An online accelerated accounting degree can help you earn your degree at a faster pace so you have the opportunity to start your accounting career sooner.

The Bureau of Labor Statistics estimates that the accounting field will grow by 4% in the next 10 years. Plus, the globalization of business is bringing an increase in international trade, finance, and business.

This means that the type of jobs that are coming up may be with prestigious accounting and business firms that are working internationally.

Editorial Listing ShortCode:

Universities Offering Accelerated Accounting Degree Online Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

The following universities offer either an online bachelor’s in accounting or an online bachelor’s in business administration with an accounting concentration.

1. Athens State University

Athens State University is located in Athens, Alabama. It was founded in 1822 and was first called Athens Female Academy. It has over 50 different majors across its three colleges: Business, Arts and Sciences, and Education.

The university’s Accounting program aims to prepare students for their future careers as professional accountants. By achieving high academic standards, excellent training, superior teaching, and using state-of-the-art technology, students can obtain a quality degree that can open new and exciting opportunities.

- Bachelor of Science in Accounting

- Bachelor of Science in Forensic Accounting

Athens State is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

2. Auburn University

Auburn University equips students with the relevant skills and knowledge to pursue a successful career in accounting through the Bachelor of Science in Business Administration. The program can be completed both on campus and online.

Getting an online accounting degree at Auburn is convenient, even while juggling work and family life as the course of study can be completed within 30 semester hours.

- BS in Business Administration – Accountancy

Auburn University is accredited by the Southern Association of Colleges and Schools (SACS).

3. Bellevue University

Bellevue University’s Bachelor of Science in Accounting equips students with lifelong knowledge and skills in auditing, financial accounting, cost accounting, tax accounting, and analysis.

The university is a nationally recognized leader in preparing students for successful careers success with affordable tuition fees. Its main campus is located in Bellevue, Nebraska.

- Bachelor of Science in Accounting

Bellevue is regionally accredited by the Higher Learning Commission.

4. Bemidji State University

Bemidji State University is located in Bemidji, Minnesota. It was founded in 1919 as a preparatory school for teachers.

Students are offered the flexibility to pursue their degree in their own time and from anywhere. Online learners will have access to the same rigorous and engaging degree program as on-campus students.

- Bachelor of Science in Accounting

BSU is accredited by the Higher Learning Commission.

5. Brenau University

Brenau University in Gainesville, Georgia is a globally recognized leader in innovative higher education. With a strong foundation of liberal arts, it offers advanced degrees that are highly relevant and in-demand.

The university launched its first online programs in 1998, as a way of pursuing its longstanding tradition of “radical innovation” in education. At present, there are 40 existing online programs that are highly relevant to both students and employers.

- Bachelor of Business Administration in Accounting

Brenau is accredited by the Southern Association of Colleges and Schools.

6. Central Methodist University

Central Methodist University strives to fulfill its mission of preparing students to make a significant difference in the world through academic and professional excellence, social responsibility and ethical leadership.

Its Accounting and Business program promotes helps students develop technical, interpersonal, and communication skills. With its Business approach to Accounting, learners are trained on how businesses actually operate.

- Bachelor of Accountancy

CMU is accredited by the Higher Learning Commission.

7. Clayton State University

Clayton State University was founded in 1969 and is located in Morrow, Georgia. At Clayton, students are offered personalized attention, affordable education, small class sizes, outstanding teaching, and a vibrant campus community. It is ranked among the Regional Universities in the South by U.S. News & World Report.

There are over 60 undergraduate majors and minors and 8 master’s degrees with more than 15 master’s concentrations.

- Bachelor of Business Administration in Accounting

CSU is accredited by the Southern Association of Colleges and Schools.

8. Colorado Christian University

Colorado Christian University, founded in 1914, is in Lakewood, Colorado, a suburb of Denver.

It offers a Bachelor of Science in Science in Accounting with emphasis on Finance, Business, Systems, Economics, Management, Marketing, Pre-Law. It uses a Christian framework for its programs, which differentiates it from other accounting majors and degrees.

- Bachelor of Science in Accounting

- BSBA in Accounting

CCU is regionally accredited by the Higher Learning Commission.

9. Colorado State University

Colorado State University offers flexibility for modern learners with 100% accredited online degrees and accelerated courses.

At CSU, a degree in Accounting equips students with essential knowledge and skills to contribute successfully to an organization. Students will be taught the fundamentals of Legal Compliance and Ethics, Finance, Economics, Marketing, Qualitative Decision Making, and Leadership.

- Bachelor of Science in Accounting

Colorado State is accredited by The Higher Learning Commission, a Commission of the North Central Association of Schools and Colleges.

10. Concordia University – St. Paul

Concordia University – St Paul is committed to providing an online learning experience with affordable tuition, expert faculty, and proven results.

The university offers a blended format of Bachelor of Science in Accounting program. It consists of 54 credit hours that can be completed through on-campus and online courses. The program delivers relevant knowledge and skills that are necessary to succeed in real-world careers.

- Bachelor of Science in Accounting

Concordia – St. Paul has been accredited by the Higher Learning Commission.

11. Eastern New Mexico University

Eastern New Mexico University has been preparing students for successful careers for 85 years.

The university’s BBA in Accounting can be completed fully online. Students can complete assignments, tests, and projects throughout the semester at their own pace, anywhere.

In terms of affordability, ENMU has the second lowest bachelor’s and master’s degree tuition in the state of New Mexico and has one of the most affordable tuition rates in the country.

- Bachelor of Business Administration in Accounting

ENMU is accredited by the Higher Learning Commission.

12. Excelsior College

Excelsior College offers modern and innovative educational solutions to busy adult students, enabling them to earn college degrees and advance their professional careers.

The school’s bachelor’s in business curriculum gives students a broad foundation in liberal arts and sciences, along with the skills needed to create effective business strategies. The program is designed for working adults and can be completed online.

- BS in Business – General Accounting

Excelsior is accredited by the Middle States Commission on Higher Education.

13. Florida Atlantic University

Florida Atlantic University has campuses all over Florida. They are located in Boca Raton, Davies, Dania Beach, Fort Lauderdale, Jupiter, and Harbor Branch.

The university offers a Bachelor of Business Administration degree program with the following majors: Accounting, Management, Hospitality and Tourism Management, and Marketing. All courses can be completed fully online.

- Bachelor of Business Administration – Accounting

FAU is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

14. Florida Institute of Technology

Florida Institute of Technology is nationally recognized as one of the Best Value College in Florida according to U.S News and World Report. It allows students to advance their education and careers 100% online. It takes pride in its excellent faculty, comprehensive curriculum, and technological innovation.

Their Bachelor of Arts in Accounting prepares students for several careers in business, management, and accounting. The program is offered fully online and is built upon a broad-based liberal arts foundation with career-specific concentration courses.

- Bachelor of Arts in Accounting

Florida Tech is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

15. Fort Hays State University

Fort Hays State University, in the state of Kansas, has been delivering quality Higher education since 1902.

An accounting degree at Fort Hays State University prepares students for a variety of on-demand careers in both the public and private economic sectors. Students are equipped with the abilities required by entry-level accountants and are able to communicate accounting problems and solutions clearly.

- Bachelor of Business Administration in Accounting

Both the traditional FHSU and its Virtual College are regionally accredited by the Higher Learning Commission of the North Central Association of Colleges and Schools.

16. Golden Gate University

Golden Gate University is where theory meets cutting-edge practices. The university offers most of its courses online, taught by professionals who are experts in their fields.

The Bachelor of Science in Accounting qualifies and prepares students for examinations in professional certifications. Their courses reflect GGU’s unparalleled commitment to the real-world success of professionals.

Grounded in essential accounting principles and the liberal arts, their courses are intended to develop well-rounded and holistic professionals.

- Bachelor of Science in Accounting

- Bachelor of Science in Business – Accounting

GGU has been accredited on an institution-wide basis by the Western Association of Schools and Colleges (WASC).

17. Indiana State University

Indiana State University, founded in 1865, offers more than 100 majors, over 70 online programs, and endless opportunities for undergraduate and graduate students.

The University offers an online B.S. in accounting program that serves as excellent preparation for professional licensure. This program also serves as an excellent background for students who plan to complete an M.B.A. in accounting.

- Bachelor of Science in Accounting

Indiana State has been accredited by the Higher Learning Commission.

18. Indiana Wesleyan University

Indiana Wesleyan University is a Christian University in Marion, Indiana. It offers an online Bachelor of Science major in Accounting degree program, which may also be offered onsite at university locations in Ohio, Indiana, and Kentucky.

It is designed for busy working professionals who want to complete a baccalaureate degree focusing on accounting theory, taxation, and auditing.

- Bachelor of Science in Accounting

IWU is accredited by the Higher Learning Commission.

19. Keiser University

Keiser University was founded by Dr. Arthur Keiser and Evelyn Keiser in 1977. Its primary mission was to create an institution of higher education that caters to the needs of adult learners who seek career-focused education.

Keiser University offers an accounting program that aims to prepare students for careers as accountants in a variety of public and nonprofit organizations. It’s geared to provide advanced knowledge of profession-related concepts and skills that are essential to accountants in different areas of specialty.

- Bachelor of Arts in Accounting

Keiser is accredited by the Southern Association of Colleges and Schools.

20. Liberty University

Liberty University was founded by Rev. Jerry Falwell in 1971. It has 17 colleges and schools and offers over 600 programs of study from the certificate to the doctoral level.

This program allows students to get the flexibility of online education and the best support from teachers. Throughout this program, students will be trained in the principles and best practices of critical accounting, along with taxation laws, auditing, and analysis.

- Bachelor of Science in Accounting

Liberty is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

21. Missouri State University

The Missouri State University system has four campuses — three in Missouri and one in Dalian, China. It also offers online learning for working adults.

Missouri State University’s Evening College + gives an opportunity for learners to complete a degree conveniently and flexibly. They offer an undergraduate and a master’s degree in accounting that fulfills the education requirements for licensure examinations.

- Bachelor of Science in Accounting

Missouri State has been continuously accredited by the Higher Learning Commission.

22. National University

National University is San Diego’s largest private university. It offers more than 75 degree programs, from associate, bachelor’s, and master’s levels. Students can study on campus or online with flexible evening, weekend, and 100% online classes.

NU offers B.S. in Accountancy that prepares learners for a wide range of accounting-related careers in various business and accounting fields.

- Bachelor of Science in Accountancy

NU is accredited by the WASC Senior College and University Commission.

23. Northeastern University

Northeastern University, established in 1898, is a private research university with its main campus in Boston, Massachusetts. The Carnegie Classification of Institutions of Higher Education categorized the university as an R1 institution.

The school offers a Bachelor of Science in Finance and Accounting Management program, designed to prepare future accountants to manage budgets, leverage assets, and maximize investments.

- Bachelor of Science in Finance and Accounting Management

Northeastern is accredited by the New England Commission of Higher Education.

24. Northwestern State University of Louisiana

Northwestern State University was founded in 1884, and after over 130 years, it has expanded to being a premier university that offers a full range of undergraduate and graduate degrees.

NSU’S Bachelor of Science in Accounting program forges diverse career paths for its graduates by offering courses in financial and managerial accounting, cost accounting, auditing, accounting information systems, tax, and governmental accounting.

- Bachelor of Science in Accounting

NSU is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

25. Old Dominion University

Old Dominion University continues to be a pioneer in online learning. With expertise that predates the internet, ODU started to offer courses in the mid1980s.

ODU offers an online accounting degree through ODUOnline. This degree delivers technical accounting knowledge, analytical abilities, and computer skills.

- Bachelor of Science in Business Administration – Accounting

ODU is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

26. Ottawa University

Ottawa University was established in 1865 and is a private, regionally accredited institution providing a high-quality education to more than 5,000 students. It has a residential campus in Ottawa, adult and professional studies campuses, and online programs.

It offers accounting degrees that provide an important foundation for careers in economics, finance, auditing, and administration within the public and private sectors.

- Bachelor of Arts in Accounting – Actuarial Science

- Bachelor of Arts in Accounting – Economics

- Bachelor of Arts in Accounting – Finance

- Bachelor of Arts in Accounting – Leadership and Management

Ottawa is accredited by the Higher Learning Commission.

27. Penn State World Campus

Penn State University launched its World Campus in 1998, giving learners the ability to pursue a Penn State degree entirely online. There are more than 150 programs to choose from.

Penn State’s online Bachelor of Science in Accounting is offered through World Campus. It is one of a few AACSB–accredited programs available online. U.S. News & World Report ranked Penn State as one of the top ten for its online bachelor’s degree programs.

The World Campus provides learners with exceptional support and flexibility to study whenever and wherever.

- Bachelor of Science in Accounting

Penn State Online is accredited by the Middle States Commission on Higher Education.

28. Purdue University Global

Purdue University Global offers a personalized, world-class online education online that is tailored to meet the needs of working adults.

Purdue University Global’s accounting bachelor’s degree lets students choose from concentrations in auditing, managerial, public, or tax accountancies. These prepare learners with the skills and proficiencies to advance their accounting careers.

- Bachelor of Science in Accounting

Purdue Global is accredited by the Higher Learning Commission.

29. Regis University

Regis University, founded in 1877, is a Jesuit Catholic University in Colorado.

It offers an online and on-campus accounting degree in both traditional 16-week and accelerated 8-week formats. It equips students with analytical knowledge and quantitative skills that can be applied within the private and public sectors.

The accounting program functions within a moral, ethical, and intellectual framework, helping students pursue an understanding of the evolving world of business and economic systems globally.

- Bachelor of Science in Accounting

Regis is accredited by the Higher Learning Commission.

30. Saint Leo University

Saint Leo University is the oldest Catholic institution of higher education in Florida. It has been ranked as one of “America’s Best Colleges” by U.S. News & World Report.

Saint Leo’s Bachelor’s program in Accounting prepares learners to succeed in a variety of industries all over the world. Students are provided with one-on-one attention from faculty members. They go to internships with Big 4 accounting firms every summer, building professional networks in the corporate sector.

- Bachelor of Arts in Accounting

Saint Leo is accredited by the Southern Association of Colleges and Schools.

31. Siena Heights University

Siena Heights University, founded in 1919, is a Catholic university with its main campus located in Adrian, Michigan.

The university’s Accounting program allows students to gain and apply accounting knowledge in various managerial situations. They will learn the fundamental skills in preparing financial reports, analyzing financial data, and making decisions that impact their businesses and organizations.

- Bachelor of Business Administration in Accounting

Siena Heights is accredited by the Higher Learning Commission.

32. Southern New Hampshire University

Southern New Hampshire University is one of the fastest growing universities in the country. It was founded in 1932, and at present, it offers over 200 programs ranging from certificate to doctoral degree levels.

In the university’s online Bachelor of Science in Accounting program, students can gain relevant knowledge of accounting practices, supplemented by business-specific skills employers look for. The classes focus on building a strong foundation in general accounting principles, financial analysis, auditing, and taxation.

- Bachelor of Science in Accounting

- Bachelor of Science in Accounting Finance

SNHU is accredited by the New England Commission of Higher Education.

33. SUNY Plattsburgh

Since its founding in 1889 as a teaching college, SUNY Plattsburgh has since expanded to meet regional and statewide needs for higher education.

The school takes pride in its state-of-the-art hands-on accounting lab, equipped with current accounting software that accounting majors need to work with. Its Accounting program also has a special course in communication and professionalism to help ensure that students have the skills necessary to achieve their career goals.

- Bachelor of Science in Accounting

SUNY Plattsburgh is accredited by the Middle States Commission on Higher Education.

34. Temple University

Temple University, a public research university in Philadelphia, was founded in 1884.

Bachelor of Business Administration (BBA) in Accounting at Temple University is a 124-credit undergraduate degree that provides students with a broad general education and intensive study for professional careers in public accounting, financial management, consulting, and tax accounting.

- Bachelor of Business Administration in Accounting

Temple is accredited by the Middle States Commission on Higher Education.

35. Thomas Edison State University

Thomas Edison State University was founded by the State of New Jersey and chartered by the New Jersey Board of Higher Education in 1972.

The university’s Bachelor of Science in Business Administration degree in Accounting is designed for adult learners who want to become accountants and auditors. It ensures competence in the principles of finance, business, and arts and sciences.

Students who are interested in becoming certified public accountants can seamlessly integrate this accounting degree into the CPA and Master’s Track.

- Bachelor of Science in Business Administration – Accounting

TESU is accredited by the Middle States Commission on Higher Education.

36. Touro University Worldwide

Touro University Worldwide aims to deliver superior-quality education to everyone, allowing students to pursue learning at their own pace in the comfort of their own setting.

The school’s Bachelor of Science in Business Administration degree allows students to acquire essential management concepts and techniques. It offers a flexible course of study through its online learning. With top-notch faculty, students learn firsthand from industry experts.

- Bachelor of Science in Business Administration – Accounting

TUW is fully accredited by the WASC Senior College and University Commission.

37. University of Alabama – Birmingham

The University of Alabama at Birmingham is a public research university. It started as an academic extension center in 1936 and later became a four-year campus in 1966.

The Bachelor of Science in Accounting degree from the University of Alabama at Birmingham is offered 100% online, helping students build a solid foundation in conceptual accounting and business. Courses are taught by award-winning and supportive faculty who are experts in the industry.

- Bachelor of Science in Accounting

UAB is accredited by the Southern Association of Colleges and Schools.

38. University of Mary

The University of Mary first began when Benedictine Sisters of the Annunciation arrived in the Dakota Territory in 1878.

The university designed its degree programs to suit adult learners’ schedules and life situations. It provides students options to pursue a Bachelor’s Degree in Accounting entirely online, one evening per week on campus, or a blend of both.

It is offered in an accelerated format, which enables learners to begin an MBA-accountancy program and prepare for the CPA exam in less time at other colleges and universities.

- Bachelor of Science in Accounting

UMary is accredited by the Higher Learning Commission.

39. University of Maryland Global Campus

The University of Maryland Global Campus offers online and hybrid courses in over 90 programs and specializations.

The university’s curriculum in the bachelor’s degree in accounting was developed in consultation with employers, so it features real-world data sets. Courses include statistics, economics, taxation, cost accounting, business law, and auditing.

The faculty and staff hold a wide range of leadership positions in the industry, giving them diverse insights and a depth and breadth of knowledge.

- Bachelor of Science in Accounting

UMUC is accredited by the Middle States Commission on Higher Education.

40. University of Massachusetts – Amherst

UMass Amherst is among the major public research universities in the country. Its campus is located in Amherst, Massachusetts, offering a rich cultural environment in a rural setting close to major urban centers.

The university’s accounting curriculum prepares students to perform a wide range of accounting, auditing, and consulting activities to steer clients and employers in a sound financial direction.

Teachers and advisors are accounting experts with over ten years of experience, so students can get exceptional guidance throughout the program.

- Bachelor of Science in Accounting

UMass – Amherst is accredited by the New England Commission of Higher Education.

41. University of Massachusetts – Dartmouth

The University of Massachusetts – Dartmouth was formerly called Southeastern Massachusetts University. It became part of the University of Massachusetts system in 1991.

UMass Dartmouth offers a BS in Accounting degree which can be completed fully online. It prepares students for careers in public accounting, management accounting, and auditing.

Completion of this program requires students to fulfill 120 credits, including hands-on work experience.

- Bachelor of Science in Accounting

UMass Dartmouth is accredited by the New England Commission of Higher Education.

42. University of Massachusetts – Global

The University of Massachusetts Global has more than 25 campuses throughout California and Washington and an online campus, which provides the opportunity for working adults to pursue their professional goals alongside their jobs and other responsibilities.

UMass Global’s accounting program integrates the latest business issues and fundamental accounting principles and techniques. The university prepares its students for global employment across a wide range of professional fields.

- Bachelor of Business Administration in Accounting

The University of Massachusetts Global is accredited by the WSCUC Senior College and University Commission.

43. University of Michigan – Flint

The University of Michigan – Flint was founded in 1956 on a commitment to bring high-quality education to its region.

The university offers classes during the day, evening, and in a hybrid format. It also has a 100% online business program, which offers students the flexibility to take classes on or off campus.

In this program, students are expected to develop better communication skills, critical thinking, teamwork, and finance and management skills.

- Bachelor of Business Administration – Accounting

UM is accredited by the Higher Learning Commission.

44. University of Minnesota – Crookston

The University of Minnesota Crookston is a public, baccalaureate institution; and is one of the five statewide campuses of the University of Minnesota System.

The university’s B.S in Accounting degree equips students with the fundamental and advanced techniques needed to assist future clients with financial reports. With small classrooms and excellent faculty support, students gain mastery of fundamental principles of finance, banking, management, and taxation.

- Bachelor of Science in Accounting

UMN – Crookston is accredited by the Higher Learning Commission.

45. University of South Carolina

Founded in 1801, the University of South Carolina was then known as South Carolina College. It is among the country’s oldest and most comprehensive public universities.

The university offers a business administration degree with an accounting concentration, where graduates can explore opportunities from a variety of careers in all business sectors.

The curriculum has been developed to reflect modern employers’ real-world needs, so graduates develop problem-solving skills that are needed in today’s marketplace.

- Bachelor of Science in Business Administration – Accounting

UofSC is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

46. University of Toledo

The University of Toledo is a student-centered, public metropolitan research university and a member of the state university system of Ohio. It offers over 300 undergraduate graduate and professional programs.

The university’s bachelor of business administration degree in accounting can be completed 100% online. Students get the same rigorous academic experience as the on-campus setting but with the added flexibility of online classes. This program can be completed full-time or part-time.

- Bachelor of Business Administration in Accounting

The U of Toledo is accredited by the Higher Learning Commission.

47. University of West Georgia

The University of West Georgia was established in 1906 in a call for a more realistic educational program for the rural youth. Presently, the university offers a number of programs of study at the undergraduate, graduate, and doctoral levels.

The university’s Bachelor of Business Administration program in accounting provides students with high-standard liberal arts based educational foundation. The program is composed of eight upper-level accounting courses and a three-hour capstone course in strategic management.

The program can be completed partially online.

- Bachelor of Business Administration in Accounting (Partially Online)

UWG is accredited by the Commission on Colleges of the Southern Association of Colleges and Schools.

48. Washington State University

For more than a hundred years, Washington State University has maintained an outstanding reputation for academic excellence, innovative research, and a diverse community of students and faculty.

WSU’s accounting program is offered completely online. It provides students the foundation they need to start or enhance their professional career. The curriculum provides a strong foundation in management fundamentals, critical thinking, accounting practices, and accounting information systems.

- Bachelor of Arts in Business Administration – Accounting

WSU is accredited by the Northwest Commission on Colleges and Universities.

49. Western Governors University

Western Governors University is the first university to offer competency-based bachelor’s and master’s degrees, with online courses designed in partnership with leading employers.

The university’s Bachelor of Science in Accounting teaches students how to use accounting principles, ledgers, and journals to perform tasks related to financial assets and liabilities for individuals and businesses.

The curriculum is relevant and up-to-date, and was developed by business and accounting experts. This degree is also the first step towards gaining a CPA certification.

- Bachelor of Science in Accounting

WGU is regionally accredited by the Northwest Commission on Colleges and Universities.

50. Wilmington University

Wilmington University is a private, open-access institution that provides the unique academic needs of working adults who want to advance their career through higher education.

It offers career-oriented undergraduate, graduate, and doctoral degree programs that emphasize in-demand knowledge and skills needed by employers.

Wilmington University offers affordable bachelor’s in accounting degree program, which fully prepares students to start a career in public, private, or governmental accounting. Courses are flexible as they can be done on campus, fully online, or a blend of both.

- Bachelor of Science in Accounting

- Bachelor of Science in Accounting and Finance

Wilmington is accredited by the Middle States Commission on Higher Education.

Types of Accounting Degrees

Depending on your level of education, you may earn an accounting degree at the associate’s, bachelors, masters, or doctorate level.

You may also concentrate your studies on a particular specialization such as auditing, public accounting, or even forensic accounting.

Online Bachelor’s in Accounting Programs

An accounting degree at the bachelor’s level could come with any of these concentrations, or no concentration for a generalist’s track.

- Online Bachelor’s in Accounting

- Online Bachelor’s in Accounting – Auditing / Forensic Accountancy

- Online Bachelor’s in Accounting – Managerial Accountancy

- Online Bachelor’s in Accounting – Public Accountancy

- Online Bachelor’s in Accounting – Tax Accountancy

Editorial Listing ShortCode:

Accountants are often highly valued and needed members of every strong business.

Online Master’s in Accounting Programs

The following Master’s in Accounting is offered online, but it is not considered to be accelerated degree programs.

- Online Master’s in Professional Accounting

Editorial Listing ShortCode:

Whether it is management, public or tax accounting, there may be a spot for you to excel in.

Online Doctorate in Accounting Programs

The following online doctoral programs in accounting are not accelerated degree programs, but because they are offered online, they do allow you to have greater flexibility.

- Online DBA – Accounting (no dissertation required)

Doctoral graduates in accounting (or finance) may be equipped to pursue senior leadership positions in academia, auditing, and accounting.

Editorial Listing ShortCode:

Accounting Curriculum

Accounting classes you can expect to take as part of the curriculum include:

- Accounting Information Systems

- Auditing and Assurance

- Business Analytics

- Business Finance

- Business and Professional Ethics for Accountants

- Business Processes and Internal Controls

- Cost Accounting

- Financial Management

- Government / Institutional Accounting

- Information Analysis

- Managerial Accounting

- Microeconomics / Macroeconomics

- Professional Accounting

- Risk Management

- Strategic Management

- Taxation

These are the classes that may give you the skills to go far with an accounting degree.

Accounting Degree Careers

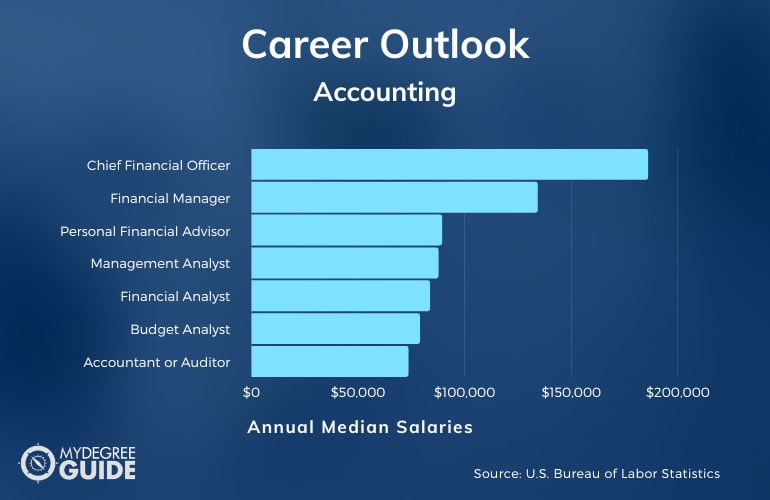

The field of accounting is projected to grow by 4% in the next few years, with jobs in fields like manufacturing, government, and insurance. The average income when you have an accounting degree is $73,560. The top 10% of accountants made more than $128,680 per year, making accounting a strategic business major.

| Careers | Annual Median Salary |

| Chief Financial Officer | $185,950 |

| Financial Manager | $134,180 |

| Personal Financial Advisor | $89,330 |

| Management Analyst | $87,660 |

| Financial Analyst | $83,660 |

| Budget Analyst | $78,970 |

| Accountant or Auditor | $73,560 |

| Cost Estimator | $66,610 |

| Tax Examiner and Collector, or Revenue Agent | $55,640 |

| Bookkeeping, Accounting, or Auditing Clerk | $42,410 |

Source: Bureau of Labor Statistics

The annual income you could make with a degree in accounting is over $30,000 more than the average income of all occupations. And it doesn’t matter if you earn an accelerated accounting degree online or if you sat in class on campus for four-plus years. Your degree will be the same either way.

Getting an Accelerated Accounting Degree Online

According to a report by the National Association of Colleges and Employers, over half of the companies surveyed responded that they would be interested in hiring a graduate with a degree in accounting.

There are famous people who have pioneered big businesses with a degree in accounting. For example, Arthur Blank, the co-founder of the multi-million dollar chain Home Depot, graduated with a degree in accounting from Babson College.

Another big name accountant is Phil Knight, the founder of Nike shoes. He also made a lot of money after graduating from the University of Oregon with a degree in accounting.

You could be taking the same classes as these big founders did.

But chances are, if you are reading this article, you actually want to speed things up a bit with a fast-track accounting degree online.

Accelerated Accounting Degree Programs Offer Year-Round Admissions

Accelerated online accounting degree programs at many universities have new start dates each month. Instead of waiting until it is a good time for a school to run its classes, you may start when it is a good time for you.

Or time your graduation so that you are walking into the job market right around tax season when everybody is scrambling for an accountant.

Accelerated Online Accounting Classes

Earning an accelerated accounting degree online may be easy to fit into your life. The reason for that is accelerated online courses. If you thrive with a regular schedule and set due dates, then accelerated online classes may very well be a good fit for you.

Instead of taking a 16-week semester accounting class, you can take an 8-week online course in accounting and be done twice as fast.

3 Ways to Accelerate Your Accounting Degree Online

Most universities offer traditional online degree programs. With the exception of a few universities, they do not call their accounting degrees “accelerated” programs.

That being said, more and more universities are offering 8 week online courses, which can help you finish your classes faster. Add to those accelerated courses some life experience college credits (get college credit for previous experience) or CLEP exams and you may finish even faster.

1. Test Out of College Classes (Up to 1 Year of Classes)

You do not have to attend class to earn your 120 credit hours. There is a completely valid way to earn college credit that doesn’t involve going to class.

You take a 90-minute multiple choice exam instead.

Over 2,900 universities award college credits for these tests.

Most universities will allow you to earn between 15 to 30 college credits through credit by exam. Depending on the college, that may be a whole year of classes! So, instead of needing 4 years to get your degree, you may shave up to one year off your time to graduation by cramming for a few multiple choice exams in your spare time.

We go deeper into this topic here: Testing out of college classes.

This may work really well for the introductory level classes. For example, it may be fairly easy to cram for Intro to Sociology or Psychology to fulfill your social science requirements. You may also knock out your history and government requirements pretty quickly. Just review the list of exams your college accepts for credit before you cram for the exam.

At most schools, as long as you pass the multiple-choice exam with a grade of 50% or more, they will give you college credit for that course.

2. Get College Credit for Your Life and Work Experience

If you have been working in the field of finance, business, technology, computers, or even insurance, you may be able to get college credit for prior learning.

You may work together with your university to put together a portfolio outlining your training, experiences, credentials and a few reference letters. Once you submit your portfolio, you may then get college credit for the classes you need.

To give you an example, at Liberty University, you may be able to get college credit for these classes by submitting an acceptable portfolio:

- Accounting Information Systems

- Auditing

- Introduction to Business

- Personal Finance

- Principles of Accounting

- Taxation

You may also use credit for prior learning to fulfill all your elective classes. In my case, I had 12 years of computer and technology experience. After submitting my portfolio, I received 18 college credits for my documented life experience in this field. That was another 6 classes I was able to get out of the way without sitting in classes.

The American Council on Education recommends colleges and universities grant credit for a variety of courses or training offered by employers. ACE is well-recognized by a large number of colleges.

If you max out the number of college credits you can earn through prior learning, you may be able to knock out another semester of courses you would otherwise have to take.

3. Stay Continuously Enrolled with the Max Course Load Allowed

The third step to accelerating your degree involves the most work.

Typically, a campus student will enroll in 30 credits each year (15 in the Fall semester, 15 in the Spring). But you don’t have to be typical; you can be exceptional. Many universities will allow you to take up to 18 credit hours per traditional semester. Plus, you can enroll during the summer. And in some cases, during a winter (January) session.

Here’s an example of how that could look:

- 18 credit hours in the Fall

- 18 credit hours in the Spring

- 12 credit hours in the Summer (Take 2 classes during Summer 1 and 2 classes during Summer 2)

This can bring you to the 48-credit-hour mark in just one year. If your school has a winter (3-week) session, you can add another 3 credit hours to that tally.

It’s a lot of work but doable.

Credit by exam (30 credits) + Life experience credits (15 credits) + One year taking the maximum course load (48 credits) = 93 credit hours in just one year. Only 27 left to go…

Obviously, this pace would be insane for most people. Your social life would be non-existent. But it is possible.

Transferring Your Existing College Credits

If you have taken any college classes in the past, that may count toward your degree requirements. As long as the credit you have earned is from an accredited college, you may transfer it to your accounting degree program.

Maybe you took an Advanced Placement class in high school and passed the AP exam at the end of the semester. You may add that previously earned college credit to your accounting degree plan as long as your target university accepts AP credit in that subject.

Even if it doesn’t fit into your accounting degree plan, you may use it anyway! Whatever college credits you have leftover may be used to fulfill your elective requirements. That means fewer classes you have to take so you can finish faster.

Lower Tuition Costs

The biggest expense in an accounting degree will be your tuition. Every class you take will cost you more. So, take fewer classes, pay less.

You may earn 3 credits by taking a College Level Examination Program, which will only cost you less than $100. That’s down from the $1,200 to $1,500 or so taking the class would cost you.

Plus, when you take online classes, you’re eligible for the same financial aid opportunities as on-campus students. See what you qualify for by filling out the Free Application for Federal Student Aid (FAFSA). You can also research private organizations that offer scholarships to qualifying students.

Are Accelerated Accounting Degree Programs Accredited?

As long as your online accounting degree is earned at a regionally accredited college, then it is a real, valid degree.

The regional accreditors listed below are the same agencies that accredit Harvard, Yale, Stanford, and every other prestigious university. So, you can rest assured that your online accounting program will be reputable if it is accredited by one of these agencies.

- Western Association of Schools and Colleges

- Higher Learning Commission

- Middle States Commission on Higher Education

- New England Commission of Higher Education

- Southern Association of Colleges and Schools Commission on Colleges

- WASC Senior College and University Commission

To go for a higher level of accreditation specific to Business Administration (or Accounting), you may look for schools that are accredited by one of the following agencies (in addition to having regional accreditation):

- Association to Advance Collegiate Schools of Business (AACSB)

- Accreditation Council for Business Schools and Programs (ACBSP)

These accreditors will make sure that the degree you earn is reputable and valid. Many accounting degree holders will seek to also receive designation with the American Institute of Certified Public Accountants to become a Certified Public Accountant (CPA).

Is an Accelerated Accounting Degree Online Program Right for You?

For the right person, accounting may be a good major. Accountants are in high demand, and if you’re motivated, you may cut tuition costs and finish your accounting degree faster online. Testing out of classes, credit for prior learning, and accelerated online classes can help you get your accounting degree online fast!

You can start the process by requesting information or applying to a few schools offering programs online.