Explore Online Masters in Taxation for 2024. Compare schools with no GMAT required & accelerated courses available.

Although the tax code baffles many people, it’s fascinating to you, so study it in-depth during a master’s in taxation program. It can help you become an expert who is prepared for leadership roles in revenue agencies or accounting departments.

To start your taxation graduate studies soon, enroll in an online, no-GMAT school.

Editorial Listing ShortCode:

List of Universities with Masters in Taxation Online No GMAT Programs

Methodology: These schools all maintain proper accreditation and offer online master’s programs in the field of taxation with no GMAT requirement or offer GMAT waivers.

1. Bentley University

Located in Waltham, Massachusetts, Bentley University is a private institution that was originally founded as the Bentley School of Accounting and Finance. They date back to 1917 when they were founded by Harry C. Bentley.

Although originally located in Boston’s Black Bay and completely devoted to financial sciences, they now offer degrees in sciences, liberal arts, and administration alike.

Their current campus encompasses 163 acres of suburban property, which includes a recently refurbished library, over a dozen academic buildings, student hall residences, an athletic center, and the multi-purpose arena.

Some of its more important alumni include members of the House of Representatives and Fortune 500 CEOs.

- Masters in Taxation

Bentley is accredited by the New England Association of Schools and Colleges Inc., indicating that it meets or exceeds established standards, as determined by a periodic peer group review.

2. DePaul University

DePaul University is located in Chicago, and it is a private institution affiliated with the Vincentian order of the Catholic Church. They were founded by the order in 1898 and named after St Vincent de Paul, one of 17th-century France’s most prominent religious personalities.

They have kept highly committed to their ideals of inclusion and outreach and run many scholarship programs to recruit and support first-generation college graduates.

They currently have a student body of approximately 15,000 undergraduates and several thousand postgraduate students and candidates. They are also one of the Big East Universities of the NCAA Division I thanks to the success of their Blue Demons.

- Masters in Taxation

DePaul is accredited by The Higher Learning Commission.

3. Florida Atlantic University

Sometimes known as FAU, Florida Atlantic University is located in Boca Raton, just south of Palm Beach. This sunny setting serves as the backdrop for this relatively new public university and its 850-acre urban campus. They were established in 1961 to serve as a postgraduate institution, although they now offer both undergraduate and postgraduate degrees.

They serve approximately 30,000 students and employ over 1,500 faculty members. They enjoy the benefits of participating in FAU’s high research activity and the use of their massive stadium, which houses Florida’s Atlantic Division I program.

- Masters in Taxation

FAU is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

4. Florida Gulf Coast University

Florida Gulf Coast University is a part of the State University System of Florida and is located in Fort Myers. This public University is sometimes also known as “Florida Gulf” or FGCU. Although it is one of the newest universities in its system (it was established in 1991), it already possesses a space grant and serves over 15,000 students.

Their suburban campus encompasses over 800 acres, which includes the massive Swanson Stadium and several residence halls that overlook picturesque lakes. In addition, students who choose on-campus housing can also enjoy a volleyball court and private beach entry.

- MBA – Accounting/Taxation

FGCU is accredited by the Southern Association of Colleges and Schools Commission on Colleges (SACSCOC).

5. Golden Gate University

Golden Gate University, located in San Francisco, California, is a private non-sectarian university. They were originally founded in 1901 by the Young Men’s Christian Association and were originally named YMCA Evening College.

Their first goal was to offer continuing education opportunities for local YMCA members. Nowadays, they are still run as a non-profit and serve over 5,300 students.

Their urban campus is located at the heart of San Francisco’s Financial District. However, they also have satellite campuses in Silicon Valley and Los Angeles. In addition, they also have an “online campus” that offers opportunities for distance learning.

- Masters in Accounting – Taxation

- Masters in Taxation

GGU has been accredited on an institution-wide basis by the Western Association of Schools and Colleges (WASC) since 1959.

