A taxation certificate program is designed to help you develop the core knowledge that’s necessary for tax specialists.

With these skills, you may be able to help organizations or individuals navigate intricate tax laws in order to minimize liability. By completing a taxation certificate program, as opposed to a graduate degree, you’ll likely be able to begin or advance your career as a tax professional in a fraction of the time.

Editorial Listing ShortCode:

Read on to learn about the many benefits of taxation certificates.

Universities Offering Online Graduate Certificate in Taxation Programs

Methodology: The following school list is in alphabetical order. To be included, a college or university must be regionally accredited and offer degree programs online or in a hybrid format.

Golden Gate University

Golden Gate University offers an online Graduate Certificate in Taxation. The program aims to teach general, practical tax knowledge. The curriculum’s 4 required courses typically include Advanced Federal Income Taxation, Tax Research and Decision Making, Property Transactions, and Tax Timing. The choice of one elective is also offered, for a total of 15 credits.

GGU is accredited by WASC Senior College and University Commission.

Michigan State University

Michigan State University offers a Graduate Certificate in Taxation. This flexible online program requires 12 credits in the form of 4 to 7 week courses and can usually be completed in 12 to 20 months. Courses are mostly asynchronous, with some optional synchronous meetings. Applicants are expected to have a bachelor’s degree in either accounting or finance to qualify for admission into the program.

Michigan State University is accredited by the Higher Learning Commission.

Minnesota State University – Mankato

Minnesota State University – Mankato offers a Graduate Certificate in Taxation entirely online. The program features courses like Fundamentals of Federal Income Tax, and electives such as Accounting Theory, Tax Research and Consultancy, and Taxation of Corporations. The program requires 10 credits.

Minnesota State University – Mankato is accredited by the Higher Learning Commission.

Pennsylvania State University

Pennsylvania State University offers a Graduate Certificate in Taxation 100% online. GRE or GMAT scores are not required to apply. The program requires 9 credits, which can be counted toward the 150-hour educational requirement to receive CPA licensure in most states, and toward a master’s degree in taxation.

Penn State is accredited by the Middle States Commission on Higher Education.

Portland State University

Portland State University offers the opportunity to earn a Taxation Graduate Certificate. This online program requires 20 credits and has start dates in the summer and fall. Classes are scheduled to sync with accounting recruitment cycles, and not to interfere with tax season allowing working professionals to continue working.

Portland State University is accredited by the Northwest Commission on Colleges and Universities.

Texas A&M University – Commerce

Texas A&M University – Commerce offers a Tax Accounting Graduate Certificate that requires 12 credits, which can typically be completed in 1 year. Potential courses include Individual Income Tax Accounting, Advanced Income Tax Accounting, Sales, Franchise and Other Taxes, and Advanced Issues in Taxes. Credits earned in the program may be counted toward a Master of Science in Accounting.

Texas A&M University – Commerce is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

University of Cincinnati

The University of Cincinnati offers a Graduate Certificate in Taxation – Individual Tax online. There are multiple start dates and the option to choose full-time or part-time study. The 12 required credits may be transferred toward degree requirements for UC’s MS in Taxation or MBA with an Individual Taxation Concentration.

UC is accredited by the Higher Learning Commission.

University of Memphis

The University of Memphis offers a Graduate Certificate in Taxation. The program requires the completion of 12 credits of required courses, such as Tax Research and Theory, Taxation of Partnerships, and Taxation of Business Entities, and one elective. The curriculum is designed to teach a theoretical foundation with applied hands-on skills.

The University of Memphis is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

University of Minnesota

The University of Minnesota offers several online certificate programs. Options include Taxation, International Taxation, Closely-Held Business Taxation, Tax Executives, and High-Net-Worth Individual Taxation. Each of these certificates requires 12 credits, or 4 to 6 courses, and can usually be completed within 1 year. Credits earned in these programs may be applied to a Master of Business Taxation.

The University of Minnesota is accredited by the Higher Learning Commission.

University of North Carolina – Greensboro

The University of North Carolina – Greensboro offers a Graduate Certificate in Taxation that offers part-time study on campus or online. The curriculum typically includes Introduction to Business Entity Taxation along with 9 credit hours of electives. Potential electives include Advanced Business Law, Taxation of Flow-Through Business Entities, and Taxation of Corporations and Shareholders.

UNCG is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

Online Taxation Certificate Programs

There are many kinds of tax certificate programs that you can choose to take, all with their own unique focus. You can review the specialized certificates below to see which one best suits your goals.

Select the program that most interests you to jump to that section of the guide:

- General Taxation Graduate Certificates

- Corporate Taxation Graduate Certificates

- Individual Taxation Graduate Certificates

- International Taxation Graduate Certificates

You can explore these programs to see which ones best match your interests and goals.

Taxation (General)

A general taxation certificate is structured around the fundamental principles of taxation. As such, you may graduate with the ability to understand the ways in which taxation affects decisions made in the economy, how US federal income tax law functions in relation to corporations, and more.

Editorial Listing ShortCode:

To develop these skills, you’ll study subjects like corporate taxation, partnership taxation, and accounting methods. Upon receipt of your certificate, you may find yourself prepared for careers in tax preparation and tax representation. This certificate is often an asset to people who are early-career to mid-career professionals looking to advance their careers or switch careers and become tax professionals.

Corporate Taxation

A corporate taxation certificate program is designed to familiarize students with the many aspects of corporate tax. This graduate certificate program can help you become an expert in the ways in which federal income tax influences both corporations and shareholders. While taking a corporate taxation certificate program, you’ll be exposed to various subjects.

Editorial Listing ShortCode:

Some of these subjects include consolidated tax returns, international taxation, partnership taxation, and corporate tax life cycle strategies. A corporate tax certificate is beneficial for students looking to enter careers based in corporate taxation. Some of these careers may include tax preparers, accountants, auditors, financial managers, and more.

Individual Taxation

A graduate program on individual taxation, also known as high-net-worth individual taxation, is designed for students looking to gain valuable knowledge in the area of taxation as it affects high-net-worth individuals. By completing an individual taxation certificate, you’ll gain a valuable credential that testifies to your ability to understand the unique needs of these individuals.

Editorial Listing ShortCode:

During your studies, you’ll encounter many important subjects, including wealth transfer, income taxation of trusts, and compensation. Similar to the aforementioned certificates, a high-net-worth individual taxation certificate can help professionals qualify for careers like tax preparer, financial manager, personal financial advisor, and more.

International Taxation

These certificate programs teach students about various significant facets of international taxation. Holding this graduate certificate certifies your expertise in the subject, potentially increasing your chances of credibility and employment following graduation. International taxation certificate programs are comprised of a variety of topics that you’ll study.

Editorial Listing ShortCode:

Some of these subjects include US shareholders, controlled foreign corporations, previously taxed income, and more. Many graduates with this certificate go on to enter the workforce as tax consultants, tax managers, or accounting managers. Many of these graduates also find that they’re able to advance to mid-level and upper-level management roles.

Taxation Careers & Salaries

Taxation certificates may open the doors for many careers in tax preparation or finance. You might spend your time studying tax policy and procedure so that you can help an organization protect itself and understand these complex laws.

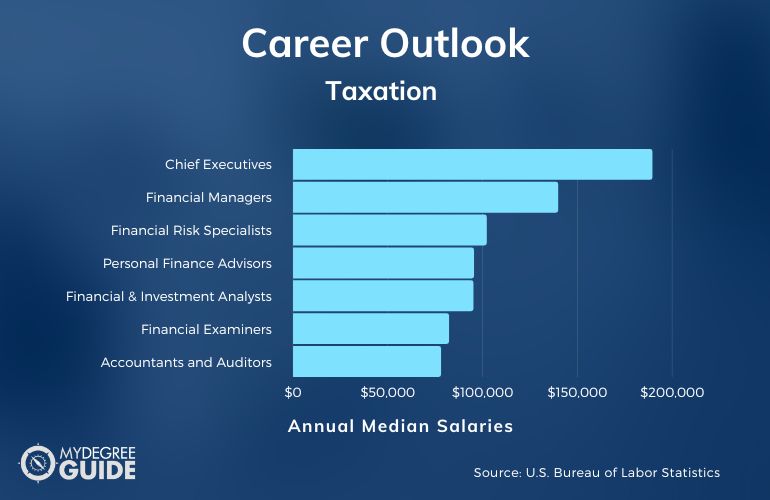

According to the Bureau of Labor Statistics, here are the median wages of careers related to taxation and finance careers.

| Careers | Annual Median Salaries |

| Chief Executives | $189,520 |

| Financial Managers | $139,790 |

| Financial Risk Specialists | $102,120 |

| Personal Finance Advisors | $95,390 |

| Financial and Investment Analysts | $95,080 |

| Financial Examiners | $82,210 |

| Accountants and Auditors | $78,000 |

| Tax Examiners and Collectors, and Revenue Agents | $57,950 |

| Tax Preparers | $48,250 |

| Bookkeeping, Accounting, and Auditing Clerks | $45,860 |

Remember that none of the above careers or salaries can be guaranteed. Many factors influence the hiring process. While holding a certificate in taxation doesn’t guarantee entry into the field, it can be very helpful in growing your marketability.

Professionals who choose to enroll in tax certificate programs may do so because they’re looking to increase their job prospects to elevate their existing careers. Completing a tax certificate online could help you grow your qualifications for senior or management roles.

Taxation Certificate Curriculum & Courses

Earning a tax certificate online means you’ll be exposed to a variety of courses that are meant to hone your expertise in various taxation principles. Here are some example courses:

- Taxation: This course provides an introduction to the basic principles of US federal income tax.

- Corporate Taxation and Financial Reporting: This course is focused on the unique tax treatment of operations, distributions, corporate formations, and more.

- Survey of Tax Topics: This course is focused on the taxation of pass-through entities and the law defining that taxation.

- International Taxation: In this course, you’ll delve into US federal income tax and how it pertains to international taxation.

- State and Local Taxation: In this course, you’ll cover various topics on local and state taxation, including sales and use tax and legal limitations to taxation.

- Federal Income Taxation: In this course, you’ll explore topics like tax determination, gross income, and individual taxation issues.

- Taxation of Corporations and Shareholders: This course will cover topics surrounding corporate tax, like transfers of property, small business, stock, and earnings.

- Partnership Taxation: This course delves into both the legal and tax topics involved in operating and then dissolving a partnership.

- Federal Tax Practice and Procedures: In this course, you’ll learn about the daily operations of the Internal Revenue Service (IRS).

- Consolidated Tax Returns: In this course, you’ll study the unique treatment of consolidated groups.

The courses you encounter will depend on the program of your choosing. For instance, some certificate programs only consist of 4 to 6 courses.

Admissions Requirements

Like any other academic program, taxation graduate certificate programs have a series of admissions requirements that students must fulfill to be considered for admission. Some common criteria include:

- Online application

- Letters of recommendation

- Resume

- Statement of purpose

- Bachelors degree and official transcripts

The above admissions criteria should only be used as a guide when applying. It’s always helpful to review the requirements of your program of choice to ensure the best chances of success.

Accreditation

Accreditation is often an asset both during your education and afterward. Essentially, accreditation is the process by which an institution is reviewed by a formal accrediting agency and deemed consistent in providing excellent education across its programs.

When you choose to attend a regionally accredited institution, you give yourself the assurance that your education is top-notch. Additionally, the status of your institution may play a role in the hiring process. Oftentimes employers favor graduates from an accredited institution because they trust their level of education. So, when applying to schools, it’s beneficial to consider a school’s accreditation status to ensure the best chances of success.

Financial Aid and Scholarships

With the cost of education on the rise, many students require outside financial aid to help them meet the cost of their education. If you require outside aid, you have several options to explore.

Many students begin by filling out the FAFSA. The FAFSA is the formal application that determines your eligibility for federal financial aid, often given out in the form of student loans. With these student loans, you’re required to begin paying back your loans following graduation.

You can also consider applying for scholarships and grants. These options are essentially free money, so long as you’re selected to receive the aid. They’re also offered on a state and national level, giving you increased chances of receiving aid.

What Can You Do with a Taxation Certificate?

Taxation graduate certificates are usually designed for students looking to expedite their education to further advance their careers. Many students are tax preparers looking to advance their careers or even attorneys or accountants looking to specialize in taxation.

Given the various backgrounds of these students, it’s very common for them to enter positions as financial managers, accountants, or tax preparers following graduation. Graduates may even stay within their current field but seek out senior-level positions. It’s also common for graduates to use their certificate as a springboard for continued education.

How Long Does It Take to Get a Graduate Certificate in Taxation Online?

Taxation certificate programs can consist of a range of courses and credit hours, depending on the school. They’re often comprised of around 4 to 6 courses. Because of the accelerated nature of these programs, students can usually complete a graduate certificate program online between 6 months and 1 year.

Of course, several factors may influence the duration of your program, with the primary factor being whether or not you intend to take the program full-time or part-time. Some programs, though, are designed to be taken part-time over the course of 1 year.

Is a Certificate in Taxation Worth It?

Yes, a certificate in taxation is worth it for many students. Companies of all kinds require the expertise that tax professionals possess. With talented and knowledgeable tax professionals on board, companies can better protect themselves from as well as abide by modern tax laws.

According to the Bureau of Labor Statistics, employment for accountants and auditors is expected to grow 6% over the next ten years, which is as fast as the average for all occupations. With a taxation graduate certificate, you can grow your skills and qualifications in this specialized field.

Getting Your Taxation Certificate Online

Taxation certificates are beneficial academic programs for professionals with existing work experience or for students with a bachelor’s looking to increase their career prospects.

A graduate certificate in taxation can help open the doors to advanced roles or continued education. Earning a taxation certificate online gives you the opportunity to develop your expertise in a specific area of taxation, all while studying from the comfort of your own home. As opposed to a graduate degree, graduate certificates grant you more flexibility, affordability, and time.

If you think a taxation certificate is right for you, you could start researching available programs from accredited universities today!