If you have a knack for numbers and an interest in research and investigation, you might want to learn more about an online masters in forensic accounting.

Earning a masters degree in forensic accounting can be a strategic opportunity to jump-start a new career or enhance your current knowledge and skill sets.

Editorial Listing ShortCode:

Here you can take a look at some of the details involved with pursuing an online accounting degree.

Online Masters in Forensic Accounting Programs

Forensic accounting combines traditional accounting skills with in-depth research. Specialists in this field tend to review financial documents and transactions to find evidence of fraud or other financial crimes.

If you pursue a Master of Forensic Accounting, you’ll have the opportunity to learn many skills throughout your studies. For example, you could choose to focus on computer skills as they relate to forensic accounting, learning to identify various accounts and utilize accounting programs.

Editorial Listing ShortCode:

Forensic accountants apply strong analytical skills to their understanding of both accounting and criminal justice. Your studies in forensic accounting can help you amplify your math skills and your ability to find inconsistencies.

Graduates with an MS in Forensic Accounting may consider advancing their careers in one of the following roles:

- Financial examiner

- Auditor

- IT fraud investigator

- Financial analyst

Graduate programs in the forensic accounting field typically provide many opportunities to learn more about financial analysis and computer forensics. You’ll likely learn advanced auditing techniques as well.

A masters program in forensic accounting typically covers new methods of deep critical thinking and accounting laws and practices, along with their real-life applications.

Forensic Accounting Careers & Salaries

Accountants and auditors continue to be in high demand due to a rapidly globalizing economy. Professionals who are trained in complex financial policies and procedures are especially sought after.

In fact, the Bureau of Labor Statistics projects 8% job growth for business and financial occupations over the next ten years. Some forensic accounting roles are inclined more toward the investigative aspects, the enforcement activities, or the monitoring of various financial documents.

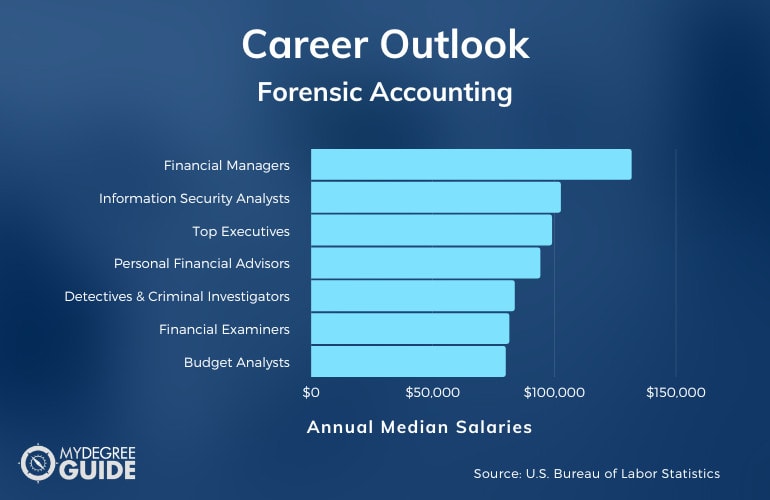

According to the Bureau of Labor Statistics, those with advanced degrees in forensic accounting can explore a variety of career options that offer a range of salaries, as demonstrated in this table.

| Careers | Annual Median Salaries |

| Financial Managers | $131,710 |

| Information Security Analysts |

$102,600 |

| Top Executives | $98,980 |

| Personal Financial Advisors | $94,170 |

| Detectives and Criminal Investigators | $83,640 |

| Financial Examiners | $81,410 |

| Budget Analysts | $79,940 |

| Accountants and Auditors | $77,250 |

| Claims Adjusters, Appraisers, Examiners, and Investigators | $64,710 |

| Tax Examiners and Collectors, and Revenue Agents | $56,780 |

There are many professional choices available to those who pursue their masters degree in forensic accounting. The career paths you qualify for will depend on your interests, experience, and area of specialization.

Editorial Listing ShortCode:

The skills learned in a forensic accounting master’s program can also aid your professional development in fraud recognition and prevention. For instance, the advanced analytical skills this program can help you develop can assist you in careers that require the recognition of patterns and problems.

Forensic Accounting Masters Curriculum & Courses

While each school and program offers their own specific curriculum, you’ll likely encounter some of these courses throughout your studies:

- Fraud Prevention: This course discusses how to identify fraudulent activity and what measures can be taken to expose and correct potential issues in accounting systems.

- Legal and Ethical Processes: This course provides details on how to properly investigate fraud, including reporting a potential crime and collecting evidence.

- Cybersecurity: This course explores how to keep accounting systems protected from vulnerabilities to help prevent fraud and expose system weaknesses.

- Forensic Investigation Techniques: This course covers how to come up with an investigation plan and how to collect evidence correctly.

- Loss Assessment: This course teaches how to quantify and document findings when loss is experienced due to fraud.

- Risk Management: This course can help you learn how to uncover potential problems and create policies and procedures to mitigate risk.

- Accounting Ethics: Members of the American Institute of Certified Public Accountants (AICPA) follow a specific Code of Professional Conduct, which is explained in this course.

- IT Fraud Analysis: From current database protection to historical document tracking and recovery, this course provides insight into how forensic accounting crimes are investigated.

- Corporate Governance: This course can help you learn to appreciate and understand some of the rules and regulations corporations put in place to prevent financial fraud.

- Financial Reporting Practices: There are specific guidelines regarding how certain transactions should be reported, which this course will cover.

The courses taken when pursuing an online master’s in forensic accounting are designed to enhance your knowledge of accounting while incorporating legal and ethical elements. They can also help you gain insight into standard investigative practices.

Admissions Requirements

When applying to MS in Forensic Accounting programs, it’s strategic to pay close attention to the admissions requirements of each program because each school may require different criteria.

Some common admissions requirements include:

- GMAT or GRE scores (only some schools require them)

- Bachelors in accounting or related field

- Minimum GPA requirement

- Coursework prerequisites

- Letter of intent

Depending on the program, your school may also request letters of recommendation or transcripts from your college studies. It’s also common to submit an application and an application processing fee.

Forensic Accounting Graduate Programs Accreditation

It’s strategic to select a program for your masters degree in forensic accounting that is regionally accredited. Accreditation means that a school’s programs meet the rigorous standards created by the US Department of Education or the Council for Higher Education Accreditation (CHEA).

You can verify a school’s accreditation status by visiting the US Department of Education’s website.

Editorial Listing ShortCode:

Future employers may be on the lookout for students who graduated from accredited programs, as this means they will likely have received training that’s up to industry standards. Students in accredited programs may also have access to additional resources and financial assistance.

Financial Aid and Scholarships

Each masters in forensic accounting program will include various fees and costs. You may pay a regular tuition at the beginning of the semester, or you might pay based on the courses and credits you take, depending on the school.

There are many financial aid opportunities for students who qualify. To apply for federal aid, you can fill out and submit the Free Application for Federal Student Aid (FAFSA). Each of your prospective schools may also offer need-based or merit-based financial aid options, such as scholarships. You may also seek assistance from your employer or local organizations.

What Is a Masters in Forensic Accounting?

A masters in forensic accounting is a graduate program that can help you advance your expertise in this field. Forensic accountants regularly analyze and review financial and accounting practices.

Some professionals choose to specialize in creating and implementing computer programs that strengthen a business’s protection against financial fraud. You may also be asked to track and investigate financial discrepancies in recordkeeping.

A masters program in forensic accounting can help you develop industry-related skills used to investigate fraud and create practical solutions to prevent and report financial fraud.

What Can You Do with a Forensic Accounting Master’s Degree?

Some with degrees in forensic accounting may be more interested in the criminal side of the field, in which financial information is analyzed to track possible illegal activity. Others may be more interested in fraud prevention and analysis.

These roles involve reviewing financial processes for potential problems or vulnerabilities to prevent criminal acts. There are also IT aspects of forensic accounting. In this sector, you may develop and analyze programming designs to reduce and track fraudulent financial activity.

Some forensic accounting graduates pursue other business and finance career paths. For instance, they may work as financial managers, personal financial advisors, or budget analysts.

Do You Need a Masters to Be a Forensic Accountant?

A bachelor’s degree in accounting or a related field is often the minimum education requirement for forensic accountants. Some employers may prefer their forensic accountants to hold a graduate degree.

A masters in forensic accounting can help you advance your expertise and qualifications in this field. This field can deal with potential criminal activity, such as embezzlement, money laundering, and fraud. So, the skills used in forensic accounting adhere to best practices established on the national level.

Forensic accountants may apply in-depth knowledge in areas such as:

- Public policy

- Civil law

- Economics

- Legal procedures

Completing your MS in Forensic Accounting from an accredited school can demonstrate to future employers that you have studied accurate, up-to-date practices and laws in these areas.

What Do Forensic Accountants Do?

Not all forensic accountants work in conjunction with law enforcement, but it is a possibility. There are many types of crimes that can potentially be investigated by forensic accountants, such as money laundering, fraud, and embezzlement. Forensic accountants may also review the financial history of suspected criminals to find evidence of their deeds.

Editorial Listing ShortCode:

Many forensic accountants work for corporations and smaller businesses, reviewing their financial transactions and records. In these cases, you may have the opportunity to specialize in system or policy development to focus on preventing illegal activity.

Is There a High Demand for Forensic Accountants?

Professionals in the field of accounting and auditing are in high demand. The Bureau of Labor Statistics anticipates 7% job growth for accounting and auditing fields over the next ten years. Reasons for this increase include rapidly expanding financial markets and frequent economic changes.

Those with a background in forensic accounting may have a greater chance of receiving a job related to their chosen field.

How Long Does It Take to Get a Masters in Forensic Accounting Online?

If you select a 36 credit hour program and enroll full-time and year round, you may be able to earn your masters in forensic accounting online in 1 year.

Some programs ask you to complete a final thesis or capstone course to demonstrate your understanding of all that you have learned. If this is the case, your degree may take additional time to complete. Another thing to consider is whether your program or employer requires you to pass the CPA (Certified Public Accountant) or CFE (Certified Fraud Examiner) exam. This could involve more time for preparation.

What’s the Difference between a Graduate Certificate vs. Masters in Forensic Accounting?

Here are a few key differences between a graduate certificate and a masters degree in forensic accounting.

| Graduate Certificate | Masters Degree |

|

|

Depending on your future goals, a masters program generally offers broader development than a graduate certificate.

What’s the Difference between an MBA vs. Masters in Forensic Accounting?

Here are a few differences between an MBA and a masters in forensic accounting.

| Master of Business Administration | Masters in Forensic Accounting |

|

|

A Master of Business Administration (MBA) is a common and versatile business degree with options for specialization that cater to a wide array of interests and career paths. Students may choose to focus on certain skills and pursue an online MBA in Accounting or an MBA in Forensic Accounting.

Is a Master’s Degree in Forensic Accounting Worth It?

Yes, a master’s degree in forensic accounting is worth it for many students. Accountants and auditors are expected to see 7% job growth over the next ten years (Bureau of Labor Statistics). This could lead to a greater range of available jobs for those with an MS in Forensic Accounting.

Editorial Listing ShortCode:

Due to their close relationship to the economy, jobs related to forensics accounting may continue to increase in number, as financial crime is a constant concern. Earning a masters degree in forensic accounting can help you advance your expertise and qualifications in this field.

Universities Offering Online Masters in Forensic Accounting Degree Program

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Bay Path University offers an Accounting MS with a Forensic Accounting concentration. The program is designed for those who already have experience in accounting and help them become Certified Fraud Examiners.

Courses include Data Analytics and IT for Accountants, Contemporary Issues in Accounting, Government, and Nonprofit Accounting, and more.

Bay Path University is accredited by the New England Commission of Higher Education.

Carlow University offers an online program for a Master’s in Forensic Accounting and Fraud Investigation. The program requires the completion of 30 credit hours, and it can typically be finished in 14 months. It is designed to provide preparation for the CFE exam.

To apply, applicants need a minimum GPA of 3.0, but GRE and GMAT scores are not needed.

Carlow University is accredited by the Middle States Commission on Higher Education.

Colorado State University offers an online program for a Master’s in Professional Accounting. Students can choose from five different areas of emphasis, including one in Fraud Investigations and Forensic Accounting. The curriculum is designed to prepare students for the CPA exam.

Classes start monthly, and there are no set times or locations.

Colorado State University is accredited by the Higher Learning Commission.

Florida Atlantic University offers an Executive Master of Accounting with a concentration in Forensic Accounting. The program can be completed entirely online, entirely on campus, or in a combination of both. The online classes are designed to provide flexibility and convenience for busy professionals.

Florida Atlantic University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Liberty University offers a 100% online program for a Master of Science in Accounting – Forensic Accounting. It requires the completion of 30 credit hours that can typically be finished in just one year, and classes are each just 8 weeks long.

Courses include Accounting Ethics, Corporate Governance and Fraudulent Financial Reporting, Fraud Examination, Information Technology and Fraud, and more.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

New England College offers an online Forensic Accounting MS program. Courses include Intermediate Accounting I, Cost Accounting, Federal Taxation, Government and Non-Profit Reporting, Accounting for Mergers and Acquisitions, and more.

The program aims to help students gain an understanding of complex financial transactions and learn how to identify possible instances of fraud and illegal activity.

New England College is accredited by the New England Commission of Higher Education.

The Master’s in Accounting from Regis University is designed to help students become licensed CPAs. Classes can be taken on campus or online. Classes are just 8 weeks long, and there are six start dates per year. There are four optional specialization areas, including Fraud and Forensic Auditing.

Regis University is accredited by the Higher Learning Commission.

Seton Hill University offers an MBA in Forensic Accounting and Fraud Investigation. The program is designed to help students become licensed CPAs and earn additional credentials as Certified Fraud Examiners or Certified Internal Auditors. Seton Hill’s classes are taught by faculty with substantial business experience.

Seton Hill University is accredited by the Middle States Commission on Higher Education.

Southern New Hampshire University offers a Master of Science in Accounting with a concentration in Forensic Accounting. Courses include Detection and Prevention of Fraudulent Financial Statements, Interview Techniques and Legal Aspects of Fraud, Investigation with Computers, and more.

Online course materials are available 24/7, and there are no set class meeting times.

Southern New Hampshire University is accredited by the New England Commission of Higher Education.

Stevenson University offers a Master of Science in Forensic Accounting that can be earned entirely online. This is a career-focused program designed to provide convenience for working adults. Classes are taught by faculty with real-world experience.

The program aims to teach students how to assess fraud, evaluate financial evidence, and communicate effectively during legal proceedings.

Stevenson University is accredited by the Middle States Commission on Higher Education.

SUNY Polytechnic Institute offers a Master of Science in Accountancy. This is a fully online program that includes 33 credit hours of coursework. It is intended for students who already have an undergraduate degree in accounting or a related field. Other students may need to take additional prerequisite coursework.

SUNY Polytechnic Institute is accredited by the Middle States Commission on Higher Education.

The University of New Haven offers an MS in Accounting with a concentration in Forensics. The program is designed to give students practical training in auditing techniques and courtroom procedures. It can be completed 100% online, typically in just one year. Courses are just 7 weeks long.

The University of New Haven is accredited by the New England Commission of Higher Education.

The University of North Carolina—Pembroke offers a Master of Business Administration in Forensic Accounting. The program requires the completion of 36 credit hours and can potentially be finished in just one year. Multiple start dates are available each year.

Courses include International Business, Organizational Theory and Behavior, Fraud Examination, Legal Issues for Managers, and more.

The University of North Carolina at Pembroke is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Utica University offers an online program for a Master of Science in Forensic Accounting. It is designed to prepare students for CPA licensure and CAMS and CipherTrace certification. It typically takes 2 years to complete. Applicants are not required to already have a bachelor’s in accounting.

Utica University is accredited by the Middle States Commission on Higher Education.

West Virginia University offers an online program for an MS in Forensic and Fraud Investigation. There are multiple start dates each year. It includes 10 courses that are designed to help students develop an interdisciplinary skillset in cost accounting, law, data technology, and more.

Certain prerequisite courses are required but may be waived for students with relevant professional experience.

West Virginia University is accredited by the Higher Learning Commission.

Getting Your Master in Forensic Accounting Degree Online

If you enjoy working with numbers and conducting detailed research, getting an online masters in forensic accounting may be a rewarding move.

There’s a wide range of jobs related to this field, so there are also many ways you can put the knowledge you gain in an online forensic accounting degree program to use.

If you’re ready to take this next step in your educational journey, you can start by exploring available forensic accounting masters programs from accredited universities. The sooner you begin researching graduate programs, the sooner you may find ones that align with your professional goals.