6. Liberty University

Liberty University was established in 1971 as a private Evangelical Institution. They are based in Lynchburg, Virginia and were formerly known as Lynchburg Baptist College.

Their suburban campus encompasses over 7,000 acres of parks, fields, academic buildings, and the Liberty Center for Music and Worship, where the Miss Virginia beauty pageant is usually held.

Although the university currently has nearly 90,000 students enrolled, their Lynchburg campus only serves approximately 15,000 of them. The rest are enrolled in their satellite campuses or attend their long-distance online programs.

- Masters in Accounting – Taxation

Liberty is accredited by the Southern Association of Colleges and Schools Commission on Colleges.

7. New York University

The highly renowned “NYU” has been one of the leading educational facilities in the East Coast for decades. This private university’s motto is “to persevere and to excel” and many of its alumni have gone on to do exactly that.

They were founded in 1831 in Greenwich Village, Manhattan, where their historical buildings are still located. They currently have over 51,000 students, both at their main campus and their international academic centers (which span from Washington D.C to Shanghai).

- MSL – Taxation

NYU is regionally accredited by the Middle States Commission on Higher Education.

8. Northeastern University

Northeastern University was established in 1898 as is located in Boston, Massachusetts. It features a cooperative education program that integrates classroom study with professional experience with over 3,100 partners across the globe.

This program is a key feature in the university’s curriculum which focuses on experiential learning. This unique approach to learning sets the university apart. Experience is at the heart of everything they do.

The university has an inclusive and diverse multicultural community which seeks to strengthen students around the world and to harness the power of diversity.

- Masters in Taxation

Northeastern is regionally accredited by the New England Association of Schools and Colleges, Inc.

9. Nova Southeastern University

Founded on a WWII naval airfield in 1964, this private university based in Davie, Florida has over 20,000 students on a 480-acre campus. It is close to Fort Lauderdale and participates in a wide array of sports in the NCAA Division II under the moniker “Sharks.”

This is a high-research institution that also values student life and athletics. One of its most notable alumni is professional baseball player. J. D. Martinez.

- Master of Accounting in Taxation

NSU is accredited by the Southern Association of Colleges and Schools Commission on Colleges (SACSCOC).

10. Portland State University

Portland University is the very enviable position of being one of the most established public universities in one of the U.S.’s most fashionable cities.

Originally founded as an Educational Extension Center in 1946, the university’s student body and prestige has grown exponentially over the past two decades. This is partly because they are the only public university in Oregon that enjoys the connectivity of an urban campus.

They now serve approximately 28,000 students, most of them undergraduates. They get to enjoy an active Greek life scene and participation in one of their 15 varsity teams.

- Masters in Taxation

PSU is accredited by the Northwest Commission on Colleges and Universities (NWCCU).

11. Southern New Hampshire University

SNHU, located between the cities of Hookset and Manchester, New Hampshire, is a privately run university with an open enrollment model. All you need to have is a high school diploma or GED to be admitted.

This has allowed the school to grow quickly, now serving over 90,000 students. About 20,000 of them are postgraduates, and many of them take classes online.

This university was founded in 1932 and was ranked as the #1 Most Innovative College by US News & World Report.

- Masters in Accounting – Taxation

SNHU is accredited by the New England Commission of Higher Education (NECHE).

12. St. John’s University

St John’s University is a private institution located in New York City. They were originally founded in 1870 by a Vincentian Congregation and remain affiliated with the Roman Catholic Church. Their approximately 21,000 students can enjoy a campus in Queens and satellite facilities in Staten Island and in Rome (Italy).

They maintain active international programs that offer the opportunity to spend semesters abroad in France and Ireland. This university enjoys a well-connected location that is close to many MTA stations, in addition to a very active Greek Life scene and several student-run newspapers and newsletters.

- Masters in Taxation

SJU is accredited by the Middle States Commission on Higher Education.

