, you may have the option to select several electives of your choosing. Through your electives, you can tailor your studies to a particular area of accounting, or you can pick varied courses that will support your future career goals.

Master’s in Forensic Accounting

Choosing to earn a master’s degree in Forensic Accounting can equip you with the knowledge you need for investigating financial matters. Forensic accountants are responsible for combing through financial records to settle matters of dispute, confusion or fraud.

Some graduates use their forensic accounting degree in business settings as company employees or consultants. They may audit the books, look for suspicious activity or ensure that the organization is complying with the law.

Editorial Listing ShortCode:

The curriculum for this program may include:

- Advanced Auditing Theory

- Accounting Fraud

- Accounting in Legal Settings

- Information Systems for Accounting Practice

- Systems for Financial Reports

A forensic accounting program can also prepare you to work within the legal system. Accountants may need to investigate whether fraud occurred or provide testimony about financial matters in criminal cases.

Others go to work for government agencies. For example, federal tax auditors may hold a Master’s in Forensic Accounting. The FBI hires forensic accountants to collect evidence, interview witnesses and deliver expert testimony.

Master’s in Taxation Accounting

If you’re particularly interested studying taxes, consider earning a specialized master’s degree in Taxation Accounting. This branch of accounting prepares people to become tax experts. Considering that tax law can be quite complicated, it can be essential for businesses to rely on the services of taxation professionals.

That can make this an in-demand specialty.

Editorial Listing ShortCode:

Course in this master’s program should cover topics such as:

- Laws related to taxation

- Ethical accounting practice

- Income taxes for businesses and corporations

- Taxation authority of the government

- Case studies in financial analysis

- Business tax planning

As an expert in this field, you could choose to work in a business setting to head up a company’s tax matters. This could include tax filing, planning and compliance. You could also serve in a consulting position. As a consultant, various businesses might contract with you to take care of their taxation obligations.

Others with this degree choose to work in tax preparation for individuals. Holding a master’s may qualify you for a supervisory position in a tax firm.

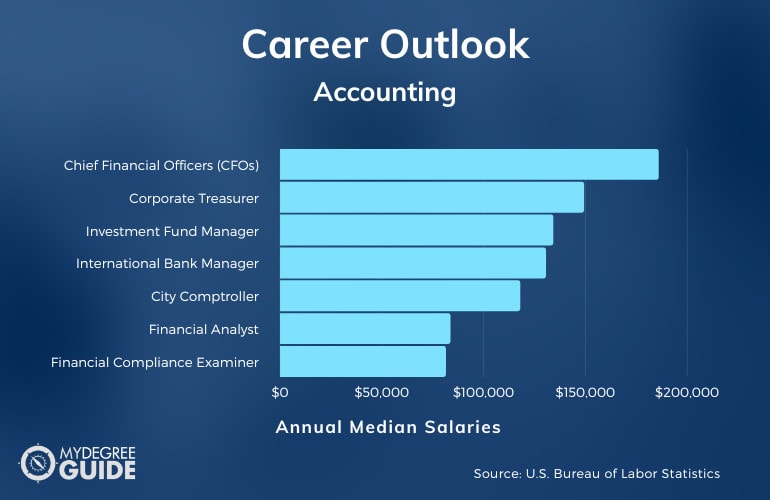

Master’s in Accounting Careers & Salaries

Accounting can be a profitable career, especially when you hold a master’s degree in the field.

The U.S. Bureau of Labor Statistics shows the following job and salary data for accountants and auditors:

- Median annual salary: $73,560

- Projected job growth: 4% job growth for the next 10 years

- If you choose to work as an accountant, you may want to pursue CPA certification

To decide which path is the right fit for you, you might want to consider your personal interests, the average salary and the projected growth of jobs in that field.

| Careers | Annual Median Salary |

| Chief Financial Officers (CFOs) | $185,950 |

| Corporate Treasurer | $149,300 |

| Investment Fund Manager | $134,180 |

| International Bank Manager | $130,600 |

| City Comptroller | $117,940 |

| Financial Analyst | $83,660 |

| Financial Compliance Examiner | $81,430 |

| Financial Auditor | $73,560 |

| Cost Accountant | $73,180 |

| City Tax Auditor | $72,260 |

The potential salary range varies depending on the position you hold and the area of the country where you live. In general, though, having plenty of education and professional experience tends to pay off.

