Wondering what you can do with an accounting degree? Curious to find out if accounting is a good major?

With a projected job growth rate of 4% (Bureau of Labor Statistics), and the ability to specialize in many areas of accounting, earning an accounting online degree can help you position yourself for a wide-range of positions.

Editorial Listing ShortCode:

There are also many opportunities for graduates to work in non-accounting jobs.

What Can You Do with an Accounting Degree Once You Graduate?

Upon graduation, you may choose to attend graduate school and earn a master’s degree or doctorate degree, or you may choose to enter the workforce and apply to various jobs. This decision depends on your career goals, educational goals, and personal interests.

If you decide to further your education, there are many colleges and universities throughout the world offering a Master’s in Accounting. With this degree, you may learn advanced knowledge and skills in accounting, theories, and practice. Most students that earn a master’s degree are also able to choose a specialization to focus on in the accounting field.

Additionally, doctorate programs are becoming more common and are a good way to stand out among other job applicants.

The two doctoral degree programs in accounting are the Doctor of Business (DBA) Administration and a PhD. The DBA is centered around leadership and using your accounting education in an administrative setting, whereas the PhD is typically for individuals interested in teaching accounting in colleges or who want to work in a research setting.

What to Do with an Accounting Degree Now?

There are many different types of organizations in various industries that may employ a person with a bachelor’s in accounting. All kinds of businesses need accounting experts to prepare and assess their financial records; they ensure that the company’s financial records are correct and that their taxes are accurately and promptly paid.

The following list provides examples of different industries that accountants may work in:

- Accounting, Tax Preparation, Bookkeeping, and Payroll

- Architecture and Engineering Companies

- Colleges and Universities

- Computer Services

- Employment Services

- Executive, Legislative, and other Government Agencies

- Financial Investment Companies

- Hospitals

- Insurance Companies

- Pharmaceutical Companies

- Real Estate Agencies

- Scientific Research Companies

- Software Companies

- Travel Accommodation Companies

Accountants are needed in almost all industries to help businesses run smoothly. This means that you may have a lot of diverse career options throughout the country upon graduation. When completing job applications, make sure that you choose organizations in industries fitting your objectives.

Accounting Degree Jobs Outlook

The outlook for accounting degree jobs is very good. The job field is expected to grow at least 4% over the next decade. The field of accounting is connected to the economy, so if the economy continues to improve and grow, more accountants will be needed to help companies and businesses analyze and prepare their financial records.

There are a few reasons why the accounting profession is growing, which are more IPO’s, globalization, and technological advancement.

When a company becomes public, their need for financial assessment grows tremendously. Also, if businesses go international, this means that they must follow several tax codes. In addition, even with technology continuing to advance, accounting skills are needed to analyze and advise automation processes.

Accounting expertise is needed across the world; it is not a field that can only be found in one location. However, the states with the most job growth in the accounting field are California, Texas, Pennsylvania, Florida, and New York.

These are great states to look at for accounting jobs, but it is not required. Strong skills in accounting are in high demand almost everywhere.

Accounting Careers & Salaries

A bachelor’s degree in accounting is often considered one of the best degrees to invest in, and it is known to be one of the degrees that may lead to a rewarding career and salary. If you are wondering what you may be able to do with an accounting degree, there are many different opportunities depending on your interests and goals.

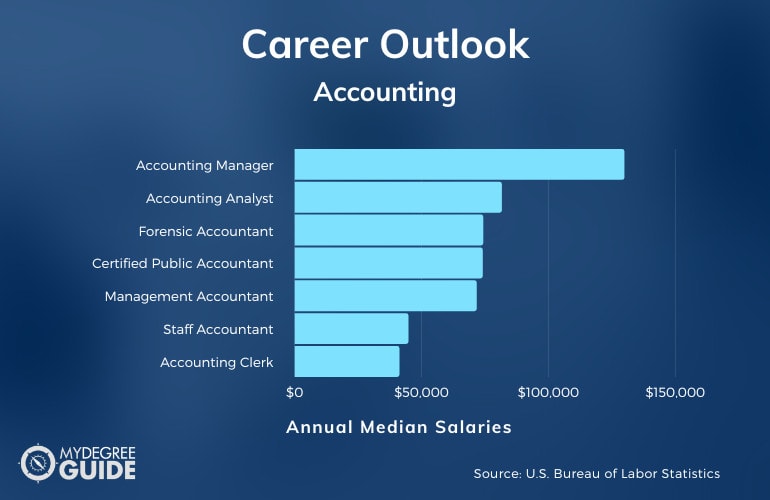

According to the Bureau of Labor Statistics, common careers in the accounting field that students may choose after graduation include:

- Accounting Manager – this career path is focused on creating and implementing systems that collect, analyze, and report financial information. An accounting manager makes an average salary of $129,890.

- Forensic Accountant – the primary duties of a forensic accountant include detecting fraud, investigating and analyzing financial information, looking at evidence, and assisting with court hearings. A forensic accountant makes an average yearly salary of $74,260.

- Certified Public Accountant – this career path is centered around reviewing and assessing finances, taxes, and audits. Each year, a certified public accountant makes an average income of $74,060.

- Management Accountant – the main responsibility of a management accountant is providing financial information to help companies make important financial decisions. A management accountant makes an average annual salary of $71,680.

- Accounting Analyst – this career path is dedicated to analyzing financial data for companies. The average annual salary that an accounting analyst makes is $81,590.

- Staff Accountant:– an individual that chooses to become a staff accountant may be performing a variety of duties, such as budgeting, auditing software programs, typing and analyzing reports for companies, and more. Yearly, a staff accountant makes an average income of $44,770.

- Accounting Clerk – this is a career path for individuals interested in working with ledger accounts, resolving customer issues, and helping vendors. The average yearly salary that an accounting clerk makes is around $41,230.

As you can see, there are many different types of accountants. One of the best parts of entering into the field of accounting is that it typically provides stability.

Businesses, organizations, and companies will most likely always need help with their finances and taxes. Any one of these career paths has the potential for a steady income and a rewarding career.

Non-Accounting Jobs with Accounting Degree

If you are earning or planning to pursue an education in accounting and do not want to become an accountant, there are numerous of other careers for accounting majors.

An accounting degree is still essential in teaching how to manage money, budgeting, and conducting financial planning. These are great skills that may help you with any career in the financial sector.

Here are some examples of alternative career paths, according to the Bureau of Labor Statistics, that an individual with an accounting degree may pursue.

- Chief Financial Officer -individuals with this important job title manage the financial operations of companies and oversee the efficiency of the accounting and finance departments. The average annual salary a chief financial officer makes is $184,460.

- Financial Manager – this is a very important role in various companies; the financial manager helps determine the weaknesses and risks of a company’s finances and develops recommendations to avoid them. The average yearly salary a financial manager makes is $129,890.

- Actuary – this career path is responsible for determining if a company should issue an insurance policy to someone and how much the premium should be. The annual income that an actuary typically makes is $108,350.

- Personal Financial Advisor – this career path is centered around helping individual clients with their financial goals, educational goals, retirement plans, and more. Personal financial advisors make an average annual income of $87,850.

- Financial Analyst – this career path focuses on analyzing marketplace trends, demographics, and other important factors to assist companies in making good investments. Financial analysts make an average annual salary of $81,590.

- Financial Examiner – individuals interested in this career path are responsible for reviewing the activities of companies and ensuring that they are complying with the rules and regulations. Financial examiners make an average salary each year of $81,090.

- Budget Analyst – this can be a wonderful career option for those interested in looking at a company’s money and budget information and determining the most effective allocation of funds throughout the company. Yearly, a budget analyst’s average salary is $76,540.

- Business Consultant – organization is the key element of the business consultant career path; these individuals organize businesses to increase more effective performance. Annually, a business consultant makes an average salary of $73,570.

- Auditor – this is an important career path that examines company records and makes sure they are accurate. Each year, auditors make an average income of $71,550.

- Cost Estimator – individuals pursuing a career as a cost estimator are dedicated to helping companies determine the estimation of how much production may cost for various products. The average annual salary of a cost estimator is $65,250.

Accounting degrees typically provide a foundation of business knowledge as well as financial rules and regulations.

In addition, you may gain skills in analytical thinking, critical thinking, and communication to help prepare you for all types of jobs for accounting majors, whether it be financial planning, business consulting, managing budgets, or analyzing data.

What’s the Difference Between Finance and Accounting?

The main difference between finance and accounting is that an accountant’s duties are typically centered around the daily flow of money that comes in and out of the business, and an individual in finance is usually responsible for managing the assets and liabilities as well as coming up with strategies for future growth.

What Can I Do with an Accounting Degree?

There are so many different career paths you may pursue with an accounting degree. Some graduates may choose to become a type of accountant for a company, whereas other graduates may choose to hold a different title and focus on other duties for companies. This is up to you and your career goals.

Regardless, expertise in this field is highly needed by a variety of different businesses.

What Can I Do with an Accounting Degree Besides Accounting?

If you do not want to become any sort of accountant after graduation, there are plenty of other options. For example, you may choose to become a cost estimator, anti-money laundering officer, personal financial advisor, or a budget analyst.

An accounting program can help prepare you for many different careers, especially if you are interested in managing money, budgeting, and helping companies plan their finances.

There are a wide range of opportunities in various industries for individuals possessing these interests and the skills that an accounting degree teaches, such as problem-solving, analytical and critical thinking, and effective communication.

What Jobs Can You Get with an Accounting Degree?

With an accounting degree, you may have several career options to choose from. The majority of graduates pursue a career as a type of accountant, such as an accounting manager, forensic accountant, management accountant, staff accountant, or an accounting clerk.

However, some graduates may prefer to begin a career in a different field besides accounting. The alternative jobs you can get with an accounting degree are business and financial consultant, chief financial officer, financial analyst, and more.

Do Accountants Get Paid Well?

Yes, accountants do tend to get paid well. According to the Bureau of Labor Statistics, the average annual accounting degree jobs salary is $71,000.

An accountant performs various duties, such as financial reporting, taxes, auditing, and more. Therefore, jobs are usually well-paid to match the accountant’s responsibilities.

As a point of comparison, let’s look at accounting vs. computer science as a college major. On the low end, computer science majors make an average of $53,000 annually.

Getting Your Accounting Degree Online

Yes, a bachelor’s degree in accounting is worth it for many students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years. Common careers in this field include accounting manager, management accountant, financial examiner, and auditor.

It is suitable for individuals who plan to pursue a lifelong career examining businesses and companies’ financial reports and tax information.

Before applying to college and university programs, it is extremely important to make sure that your education aligns with your interests and career goals.

This degree can help you learn the necessary skills to thrive in the field of accounting, such as how to communicate effectively, analyze data, solve problems, and think critically. These skills may also help you stand out to employers among other applicants.

Begin applying to bachelor’s degree programs for accounting to prepare for your accounting career, whether as an accountant or an alternative career in the field.