13. University of Akron

Located in Akron, Ohio, the University of Akron is a public university and part of the University System of Ohio. It was originally founded in 1870 as Buchtel College by the Universalist Church, although now they are completely non-denominational.

The University keeps a strong focus on STEM fields and research, although they have programs across a variety of fields.

They have approximately 16,000 students, almost all of them undergraduates. They also employ over 1,500 people as part of their academic staff. Their urban campus includes classroom halls, residences, and the InfoCisium Stadium.

- Masters in Taxation

UA is accredited by the Higher Learning Commission.

14. University of Baltimore

Established in 1925, the University of Baltimore is a public university and one of the flagships of the University System of Maryland. They were originally meant to be a junior college offering vocational training and received funding from several Baltimore businessmen for this purpose.

They became an “upper-division academic institution” in 1971 and a full-fledged university in 1988. They now serve approximately 3,000 undergraduates and 1,800 postgraduate students. They enjoy access to both on-campus and off-campus housing and a recently-refurbished Wellness Center.

- Masters in Taxation

UB is officially accredited by the Middle States Commission on Higher Education.

15. University of Cincinnati

Located in Cincinnati, Ohio, the University of Cincinnati is a public research university with over 37,000 students. They were originally established in 1819 as the Medical College of Ohio. They were subsequently expanded to include a Law School and then a more diverse catalog of programs in 1819.

They now have a main campus (often referred to as the Uptown Campus) and two regional satellite campuses located in Blue Ash and Batavia. Their medical school is technically a part of their Uptown Campus, often referred to as “West Campus.”

- Masters in Taxation

- MBA – Corporate Taxation

- MBA – Individual Taxation

The University of Cincinnati and all regional campuses are accredited by the Higher Learning Commission (HLC).

16. University of Denver

The University of Denver is a private university located in Denver and established in 1864. This makes them the oldest private university in the Rocky Mountains.

Originally, they were founded by a Methodist congregation. Although they are now non-sectarian, they have kept their original motto of “For Science and Religion.”

Their main campus spans over 125 acres and is located in a residential section of Denver. In it, all class buildings and residence halls are set in between a massive arboretum that contains many rare species.

They currently have a bit over 11,000 students, evenly distributed between undergraduates and postgraduates.

- Masters in Taxation

DU is regionally accredited by the Higher Learning Commission (HLC) of the North Central Association.

17. University of Hartford

The University of Hartford is located in West Hartford, Connecticut. This is a private institution founded in 1957 after merging an Art School, a Nursing School, and a liberal arts college together.

They now have over 6,700 students, most of them undergraduates. Their suburban campus is well connected through public transport and includes several residence halls and a student-oriented community center known as the Village Lawn.

Their adjacent magnet school offers advanced placement classes in science and engineering for Hartford teenagers.

- Masters in Accounting and Taxation

Last reaffirmed in May 2012, the University of Hartford is regionally accredited by the Commission on Institutions of Higher Education (CIHE) for the New England Association of Schools and Colleges (NEASC).

18. University of Minnesota

Although their full name is “University of Minnesota Twin Cities,” they are most commonly known as U of M. They are a public institution and possess both a land grant and a space grant. This is why it is now also the flagship university of its state’s university system.

They were established in 1851 and now serve approximately 47,000 students. They have been ranked as a “high research activity” center and are publicly recognized as one of the “Public Ivy” institutions. Their alumni include 26 Nobel laureate and 3 Pulitzer Prize winners (Wikipedia).

- Masters in Business Taxation

The five UMN campuses are accredited separately at the institutional level by the Higher Learning Commission of the North Central Association of Colleges and Schools.

19. University of Southern California

The Marshall School of Business is a private university located in Los Angeles, California. They are a part of the University of Southern California Private system. They received their name following a major donation by alumnus Gordon S. Marshall.