Accounting Industry Growth

Chat with others during tax season, and you’ll quickly be reminded how tricky it can be for people to navigate tax laws on their own. Business taxes can be even more complicated. If you have an aptitude for numbers and figures, you’ll probably find that your skills are hotly sought after by those who find taxes confusing and overwhelming.

Tax regulations are unlikely to get less confusing anytime soon, so your accounting skills should continue to be useful year after year.

That’s just one reason why the Bureau of Labor Statistics expects jobs in the accounting field to increase by 4% for the next 10 years. Another factor is the increasing globalization of the business world. Experts who understand global finance and how to operate in international markets are highly valued by companies that want to expand their worldwide presence.

Even for companies that operate solely in the United States, keeping track of financial details is a must. If your bookkeeping fails, the company itself may not be far behind. Without good accounting practices, it’s hard for a business to set a reliable budget, forecast future trends or invest money wisely.

From tiny startups to massive corporations, every company can benefit from the involvement of at least one accounting expert.

The average accountant or auditor earns around $70,000 each year (Bureau of Labor Statistics). If you advance through the ranks to an executive position, you could eventually earn a three-figure annual salary.

According to industry experts, the following jobs within the field are particularly in demand:

- Accountants, including staff and senior accountants

- Financial controllers

- Managers over payroll or accounting departments

- Financial analysts

- Auditors, especially internal auditors

In addition, certain education and credentials may help you land desirable accounting positions. For example, employers look favorably on candidates who have master’s degrees in accounting. Getting industry-specific certifications can help as well. Options include Certified Public Accountant (CPA) and Chartered Global Management Accountant (CGMA).

Choosing a Master’s Degree in Accounting Program

Plenty of schools offer master’s degree programs in accounting. How can you decide which is right for you?

Quick Facts |

|

| Completion Time | A Master’s degree in Accounting generally takes around two years to complete, may be even longer for part-time students. However, accelerated programs with fast-track courses can let you finish in 1.5 years or less. |

| Hours | A minimum of at least 30 credit hours |

| Specializations |

|

| Accreditation | Aside from regional accreditations, prospective online Master’s in Accounting students should also consider the approval of the following accrediting organizations.

|

Consider the following four factors:

Location

Some schools offer on-campus programs, and others do theirs online. For many people, especially those with full-time jobs, the online option offers greater flexibility.

Licensing options

A master’s program may prepare you to become certified as a CPA. If that’s your goal, it’s important to make sure that the program you are considering meets licensing requirements in your state.

Cost

The tuition price of a master’s program can vary widely between schools. Programs with lower credit-hour requirements often cost less in the long run.

Time to completion

In addition to selecting a school that requires fewer credit hours, consider accelerated online programs if you want to get done with your master’s program quickly.

Master’s in Accounting Specializations

Many sectors rely on the knowledge and skills of accountants. Because the accounting field is so broad, you may want to select a specialization in which you can develop advanced skills in one particular area.

Accounting in the Public Sector

The government relies on the skills of accounting professionals, and a specialization in Accounting in the Public Sector can prepare you for the unique needs of government agencies. You could become an auditor who analyzes tax returns, a government budget analyst or an accountant for a public bureau.

Auditing

Experts in auditing know how to uncover and resolve issues in financial records. Some auditors work with tax statements, and others keep an eye on businesses’ books. An auditing-focused program can equip you with the ability to use software and other technologies to help you be successful as a compliance auditor or a corporate accountant.

Financial Accounting

For employment in an organization or a corporation, choose a specialization in Financial Accounting. This course of study focuses on the financial needs of the private sector; these needs include budget analysis, market evaluation and financial reporting.

You’ll probably hold a financial title for an organization. Job possibilities include analyst, accountant or chief financial officer.

Forensic Accounting

To put your detective skills to work in an accounting setting, consider a concentration in Forensic Accounting. This specialization can train you to uncover problems in financial records and statements. You could put this degree into practice as a fraud investigator, an expert witness or a forensic accountant in the private sector.

International Accounting

If you want to work overseas, hold a position with a multinational corporation or conduct deals with international businesses, then a specialization in International Accounting can provide important preparation for your career. Students learn about global markets, exchange rates and worldwide accounting ethics. Career options include international accounting or auditing.

Management Accounting

If you run a business, you’ll probably need to understand accounting principles even if “accountant” isn’t your official job title. As you study for a Management Accounting concentration, you can learn about budgeting, internal audits and financial predictions. This degree is useful for small business owners, chief financial officers and managers.

Public Accounting

To perform accounting services for a variety of clients, consider studying Public Accounting. Your studies can prepare you to take care of tax returns and other accounting matters for individuals and businesses. Many people in this field are licensed as Certified Public Accountants (CPA).

Taxation Accounting

To become extremely well-versed in all matters related to taxation, pursue a concentration in Taxation Accounting. You can learn about tax laws that apply to organizations and individuals. Taxation accounting coursework covers information like reporting methods that fulfill legal requirements and how to conduct audits. Career options include tax manager and tax auditor.

What Will You Learn in a Master of Accountancy Program?

At some schools, the accounting-related master’s program is not a Master of Accounting degree but a Master of Accountancy degree. This small word change reflects a slight shift in the focus of the program.

- Accounting refers to the processes that are used for maintaining and analyzing financial information.

- Accountancy refers to the practice of carrying out accounting work.

Your studies may focus on:

- Carrying out accounting research

- Solving financial and budgetary problems

- Making reliable, ethical decisions for business and individuals

- Determining which factors are most critical to consider when making business decisions

- Gaining real-world experience

An accountancy program can equip you with practical tools for putting your financial knowledge into practice.

Master’s in Accounting Courses

The curriculum for a master’s degree in accounting varies between schools, but during your studies, you may take classes similar to the following ones.

Financial Reporting

Accountants must keep detailed records and submit financial information to various authorities. In this class, you can study methods for tracking assets and cash flow and discuss how to use this information when making business decisions.

Business Law

Students in many business programs, including accounting, need to understand the laws that govern business practices. This course covers domestic and international rules and guidelines. These topics often lead to conversations about ethical compliance.

Globalization and Managerial Economics

To operate in international markets, you must understand laws and economies from around the world. This class aims to equip students with the tools to make legal and ethical financial decisions in worldwide markets.

Corporate Financial Management

Accountants who hold leadership positions in corporate settings need a thorough understanding of business finance and company shares. This class can help prepare you to manage a company’s resources, budgets and financial plans.

Financial Accounting

This foundational class introduces students to a deeper understanding of fundamental accounting principles. It covers methods for keeping records, understanding statements and presenting financial information to leaders, shareholders and government agencies.

Managerial Accounting

A company’s financial history and current status should influence its future decisions. In this class, your coursework can help prepare you to turn your accounting knowledge into wise company leadership. You’ll likely study budgeting, data analysis and risk assessment.

Auditing

Whether you want to audit your own company’s finances or conduct external audits on individuals or organizations, you must have a firm grasp of auditing principles, such as reviewing statements and preparing trustworthy reports.

Tax Planning

This class equips students with the skills to take charge of tax responsibilities for organizations and individuals. Common topics covered are how tax laws differ for various types of businesses and how to prepare tax returns.

Altogether, your core classes, specialization classes and electives should give you an in-depth understanding of your chosen accounting field.

Accounting Pros and Cons

Getting a master’s degree in the accounting field can be a great move. Here are some of the top reasons to consider this educational path:

- Earning an accounting master’s degree can provide the coursework needed for taking the Certified Public Accountant licensure exam. Earning this title is an essential prerequisite for many lucrative jobs.

- Networking is very important for advancing in business, and getting to know faculty, completing internships and dialoguing with other students can help you build strong network ties.

- Accounting is a critical business skill. Advanced education in this area may position you for corporate leadership responsibilities, such as becoming a chief financial officer.

Even still, this degree isn’t right for everyone. Here are a few reasons to reconsider this master’s program:

- Some schools focus more on theory than on real-world practice. You may be able to gain more real-life experience in the workforce.

- Accountants don’t always have an even workload. Some positions require a heavy investment of time and effort during tax season, but off-season loads are light.

- Getting a master’s degree requires an investment of time and money.

Of course, if accounting is truly your passion, you’ll probably find that these cons won’t stand in the way of getting your master’s degree or even an Online PhD in Accounting in the future.

Typical Admissions Criteria for a Master’s in Accounting

Master of Accounting programs can be rigorous, so admission committees carefully screen applicants to determine which are the best fit for their programs. The application requirements can vary from school to school. Even still, the following list can give you a general idea of the common criteria that most admissions departments consider.

Transcripts and previous education

- To get into a master’s program, it’s essential that you hold a bachelor’s degree. Some programs insist that an applicant’s undergrad studies be in the area of accounting. Others will allow in non-accounting majors with the caveat that they must take foundational classes in order to catch up. Either way, you’ll need to provide transcripts for your previous studies.

Some schools require applicants to have achieved a minimum GPA during their undergrad years.

Standardized tests

- The GMAT is the most common standardized test that is used for admission to accounting and other business programs. Some schools are willing to look at GRE scores as an alternative.

Not all schools require these tests, and many offer GMAT or GRE waivers, so you may be able to apply without taking either exam.

Completed application

- Of course, if you want a committee to take your application seriously, you must fill out all the parts.

This often includes an essay or a personal statement, which gives you an opportunity to highlight your strengths and passions.

Professional or academic references

- Most schools ask for letters of recommendation from people who have worked with you in professional or academic settings.

Requiring applicants to produce two or three letters is common.

Required fee

- The application fee covers the time spent on evaluating your materials, and it shows that you’re serious about pursuing the program.

Important Considerations When Applying

When you’re thinking about going to school for your master’s, blindly sending in applications to every accounting graduate program isn’t your best course of action. It’s a lot more sensible to carefully consider each program before deciding whether you should apply.

Approaching the application process in this way allows you to save your best effort (and your application fees) for the programs that truly are good fits for your needs and interests.

GMAT Waivers

If you’re not into taking tests, you’ll be glad to know that there are accounting programs for which GMAT test scores are not a necessity. Some business schools base their admissions process solely on other criteria, so they don’t ask for any test scores. Their criteria may include undergraduate GPA scores or the strength of candidates’ personal essays.

Other accounting programs offer GMAT waivers to qualifying students. If you have achieved a minimum GPA, hold professional certifications or have sufficient work experience, you may be able to apply without test scores.

Accreditation

Colleges and universities receive accreditation from regional accrediting agencies. This type of accreditor evaluates the school as a whole to ensure that it is delivering high-quality educational programs and experiences.

These agencies include:

- Higher Learning Commission (HLC)

- WASC Senior College and Learning Commission (WSCUC)

- Northwest Commission on Colleges and Universities (NWCCU)

- New England Commission of Higher Education (NECHE)

- Southern Association of Colleges and Schools Commission on Colleges (SACSCOC)

- Middle States Commission on Higher Education (MSCHE)

Every reputable college or university carries regional accreditation, so it’s essential that you pick an accredited school. With accreditation, you’ll be able to trust the quality of your schooling and be eligible to pursue financial aid.

Business School Accreditation

In addition to regional accreditation, many accounting colleges have an additional certification from an organization dedicated to accrediting business schools and programs. This type of certification indicates that you are selecting an accounting program that meets or exceeds industry standards.

The main business accreditations to look for are:

- Association to Advance Collegiate Schools of Business (AACSB)

- Accreditation Council for Business Schools and Programs (ACBSP)

- International Assembly for Collegiate Business Education (IACBE)

In general, business-specific accreditation from one of these organizations is not as essential as regional accreditation. Even still, going to a school that bears one of these certifications may affect whether you are fully prepared for licensure exams, and it may influence your future employability.

Accounting Certifications and Licenses

To prove to clients and employers that you know what you’re talking about when it comes to accounting, you can pursue certification or licensure.

Some of the most sought-after credentials in the world of accounting are:

Certified Public Accountant (CPA):

- This well-known credential certifies that you are skilled and experienced in matters of public accounting. Requirements for taking the test may vary by state.

Certified Management Accountant (CMA):

- If you intend to hold a financial leadership position, studying for this certification can help you refine your management skills.

Chartered Financial Analyst (CFA):

- This credential demonstrates your aptitude for investments.

After completing your master’s degree, consider adding one or more of these credentials to your title to improve your employability and credibility.

Accounting Professional Organizations

Business professionals often join accounting or finance organizations to connect with others in their industry. Being part of a professional organization may help you learn about job openings or give you a chance to network with industry leaders. In addition, some organizations offer courses or other resources to enhance your accounting knowledge.

- American Institute of Certified Professional Accountants (AICPA)

- American Accounting Association (AAA

- Institute of Management Accountants (IMA)

- MGI Worldwide

- American Association of Finance and Accounting (AAFA)

- Chartered Institute of Management Accountants (CIMA)

- National Society of Accountants (NSA)

- International Federation of Accountants (IFAC)

As a student, you may be able to join one or more of these organizations at a discount. Joining while still in school can enhance your learning opportunities and help you make business connections before graduation.

Financial Aid

Earning a master’s degree can be an expensive undertaking. Understanding the financial aid options that may be available to you can help you start to envision how you’ll be able to afford your accounting graduate degree.

- Loans. You can borrow money to pay for your schooling and pay it back after you’re finished. Loans often come from government sources, but private loans are available as well.

- Grants. Money that is given to you based on financial need is known as a grant. You do not have to repay a grant. State and federal government programs are often the source of grant money.

- Scholarships. Like a grant, a scholarship is a gift of money that you do not need to pay back. Although financial need may be taken into consideration, scholarships are typically awarded on the basis of merit.

- Federal Work-Study. This government program allows you earn tuition funds through on- or off-campus jobs.

- Fellowships. Typically offered at the graduate level, a fellowship is like a scholarship that gives you hands-on experience in addition to funding.

To figure out what financial aid you might be able to receive, start by filling out the federal government’s FAFSA form.

Accounting Scholarships

- AFWA Master’s Scholarship – $1000 – $4,000

- AICPA John L. Carey Scholarship – $5,000

- Byron Bird Graduate Scholarship – $3,000

- Frank L. Greathouse Government Accounting Scholarship – $10,000

- Goldberg-Miller Public Finance Scholarship – $20,000

- Women’s Executive Committee Advancing Women in Accounting Scholarship – up to $4,000

- WSCPA Foundation Scholarship – up to $8,000

What Is the GMAT?

Many business schools require at least some of their applicants to take the Graduate Management Admission Test (GMAT). This test is designed to demonstrate whether an applicant is ready for a graduate-level business program. The exam measures your skills in mathematics, critical thinking, data analysis and grammatically correct writing.

Can GMAT Be Waived?

Yes, many schools offer exceptions to their GMAT requirements. You may qualify for a waiver based on your undergraduate GPA, your previous graduate degrees or your professional experience. Waiver requirements vary among schools, so check with a university’s admissions department to learn more about the school’s GMAT policy.

Is GMAT Required for Master’s in Accounting?

No, some schools do not require any master’s in accounting applicants to submit GMAT scores. Instead, they base admissions decisions on other criteria, including GPA, professional references and personal statements. Other schools offer GMAT waivers to applicants with sufficient work experience or high GPAs.

Is the GRE Required for a Master’s in Accounting?

Although some business schools accept GRE scores as an alternative to GMAT results, this isn’t true across the board. Some master’s in accounting programs have no GRE requirements. Other schools grant GMAT or GRE waivers to well-qualified applicants.

Can You Get Your Master’s in Accounting Online?

Many accredited schools offer online master’s in accounting programs. In fact, the online programs may rely on the same coursework, taught by the same professors, as the universities’ on-campus accounting programs. Also, schools with online programs are accredited by the same agencies as colleges that offer only campus-based degrees.

Should I Get a Master’s in Accounting Online?

An accounting master’s degree can be a great way to advance your career or gain expert knowledge in this field. Online degrees present the same information as campus-based programs. You can trust that you can learn just as much through computer-based courses as you would if you attended classes on campus.

For students who have families or are already established in a career, online coursework can be especially valuable. Digital classes often use a flexible format, so you can engage in learning experiences on your schedule. Some use an accelerated calendar that can help you complete your degree quickly.

Is an Online Accounting Degree Worth It?

Yes, an accounting degree is worth it for many students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years. Common careers in this field include financial counselor, cost accountant, comptroller, and corporate treasurer.

Is a CPA Equivalent to a Master’s Degree?

CPA licensure signifies that you possess an expert level of knowledge and skill related to public accounting. To become a CPA, you must pass the certification exam. Earning a master’s degree in accounting does not automatically qualify you for this title.

What your master’s studies can do is help prepare you for the CPA exam. In many states, you must earn 150 post-secondary accounting credit hours in order to sit for the test. A bachelor’s alone isn’t enough to accumulate 150 hours, but a bachelor’s plus a master’s can get you there.

Are Online Accounting Degrees Respected?

Upon graduation, your diploma won’t specify whether you earned your degree in-person or online. Besides, online programs and on-campus ones contain equivalent content and require similar assignments. As long as you attend an accredited school, your online degree should be respected and honored by employers, certification boards and clients.

Is GMAT Just for MBA?

Non-MBA programs may ask for GMAT scores. This test is intended for schools with business or management programs. That encompasses more than just MBAs. Whether you are pursuing a Master of Accountancy, a Master of Science in Accounting or an MBA with an Accounting concentration, you may need test scores.

How Long Does It Take to Get an Online Master’s in Accounting?

In general, it takes around two years to get a master’s degree or MBA in Accounting online, but going to school part-time will extend the process. On the other hand, many online colleges offer the option of taking accelerated classes. With an accelerated masters program, the entire program may take 1.5 years or less.

For more info, you can check out our 1 Year Masters Programs guide.

How Much Does an Online Master’s in Accounting Cost?

The total cost of earning your master’s in accounting can vary greatly depending on the school that you choose and a variety of other factors.

Your master’s program costs will be influenced by:

Cost per credit hour

In-state public universities may offer the lowest rates.

Number of credit hours required

Some universities’ programs may require only 30 hours.

Additional costs

These may include books and technology fees.

The average master’s degree costs $30,000 to $40,000. Thankfully, financial aid can greatly offset your tuition costs. This might come in the form of scholarships or other discounts directly from your school. It could also come as federal loans, government grants, graduate fellowships or private scholarships.

These funding sources can make a graduate degree a lot more affordable.

Getting Your Masters in Accounting Online

To move up in your career, consider earning a graduate degree in accounting. A master’s degree can equip you with in-demand skills and increase your earning potential. For a flexible program that fits your lifestyle, seek out no-GMAT or no GRE schools that offer online master’s degrees in accounting.

Related Guides: