What can you do with a master’s in finance degree? Earning this degree can open up many job opportunities for you, and those positions may come with higher paychecks.

Editorial Listing ShortCode:

Professionals with a master’s degree in finance typically earn between $63,000 and $134,000 per year (Bureau of Labor Statistics), depending on their position and level of seniority.

Why Choose a Master’s in Finance?

You may already have a traditional or online bachelor’s degree in finance, business, or another related field. You may even have a job in the area. Do you really need another degree? It turns out that there are many good reasons to pursue a Master’s degree in Finance.

Getting a master’s degree can give you the opportunity to increase your knowledge. During graduate school, you can spend a year or more on the in-depth study of a field.

That knowledge may have many practical applications. By increasing your education, you may qualify for jobs that weren’t previously open to you. Alternatively, your company may give you greater responsibilities and allow you to supervisor junior employees.

New positions often include higher pay. According to the Bureau of Labor Statistics, financial managers with a graduate degree enjoy on average a premium of $32,000 per year over those with a bachelor’s degree.

Having a master’s degree may also qualify you for certification programs. Earning these credentials can help to improve your respectability among employers and clients, which may lead to career and salary advancement.

Masters in Finance vs MBA

Graduate degrees in finance come in a few different forms. You could pursue a Master of Finance degree or get a Master of Business Administration in Finance. Which you choose may depend on your interests and your career goals.

Master of Finance programs typically focus on finance from beginning to end. Your classes may address topics like investments, banking, retirement planning, venture capital, and market regulation. You may also take financial math classes.

Getting a Master of Finance is usually a 12- to 18-month program and often requires full-time enrollment. You may not need professional experience to get in, so you might be able to go straight from undergraduate school to this master’s program.

At its heart, an MBA in finance is a general business program with a finance specialization. That means that you’ll probably take a business core that includes classes on accounting, marketing, organizational leadership, and other business topics.

You’ll also probably take three or four finance-specific courses that cover investments, risk management, and corporate finance.

An MBA program sometimes takes longer than obtaining a Master of Finance. This varies from school to school, but some MBA degrees take 18 months to 3 years of full-time enrollment.

MBA programs often require professional experience, so this is a program to consider after you’ve been out of school for a while. If you can’t commit to taking a few years off work, part-time enrollment may be an option.

Job possibilities for these two degrees are relatively interchangeable. If you know you want to continue advancing into higher and higher finance positions, then the narrow focus of a Master of Finance might be for you.

But if the idea of being able to take varied business positions appeals to you, then an MBA in finance might be just what you need.

Masters in Finance Jobs

Having a master’s in finance can demonstrate to employers that you know a lot more about financial topics than the average person. Your skills and knowledge may make you a trustworthy candidate for handling other people’s money.

A master’s program can also help you learn about leadership and management. As a result, employers may be willing to entrust you with heading up finance teams. This can help you rise to supervisory positions within a finance department or a company at large.

Many finance positions are in corporate settings. You might be a budget analyst, a compensation specialist, an accountant, or an internal auditor. With education and experience, you might become a financial manager or even the chief financial officer.

Such opportunities are available in a variety of sectors. You might work for a manufacturer, a retailer, a transportation company, a healthcare organization, or another business.

Nonprofits have similar staffing needs for their financial departments, so you might also find work with charitable organizations, school districts, or faith-based groups.

The banking and insurance industries rely on financial experts. Positions in this sector for a Master of Finance include financial analysts and credit analysts. You might also be a loan officer or an insurance underwriter.

If you want to work with securities and other financial services, you might be a broker, an investment banker, or a financial services sales agent.

Government agencies also hire finance professionals. You might provide accounting or related services for a department at the municipal, state, or federal level.

The government also needs people to make sure that revenue is collected and laws are followed. To fill those roles, you might be an external auditor, a financial examiner, a tax collector, or a tax examiner.

Personal finance is another career option to consider. As a personal financial advisor or a wealth manager, you might help people plan for their futures with reliable retirement accounts, college savings plans, or stock portfolios.

You might also take responsibility for helping people with their taxes.

How Much Money Can You Make with a Masters in Finance?

Financial experts play a critical role in organizations, so many companies reward their top people handsomely. The top 10% of financial analysts earn over $159,560 annually.

Some financial managers, chief financial officers, and other senior executives make more than $208,000 each year (Bureau of Labor Statistics).

Of course, those aren’t roles that you can fall into overnight. It takes hard work and dedication to rise to a position of high financial leadership. Earning a bachelor’s degree in finance can help you get entry-level or middle-management roles.

To rise to more senior positions, it may be a good idea to get a Master of Finance or an MBA in finance. Studying for this degree can help you increase your financial knowledge and prepare for leadership roles.

You should next consider obtaining certifications that are specific to your area of interest. For example, if you want to be among the best financial analysts, consider becoming a chartered financial analyst.

Other certifications to consider as a financial professional include chartered financial consultant, certified financial planner, and chartered mutual fund counselor.

After becoming credentialed, you may need to keep up with continuing education courses. These classes can help you maintain your status and stay up-to-date on the latest developments in your field.

Someday, you may consider getting a doctorate in finance as well. Pursuing this degree can show that you are fully committed to being a top expert in your field. Options to consider include a Doctor of Business in finance and a PhD in finance.

Masters in Finance Salary

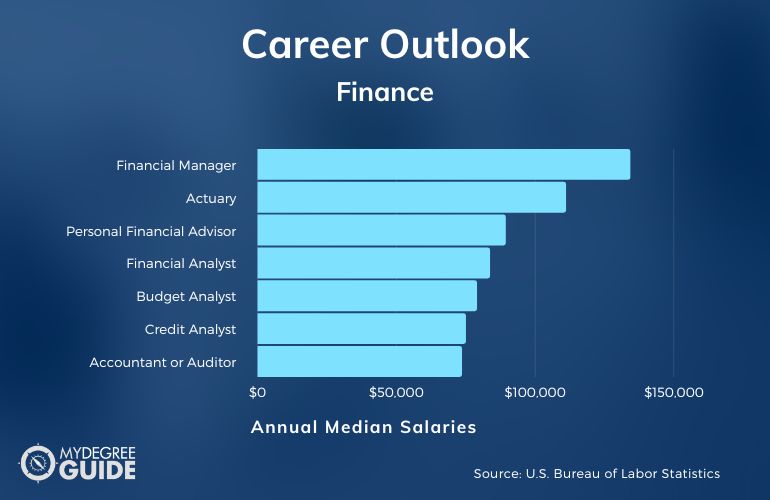

Salaries in the finance world vary among jobs. To figure out how much you might earn with a master’s in finance, take a look at the following chart. It highlights some careers in the finance field, according to the Bureau of Labor Statistics.

| Career | Median Annual Salary |

| Financial Manager | $134,180 |

| Actuary | $111,030 |

| Personal Financial Advisor | $89,330 |

| Financial Analyst | $83,660 |

| Budget Analyst | $78,970 |

| Credit Analyst | $74,970 |

| Accountant or Auditor | $73,560 |

| Loan Officer | $63,960 |

Although the table shows the median salary for various positions, you may have the ability to go even higher with a master’s degree.

Many of these job categories are open to people with only a bachelor’s degree. If you have a master’s, employers may be willing to start you at a higher salary and give you positions of greater responsibility right away, which can make getting a master’s degree in finance worth it.

Also, if you are deciding between an accounting vs finance degree, just know that the average annual salaries for both degrees are almost identical.

Further Education Opportunities for Finance Professionals

Your education doesn’t need to stop after you get your Master’s degree. Instead, consider going back to school for one of the doctoral degrees that are available in this field.

- Doctor of Finance is intended for those who plan to keep working in the Finance sector. It’s not a particularly common degree for schools to offer, though.

- Doctor of Business Administration is more commonly offered than the Doctor of Finance. The program’s scope typically includes general business topics as well as Finance-specific ones.

- PhD in Finance is a research-oriented doctoral degree. It is an excellent choice for those who want to contribute to financial theories or teach college Finance.

Having a doctorate may allow you to become a chief officer at a top corporation. You may also be qualified for high-level positions in banking, investments, and mergers. Above all, a doctorate can give you the chance to work in academia as a professor or a researcher.

Finance Certifications

As a finance professional, you need people and businesses to trust you with their money. Getting a master’s degree in finance is one step toward earning that trust.

Pursuing specialized certifications is another good idea. These credentials show that you have put extra time and effort into becoming an industry expert.

- The Certified Financial Planner certification is designed for those who help clients map out their future money plans and make smart investments. CFPs’ expertise often includes retirement and estate planning. Before taking the certification exam, you must take specific prerequisite courses and gain professional experience.

- Chartered Alternative Investment Analysts (CAIA) are professionals who have great expertise in managing portfolios with alternative investments. To earn this credential, you must take two tests and be a member of the CAIA Association.

- Chartered Financial Analyst is a credential for those who perform financial analyses in order to make smart portfolio-management decisions. It usually takes around four years to pass the three exams required for this certification. You’ll also need to join CFA Institute and accrue work experience.

- Chartered Financial Consultant is a certification for those who provide money advice for others, becoming certified as a ChFC can be a good way to demonstrate financial planning expertise. Getting this designation involves taking multiple college-level classes and passing corresponding exams. At least three years of professional experience are required.

- The Chartered Investment Counselor certification is for those choosing to take their credentialing to the next level. Receiving CIC designation demonstrates that you are truly an expert investment advisor. To be considered, you must be employed by an organization that belongs to the Investment Adviser Association, and you must have five years of work experience.

- The Chartered Life Underwriter (CLU) certification helps life insurance professionals set themselves apart. Eight courses and examinations are required for earning CLU status, but you may be able to bypass some of them if you are already a CFP or a ChFC.

- The Chartered Mutual Fund Counselor (CMFC) certification is for those who specialize in selecting the right mutual fund investments for their clients. The coursework for this program takes about one year, and there’s an examination to pass at the end.

- The Financial Risk Manager certification is for those who work in the field of risk management may want to work toward FRM status. This credential is recognized worldwide. There aren’t any minimum education requirements, but you’ll need to take a two-part test and gain work experience.

Earning these credentials will require an investment of both time and money. In the end, though, the work may be worth it if it leads to increased job opportunities, more clients, greater responsibilities, or higher salaries.

Accreditation for a Master of Finance Degree

Your master’s degree won’t mean much unless it’s from a good school. How can you know if you’ve chosen a reputable school? Look for the accreditation that the college holds.

The first type of accreditation to always look for in any college is regional accreditation. This is an institution-wide distinction that is awarded to colleges that demonstrate their ability to meet academic standards.

There are seven U.S. bodies that grant regional accreditation. One addresses junior colleges only, but the other six organizations’ scope of authority includes schools that offer graduate degrees.

- Higher Learning Commission (HLC)

- Middle States Commission on Higher Education (MSCHE)

- New England Commission of Higher Education (NECHE)

- Northwest Commission on Colleges and Universities (NWCCU)

- Southern Association of Colleges and Schools Commission on Colleges (SACSCOC)

- WASC Senior College and University Commission (WSCUC)

If your school isn’t accredited by any of these groups, it’s time to enroll elsewhere.

For a master’s in finance, it can be a good idea to consider programmatic accreditation as well. This credential is specific to a college’s business department.

Accreditation from one of these industry organizations indicates that your program can do a good job of preparing you for the business world.

- The Association to Advance Collegiate Schools of Business accredits both business and accounting programs at the undergraduate and graduate levels.

- The Accreditation Council for Business Schools and Programs provides accreditation for undergraduate, graduate, and certificate programs based on excellence in instruction and student outcomes. Both business and accounting programs can receive this credential.

- The International Assembly for Collegiate Business Education allows business and accounting programs around the world can seek accreditation. Accreditation is available for associate’s, bachelor’s, master’s, and doctoral degree programs.

Choosing a school with programmatic accreditation is a smart way to ensure the excellence of your master’s education.

Admission Requirements for a Finance Master’s Program

To get into finance school, you’ll need to send in a top-notch application that highlights your strengths and what you can bring to the program. Be sure to include all required elements.

- Your application introduces you to the admissions committee. A fee may be required.

- Many business schools ask for GMAT scores, and some accept GRE scores. You may qualify for a waiver. Some schools have no testing requirements.

- The school may require prerequisite courses or a minimum GPA from your undergraduate program.

- Work experience may be required by your school.

- Professional and academic references can highlight your strengths and skills.

- A personal statement lets you showcase your goals and interests.

It’s a good idea to tailor your application packet to each individual school instead of relying on the same essay for all of your applications.

Financial Aid for a Master of Finance Degree Online

Paying for your whole program out of pocket can be a challenge, so be sure to consider your options for financial aid.

- Grants may be an option. The state and federal government cover a portion of tuition costs for students with financial need.

- You may be able to borrow money from the government or a private source in the form of a loan.

- Private organizations, schools, and businesses give tuition scholarships to select students.

- Some organizations give students funds or fellowships to further their research efforts, school-related travel, or conference attendance.

- Your employer may cover part of your school costs under a tuition assistance program.

A robust financial assistance package can help make your graduate program more affordable. Get started by submitting the Free Application for Federal Student Aid (FAFSA).

Is a Masters Degree in Finance Worth It?

Yes, a master’s degree in finance is worth it for many students. The Bureau of Labor Statistics is projecting 5% job growth in business and financial occupations over the next 10 years. Common careers in this field include loan officer, credit analyst, personal financial advisor, and financial manager.

Your career opportunities in business and finance may increase as you further your education. A master’s degree in finance can likely be your ticket to high positions in corporations, financial institutions, and government agencies.

To learn more about your options for becoming a Master of Finance, start exploring accredited graduate schools. Then, take the next step toward advancing your career by sending applications to your favorite programs.