They currently serve over 5,000 students and employ 181 faculty members. Their facilities are all located within the larger Los Angeles campus of the University of Southern California, although they are spread across five different buildings within it. The main one is known as Popovich Hall and houses most of their Master’s level lectures.

- Masters in Business Taxation for Working Professionals

USC has been accredited by the Western Association of Schools and Colleges (WASC) since March 6, 1949.

20. Villanova University

Villanova University, located in Radnor Township, Pennsylvania, is a private Catholic University established by an Augustinian Congregation.

They date back to 1842 when originally named the Augustinian College of Villanova. It is the oldest Catholic tertiary education facility in the State of Pennsylvania.

The school keeps strong ties to the congregation, and it makes up a major part of their identity. They now have approximately 10,000 students and place a strong emphasis on student-led charitable organizations.

- Masters in Taxation

Villanova is accredited by the Middle States Commission on Higher Education.

What Kind of Taxation Degree Should You Get?

Graduate studies in taxation can come in a few different forms.

- Masters in Accounting with a Concentration in Taxation: This program may provide a broad overview of many accounting topics and include a few taxation-focused electives.

- Master of Laws with a Concentration in Taxation: This program is for students who already have a law degree and want increased knowledge about tax laws.

- Master of Taxation: This degree program focuses primarily on taxation and goes into great depth on the topic.

The more general accounting classes you take, the more prepared for the CPA exam you may be.

Taxation Curriculum

Each school’s approach to taxation curriculum can vary somewhat, but you’re sure to take many classes directly related to tax procedures and regulations.

The following class examples can give you an idea of the type of coursework you can expect from your master’s program.

- Accounting Ethics: You can discuss real-world taxation situations in which ethical decisions must be made.

- Advanced Auditing Principles: This class goes beyond the basics of auditing and covers potential complications.

- Estate Taxation: You can learn about property transfers and gift planning.

You may also need to complete a practicum and assemble a portfolio.

What Jobs Can You Get with a Masters in Taxation?

Not surprisingly, when you have a master’s degree in taxation, you’re likely to hold a job in which you deal with taxes on a daily basis. You could prepare taxes for individuals, provide federal tax guidance for corporations, or work for a government revenue service. Here are some of the jobs you may be able to obtain with your degree:

- Auditor: As an auditor, you might comb through tax statements to ensure that everything is in order. Auditors can work for revenue departments, corporations, or law enforcement agencies.

- Senior Tax Accountant: With a master’s degree, you may be able to advance into this managerial role, in which you’ll supervise lower-level tax accountants and oversee the activities in a tax accounting department.

- Tax Analyst: You could work for businesses or wealthy people to ensure that their taxes are in order. Your responsibilities might include filing government paperwork and researching applicable laws.

- Tax Consultant: As a consultant, you can expect to help businesses or individuals minimize their tax liabilities and file their taxes properly.

- Tax Director: To head up a company’s tax department, look for a job as a tax director. You’ll be in charge of overseeing payroll taxes, income taxes, and other tax-related tasks.

- Tax Examiner: As a government employee, you’ll go through tax documents to make sure that people and businesses have submitted the correct amount of money.

- Tax Manager: In this position, you’ll take care of handling a company’s tax issues, such as tax preparation and legal compliance. You could work directly for the company or hold a consultancy position.

- Tax Preparer: This career involves getting income tax returns ready to file with the government. Your main clients may be individuals, but you can do this job for businesses as well.

Whether you hold CPA credentials may play a large role in the types of jobs for which you are qualified. Although not all tax pros pursue becoming a CPA, taking the required classes and passing the examination can increase the number of positions that are available to you.

How Much Money Do People Make with a Master’s Degree in Taxation?

Earning a master’s degree can increase your salary potential. Some lucrative jobs, such as tax accountant and financial specialist, may be more likely to go to people with master’s degrees. Getting your CPA credentials can help you land good-paying positions as well.

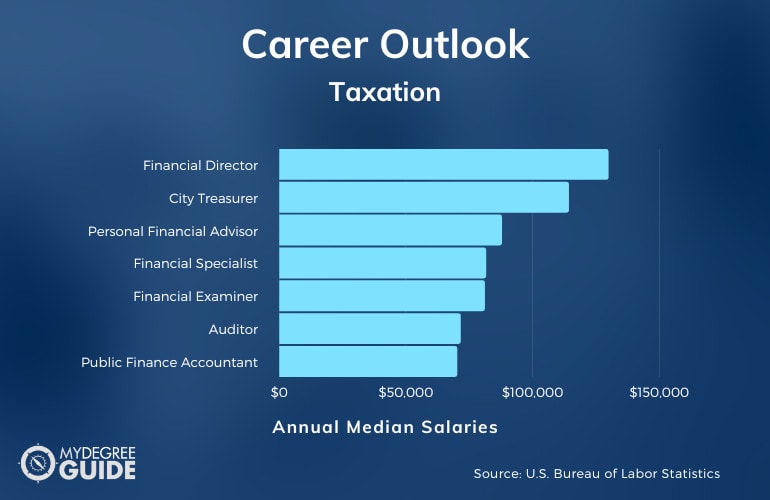

According to the Bureau of Labor Statistics, some careers in the taxation field include:

| Careers | Annual Median Salaries |

| Financial Director | $129,890 |

| City Treasurer | $114,250 |

| Personal Financial Advisor | $87,850 |

| Financial Specialist | $81,590 |

| Financial Examiner | $81,090 |

| Auditor | $71,550 |

| Public Finance Accountant | $70,180 |

| Corporate Tax Preparer | $62,030 |

| Tax Examiner | $54,890 |

| Tax Preparer | $43,080 |

Salaries around the country can vary a great deal. For example, tax preparers in Abilene, Texas may earn about $50,000 more per year than those in nonmetropolitan areas of central Kentucky.

Your level of experience factors into your pay level as well. On average, a tax examiner makes about $54,890 per year. After accumulating 10 to 19 years of experience in that position, the annual salary may jump to about $101,780.

Certifications and Licenses for Master’s in Taxation

A master’s degree on its own provides sufficient credentials for many jobs, but you can be even more qualified if you pursue industry certifications.

Certified public accountants (CPA) are highly valued among employers. Certification requirements vary among states, but you can expect to need 120 to 150 relevant college credit hours.

After getting the necessary hours and meeting other state requirements, you can sit for the Uniform CPA Examination. Depending on your school’s curriculum and your state’s regulations, you may need to take additional classes between graduation and the exam.

Other certifications to consider include:

- Certificate in Employee Benefits Law: If your position as a tax manager or director requires you to deal with payroll and benefits packages, consider enrolling in a 4.5-day seminar to earn this certificate.

- Certified Estate Planner/Master Certified Estate Planner: As a CEP or an MCEP, you can expertly help people prepare for their passing. To qualify, you must complete a series of online sessions and self-study materials.

Certifications demonstrate your commitment to professional excellence.

Professional Organizations

Staying current on industry developments may seem easy while you’re in school, but after graduation, you’ll have to take the lead in making sure that you’re aware of what’s going on in the world of taxation.

Joining a professional organization can be one of the best ways to stay in the know, and you can go ahead and sign up while you’re still in school.

- American Accounting Association: AAA focuses on research, education, and other academic aspects of the accounting field.

- National Association of Black Accountants: NABA encourages black students to enter accounting programs and helps black accounting professionals advance their careers.

- National Association of Tax Professionals: NATP offers resources to support tax preparers and other tax professionals.

Membership may provide opportunities to attend national conferences or regional meetings. You may also receive access to articles, publications, and educational programs.

Applying to a Masters in Taxation Online No GMAT Programs

What does it take to get into a taxation program? First of all, you’re going to need to submit a packet of paperwork as required by your school. It may contain:

- Transcripts

- Letters of recommendation

- Personal statement

You can often enroll in a master’s in taxation program straight out of college — no professional experience required. A bachelor’s degree is essential, though. It’s best if your major was accounting or another business discipline; otherwise, you may need to complete some prerequisite classes first.

Although accredited no-GMAT finance programs do exist, your school may ask for test scores. If so, see if you can qualify for a waiver based on your GPA score or professional experience.

Before submitting an application packet to an out-of-state school, double-check that the curriculum meets your state’s standards. This is especially important if you plan to pursue CPA credentialing.

Accreditation

How do you know whether your school is a good one? Accreditation is the key!

National accreditation has some value, but regional accreditation is the top type to look for. To qualify for regional accreditation, schools must undergo a rigorous evaluation process, so you know that you’ll be getting a high-quality education.

For a master’s in taxation, you may also want to look for programs that hold programmatic accreditation from the Association to Advance Collegiate Schools of Business (AACSB).

This organization partnered with the National Association of State Boards of Accountancy (NASBA) to establish their educational standards.

How Can You Finance Your Online Masters in Taxation Degree?

Submit the Free Application for Federal Student Aid (FAFSA) to learn whether you qualify for government grants or loans. Your state might offer similar programs.

Other funding sources include scholarships, fellowships, and school payment plans. With the right job after graduation, you might be able to take advantage of the federal Public Service Loan Forgiveness Program.

Why Earn Your Master’s in Taxation Online?

Accredited online programs, such as an online bachelors in taxation or an online masters in taxation, meet the same standards as campus-based programs, but they don’t require you to make daily drives to campus or move to a new city.

Through your online studies, you can learn to keep up to date on taxation practices, and you can become an expert at putting your accounting knowledge to work in real-life situations.

What Can You Do with a Master’s Degree in Taxation?

In nearly every tax-related job, you can find ways to apply your graduate education in taxation. Your studies might help you move into supervisory positions or become credentialed as a CPA.

After graduation, you might qualify for job titles like tax director, tax manager, tax accountant, auditor, or certified public accountant.

Why Become a Tax Advisor?

Also known as tax consultants, tax advisors are professionals who provide tax advice and services to individuals or businesses.

The number of positions for financial advisors, such as tax advisors, is currently growing, so your skills will be in demand if you choose this career path.

If you enjoy helping people take care of complicated financial matters that they might not be able to handle on their own, this job could be a great fit for you.

Why Become a Taxation Specialist?

Tax codes aren’t easy for people without specialized training to understand. As a taxation specialist, you’ll be expected to have the expertise to conduct taxation research, explain tax laws, and help businesses and individuals pay accurate taxes.

Because this is such a valuable service, you may be able to command an annual salary of around $76,850 to $101,780 as a senior tax examiner (Bureau of Labor Statistics).

How Long Does It Take to Get an Online Master’s in Taxation?

It usually takes about 36 credit hours to complete an online master’s in taxation program. Full-time students can usually accomplish this in around 24 months.

If you select a college with accelerated online classes, you may be able to finish your program in just 15 or 16 months.

Is a Master’s Degree in Taxation Worth It?

Yes, a masters degree in taxation is worth it for many students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years. Common careers in this field include financial specialist, city treasurer, and tax examiner.

If your sights are set on taxation as a career, then a master’s degree in taxation could be exactly the right program for you. Your studies will allow you to explore the topic of taxation at great length.

You can go into more detail on the topic than students in general accounting programs have a chance to do. The courses cover state, federal, and international taxes for businesses and individuals.

This degree can help you get a job with a revenue department or the financial department of a corporation. You could also provide advisory services in tax courts or investigative departments.

Keep in mind that not all master’s in taxation programs will fully prepare you for the certified public accountant exam, so you may need to complete additional studies first. For becoming a CPA, a master’s in accounting program is an alternative option to consider.

Related Guides: