Earning a masters in financial planning is a strategic step for professionals who would like to take their careers to new places.

This graduate program can provide you with greater insight into the world of financial planning as you study topics like wealth management, estate planning, and more. With these skills, you may choose to progress in your current profession or redirect your career to explore new opportunities.

Editorial Listing ShortCode:

Read on to learn more about masters programs in financial planning and determine whether it’s the right path for you.

Universities Offering Online Masters in Financial Planning Degree Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

American College of Financial Services

The American College of Financial Services offers a Master of Science in Financial Planning with two concentrations to choose from: Financial Planning or Legacy Planning. Courses follow a quarterly academic calendar. Potential courses in the curriculum include Fundamentals of Estate Planning, Income Taxation, and Fundamentals of Insurance Planning.

The American College of Financial Services is accredited by the Middle States Commission on Higher Education.

California Lutheran University

California Lutheran University offers an online Master’s in Financial Planning. The program requires the completion of 36 units, or 12 courses, and can usually be completed in 1 to 2 years. There are five 8 week terms every year. Classes are limited to 20 students and include live virtual discussions.

California Lutheran University is accredited by the Accrediting Commission for Senior Colleges of the Western Association of Schools and Colleges.

Creighton University

Creighton University offers an online Master’s in Financial Planning and Financial Psychology. The curriculum is designed to teach not only finance skills but also how subconscious beliefs affect clients’ financial decisions. Classes are taken in flexible 8 week sessions. Potential courses include Personal Financial Planning, Insurance Risk Management, and Applied Behavioral Finance.

Creighton University is accredited by The Higher Learning Commission of the North Central Association of Colleges and Schools.

Golden Gate University

Golden Gate University offers a Master of Science in Financial Planning that can be completed 100% online or in a hybrid format. The program requires the completion of 30 units. Potential courses include Personal Financial Planning, Personal Investment Management, and Retirement and Employee Benefits Planning.

GGU is accredited by WASC Senior College and University Commission.

Iowa State University

Iowa State University offers a Master of Family and Consumer Science with a Family Financial Planning specialization. Potential courses in the curriculum include Financial Theory and Research I, Financial Counseling, and Estate Planning for Families. The program is available in a fully online format through Iowa State’s partnerships with other universities.

Iowa State University is accredited by the Higher Learning Commission.

Kansas State University

Kansas State University offers a Master of Science in Personal Financial Planning that can be earned 100% online. The curriculum is designed to prepare students for the CFP examination. The program requires the completion of 30 credit hours of courses such as Retirement Planning for Families, Investing for the Family’s Future I, and Estate Planning.

Kansas State University is accredited by the Higher Learning Commission.

Liberty University

Liberty University offers a Master of Science in Finance – Financial Planning that can be earned 100% online. Each course is 8 weeks long, and all courses are taught from a biblical worldview. On average, the program can be completed in just 1 year. The curriculum is designed to prepare students for CKA and CFP certification exams.

Liberty University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Montana State University

Montana State University offers an online Master of Science in Family Financial Planning that is designed to prepare students for the CFP exam. The program requires the completion of 36 credits. Potential courses include Insurance Planning for Families, Estate Planning for Families, and Personal Income Taxation.

Montana State University is accredited by the Northwest Commission on Colleges and Universities.

North Dakota State University

North Dakota State University offers an online Master of Science in Family Financial Planning. The curriculum focuses on how to apply financial knowledge to help families in their day-to-day lives. The program requires the completion of 36 credits, Potential courses include Financial Counseling, Financial Theory and Research in Family Financial Planning I, and Personal Income Taxation.

NDSU is accredited by the Higher Learning Commission.

Oklahoma State University

Oklahoma State University offers an MS in Family Financial Planning that can be earned online. This self-paced program requires the completion of 36 credit hours. Typically, 1 to 2 courses are taken each semester and the program is completed in 3 years. Graduates of the program may sit for the CFP certification examination.

Oklahoma State University is accredited by the Higher Learning Commission.

Regent University

Regent University offers an MA in Family Planning and Law that can be earned in a supportive Christian environment. The program requires the completion of 32 credit hours. Potential courses include Foundations of Legal Thought, Portfolio Analysis, Insurance Law and Planning, Fundamentals of Estate Planning, and Survey of Taxation.

Regent University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

South Dakota State University

South Dakota State University offers an online Family Financial Planning MS program that is designed to prepare for the Certified Financial Planner exam. The program requires the completion of 36 credits. Potential courses include Financial Counseling, Financial Theory and Research I, and Insurance Planning for Families. The program offers thesis, research and design, and coursework only options.

SDSU is accredited by the Higher Learning Commission.

Texas Tech University

Texas Tech University offers an MS in Personal Financial Planning that can be earned 100% online. The program is designed to prepare students for the CFP examination. The online courses are synchronous and run at the same time as on-campus classes. Texas Tech hosts virtual networking events and welcomes online students to join the Personal Financial Planning Association student organization.

Texas Tech University is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

University of Alabama

The University of Alabama offers an online MS in Consumer Sciences with a concentration in Family Financial Planning and Counseling. The program requires the completion of 30 credit hours. Potential courses include Personal Insurance Planning and Management, Personal Retirement Planning and Employee Benefits, and Psychology of Money.

The University of Alabama is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

University of Georgia

The University of Georgia’s Master of Science in Financial Planning is available 100% online. The program requires the completion of 31 credit hours that can typically be finished in 2 years. Coursework is completed in 8 week modules. Potential courses include Wealth Management I and II, Financial Counseling and Client Communication, and Family Tax Planning. GRE scores are not needed to apply.

The University of Georgia is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

University of Missouri – Columbia

The University of Missouri – Columbia offers a Master of Science in Personal Financial Planning that can be completed 100% online. The curriculum is designed to prepare students for the Certified Financial Planner examination. The program aims to allow students to work at their own pace and work full-time while earning their degree.

The University of Missouri – Columbia is accredited by the Higher Learning Commission.

University of Nebraska – Lincoln

The University of Nebraska – Lincoln offers an online MS in Family Financial Planning. The program requires the completion of 36 semester credit hours and can typically be completed in 3 years, even while working full-time. Potential courses include Financial Counseling, Financial Planning Case Studies, and Investing for the Family’s Future.

The University of Nebraska – Lincoln is accredited by the Higher Learning Commission.

Whitworth University

Whitworth University offers a Master of Science in Financial Planning. The program is available mostly online but does require three on-campus residencies. Online classes meet in the evenings to help accommodate work schedules. There are elective options available both online and on campus. The financial planning graduate program can typically be completed in 10 to 17 months.

Whitworth University is accredited by Northwest Commission on Colleges and Universities.

Widener University

Widener University offers an MS in Taxation and Financial Planning that can be earned 100% online. The program requires the completion of 31.5 credits and can typically be completed in 2 years. The curriculum is designed to prepare students for the CFP exam and offer real-world experience working with clients.

Widener University is accredited by the Middle States Association of Colleges and Schools.

William Paterson University

William Paterson University offers a Master of Science in Finance and Financial Services with a Financial Planning track that can be completed online. The program is designed to prepare students for the CFP exam and can potentially be completed in 1 year. There are multiple start dates offered each year for the convenience of working professionals.

William Paterson University is accredited by the Middle States Commission on Higher Education.

Online Masters in Financial Planning Programs

When we think of financial planning, we tend to think of the role of a professional who helps us create budgets, figure out how much to save, and where to invest money in hopes of growing wealth.

This is a correct assessment of the traditional role of a financial planner, but an online masters in financial planning degree can be helpful for a variety of professional roles. If you have a background in mathematics, finance, economics, or law, you may benefit from the courses included in a masters in financial planning program.

Throughout a masters in financial planning program, students will have the opportunity to concentrate on areas such as:

- Retirement and estate planning. This area of financial planning focuses on those who wish to plan ahead or protect their wealth later in life.

- Budget strategies. You can learn to strategize for individuals, small businesses, corporations, and government entities.

- Tax law and liability. This knowledge is essential for finance professionals, especially financial planners.

- Insurance and investment products. These can provide opportunities for greater wealth, along with a certain amount of risk.

Students and professionals who earn their master’s in financial planning degree online often pursue careers as financial managers, advisors, or analysts. Those who are interested in roles as accountants, compensation strategists, and budget analysts can also benefit from this degree.

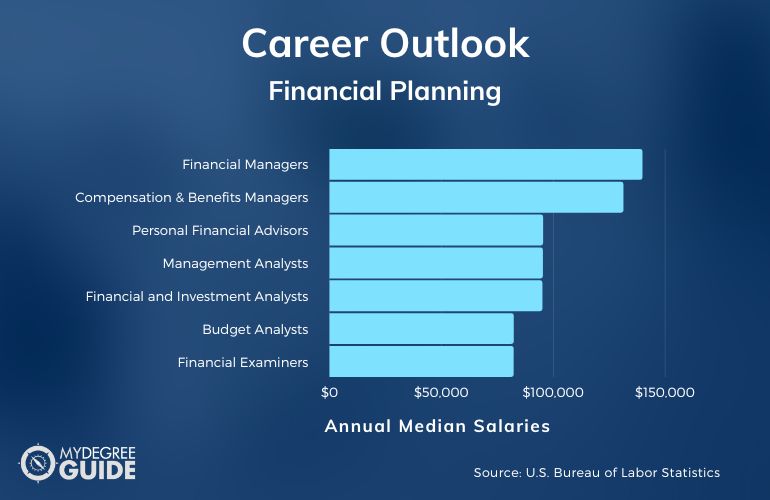

Financial Planning Careers & Salaries

Those who earn their masters in financial planning degree online often pursue careers as financial managers, analysts, or advisors. They may establish their own consulting firm or join larger corporations. Some work for the government or non-profit organizations.

According to the Bureau of Labor Statistics, employment opportunities for personal financial advisors are anticipated to increase by 15% over the next ten years.

| Careers | Annual Median Salaries |

| Financial Managers | $139,790 |

| Compensation and Benefits Managers | $131,280 |

| Personal Financial Advisors | $95,390 |

| Management Analysts | $95,290 |

| Financial and Investment Analysts | $95,080 |

| Budget Analysts | $82,260 |

| Financial Examiners | $82,210 |

| Accountants and Auditors | $78,000 |

| Compensation, Benefits, and Job Analysis Specialists | $67,780 |

| Securities, Commodities, and Financial Services Sales Agents | $67,480 |

Some graduates apply their skills to related roles, such as reviewing and managing compensation and budgets for larger businesses or government entities. Others work in financial or legal firms.

Depending on your current profession and the courses you choose to take while earning your master in financial planning online, you could use your skills to pursue a variety of career options.

Master of Financial Planning Curriculum & Courses

Each school will offer its own curriculum for a master in financial planning degree. The courses you select may also depend on your personal and professional goals.

Some of the types of courses generally found in a masters in financial planning include:

- Estate Planning: In this course, you’ll examine the process of organizing, managing, and distributing an individual’s assets following their death or disability.

- Retirement Planning: This course helps you understand various opportunities for retaining and gaining wealth in preparation for life after retiring.

- Financial Law: You’ll take a deeper dive into the laws and regulations surrounding a variety of assets and financial opportunities.

- Insurance and Investments: In this course, you’ll examine various products and opportunities that can increase wealth, along with the risks and benefits.

- Budget Management: This course helps you understand fund allocation on a deeper level, including personal, corporate, and government entity budget strategies.

- Taxes and Taxation: In this course, you’ll dive into the myriad of tax requirements for various financial situations.

- Risk Management: You’ll learn how to assess and consider various types of risk associated with budgets, investments, and financial strategies.

- Economics: Courses in economics will help you continue to build upon your understanding of fiscal considerations.

- Financial Statement Analysis: In courses like this one, you’ll examine financial data and changes to investigate opportunities and concerns.

- Ethics and Financial Goals: You can gain greater insight into the ethical considerations of dealing with wealth and supporting financial goals.

The courses you choose to study will likely be aligned with your professional goals and career interests.

MS in Financial Planning Admissions Requirements

The application process for a master’s in financial planning is generally a bit different for each school. Some of the more common admissions requirements among MS programs include:

- GRE or GMAT scores (only some schools require them)

- Prior educational transcripts

- Letter of intent

- Professional resume or CV

- Letters of recommendation

Some schools have additional admissions requirements, such as scholarly or professional writing samples. Others request that students have a related bachelor’s degree. You may want to research each school’s requirements in detail before you start the application process.

Accreditation

When selecting a school for your masters in financial planning degree, you may wish to pay close attention to a school’s accreditation status.

You can learn more about the various accrediting bodies through the Council for Higher Education Accreditation (CHEA). Schools that have received regional accreditation have been carefully evaluated for educational excellence. As a result, there are many benefits to earning your degree from an accredited institution.

Some employers and professional organizations search specifically for applicants who have earned their degrees at an accredited institution. Plus, a few financial aid opportunities are exclusively extended to those studying at accredited schools.

Financial Planning Licensure and Certifications

A variety of licenses and certifications are offered for financial planning professionals. Whether these credentials are required depends on the state in which you practice, your employer, and your professional goals.

Some common licenses and certifications for financial planners, managers, analysts, and advisors include:

- Certified Financial Planner (CFP)

- Chartered Financial Consultant (ChFC)

- Certified Public Accountant (CPA)

These nationally recognized certifications are available for professionals who have demonstrated a higher level of learning in areas such as investments, taxes, estate protection, insurance, and asset management. It’s likely that your future clients or employers will also appreciate the knowledge and dedication reflected by your credentials.

Financial Aid and Scholarships

Many students are interested in financial assistance when earning their master’s degree. A common first step for pursuing needs-based federal financial aid is to complete the FAFSA, or Free Application for Federal Student Aid.

You may also wish to explore scholarship opportunities. Scholarships and other educational awards may be offered by the school you select, private donors, community initiatives, and businesses. As a graduate-level student, you may also find grants offered for those studying in your field. These grants may be related to your thesis or future career plans.

Another option is to consider educational assistance or tuition reimbursement programs through your employer.

What Is a Financial Planning Masters Degree?

A financial planning master degree is a beneficial graduate program for individuals within the financial and economical career fields.

This masters may help you grow your qualifications and earning potential. This degree program combines crunching numbers, risk analysis, budgeting considerations, and accounting recommendations with a deep knowledge of investments, economics, and market volatility.

Some professionals earn this degree to help individuals and families plan for the future, to work with businesses to advise them on financial strategies or to consult with government entities and advise on fiscal needs.

What Can You Do with a Master’s Degree in Financial Planning?

A master in financial planning degree can be helpful for a variety of professionals who work to create long-term financial game plans while managing spending through budgeting.

The Bureau of Labor Statistics notes that career opportunities for many financial experts, such as personal financial advisors, are expected to grow faster than average over the next ten years. Some graduates choose to start their own businesses as financial planners, work as a consultant for individuals or small businesses, or gain employment within a corporate or government setting.

How Long Does It Take to Get a Masters in Financial Management Online?

Many masters programs can be completed in 1 to 2 years of full-time study. The time it takes to earn your masters degree in financial management depends on the type of program you select as well as your enrollment status.

Some masters programs require a thesis project, which can increase the amount of time it takes to complete your degree. Part-time enrollment can also extend the length of your studies. If you select a 36 credit hour program that does not include a thesis, you may be able to complete your degree in 1 year of full-time enrollment. This includes studying over a summer semester.

What’s the Difference Between a Wealth Management vs. Financial Planning Master’s Degree?

The concepts of wealth management and financial planning are very close in nature, but there are a few major differences.

| Masters in Wealth Management | Masters in Financial Planning |

|

|

While the topics studied overlap in many ways, the professional and educational focus of these two degrees is different.

What’s the Difference Between a Masters vs. MBA in Financial Planning?

Though the names are very similar, a masters in financial planning and a Master of Business Administration (MBA) in Financial Planning are somewhat different in their approach to finances.

| Masters in Financial Planning | MBA in Financial Planning |

|

|

While both degree paths provide greater insight into financial strategy, investments, risk, and opportunity, an MBA degree will often include more classes that are business- or corporate-oriented.

Is a Master’s in Financial Planning Worth It?

Yes, a master’s in financial planning is worth it for many students. If you wish to redirect or enhance your career in a financial field, this degree can provide insight into taxation, estates, wealth management, investments, and more.

Careers for financial planners and advisors are expected to continue to increase in the coming years. For instance, the Bureau of Labor Statistics projects 15% job growth for personal financial advisors over the next ten years, which is much faster than average. A master’s in financial planning can help you move into this field or advance in your current career.

Getting Your Masters in Financial Planning Online

Earning a master’s in financial planning degree online could be the next step toward reaching your personal and professional goals.

If you have an interest in the many pieces that impact financial wellness, you might consider earning your masters in financial planning to help refine your knowledge of these topics. This graduate program can also help you grow your qualifications and earning potential.

You can explore and compare accredited schools that offer online masters degree programs in financial planning to see which ones best align with your interests and goals.